Best St. Petersburg, FL Car Insurance in 2026

Car insurance in St. Petersburg, FL is a little high, partly because Florida is a no-fault state. On average, you'll pay $100 a month for full coverage.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated October 2024

- Florida is a no-fault state

- St. Petersburg drivers must have $10,000 in personal injury protection and $10,000 in property damage liability

- Auto rates are steadily rising at the rate of twice a year since 2009, in what was already one of the most expensive states in the country

Saint Petersburg is located in Pinellas County and is one of the largest cities in the state of Florida. Originally, the economy of St. Petersburg was based on fishing, but that has changed over the last several years.

The city is now a major tourist attraction due to its mild, sunny climate. The large numbers of tourists, along with its 250,000 residents, can make the streets of St. Petersburg rather congested.

To make certain that everyone is safe when traveling on the roads of St. Petersburg, there are some minimum Florida car insurance requirements that all drivers must maintain.

Use our ZIP code search and compare car insurance rates instantly.

Requirements for Auto Insurance in St. Petersburg

Florida has very low minimum car insurance required by the state compared to many other states in the country and this is not always a good idea. This is because just one accident has the potential to bankrupt a driver.

Florida practices a no-fault insurance system, which means that all costs incurred in an accident up to a given amount are paid for by the driver’s own insurance company.

Unlike the Tort system, drivers involved in accidents in St. Petersburg essentially give up the right to sue the driver at fault.

Read more: Compare Full Tort Car Insurance: Rates, Discounts, & Requirements

Since bodily liability coverage is not required in St. Petersburg, being involved in an accident with an individual having little or no bodily liability coverage can leave one with no legal recourse.

It is common sense to realize that if a driver has no significant liability car insurance, then they probably do not have any assets from which one can recover the losses due to an accident.

Generally, a home is the most common asset people have, and in St. Petersburg that is protected under the Homestead laws.

So to protect themselves many people get Uninsured/Underinsured Motorist Coverage. This type of a policy allows one to be compensated in case the other driver cannot pay for the cost of injuries incurred in an accident.

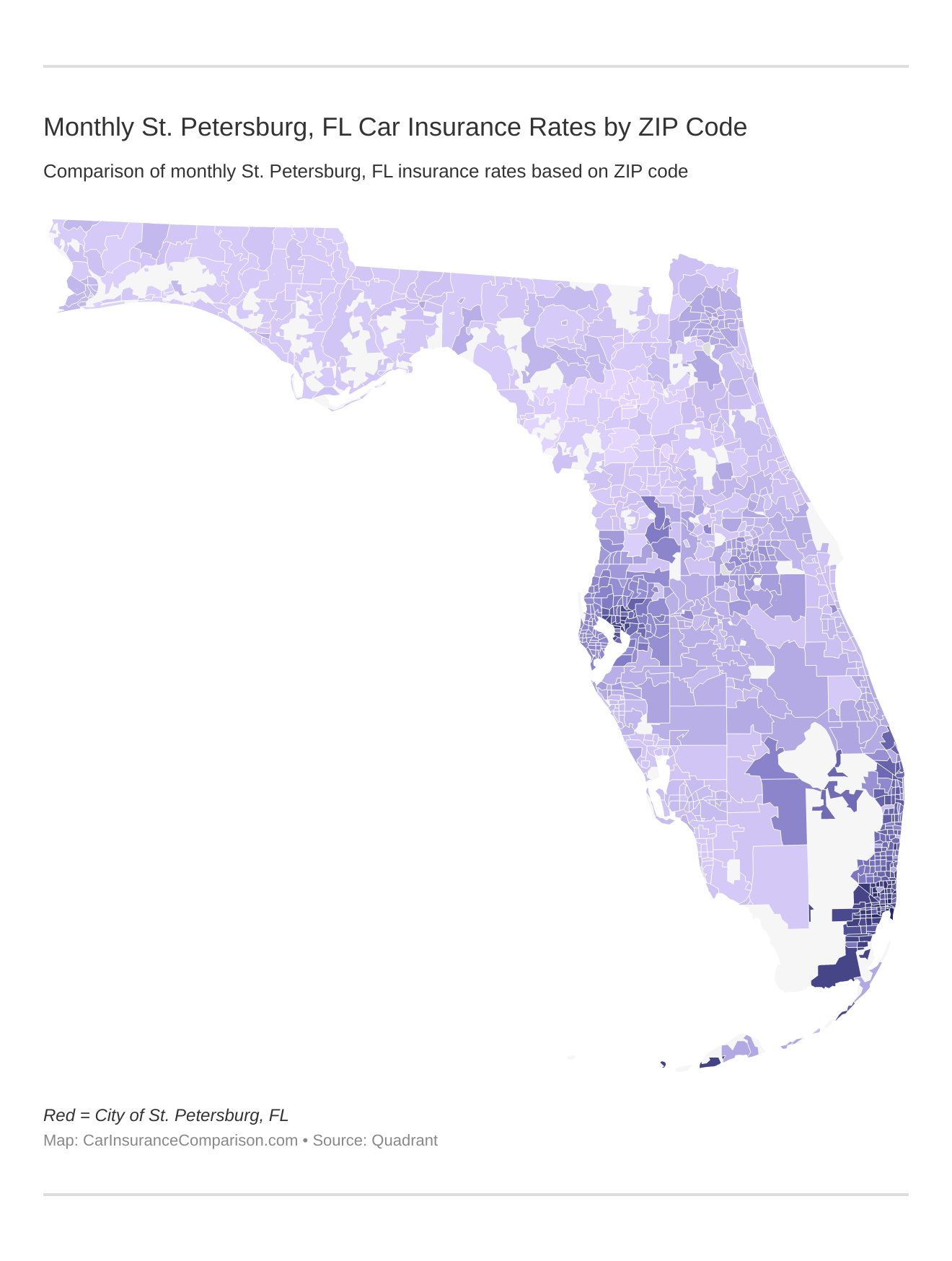

Monthly St. Petersburg, FL Car Insurance Rates by ZIP Code

Find more info about the monthly St. Petersburg, FL auto insurance rates by ZIP Code below:

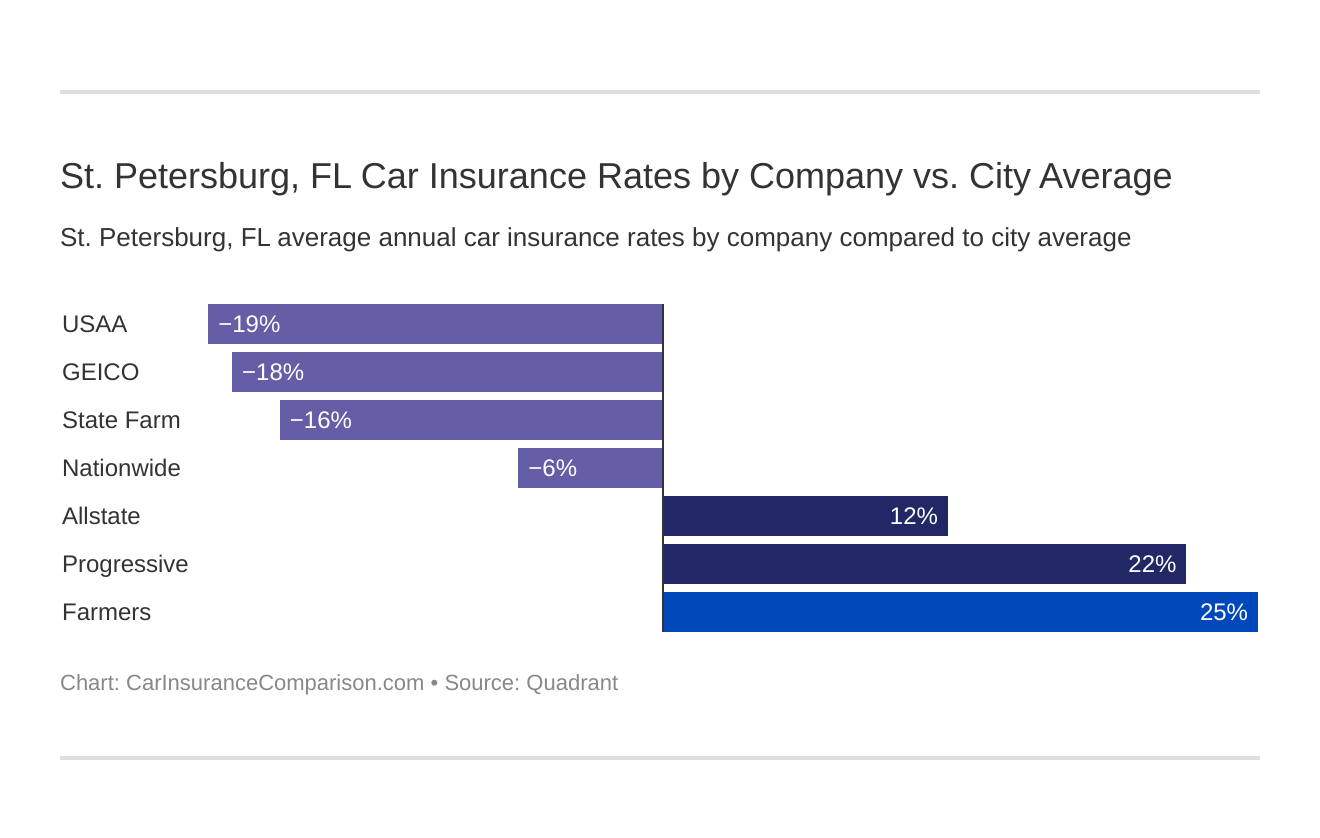

St. Petersburg, FL Car Insurance Rates by Company vs. City Average

The cheapest St. Petersburg, FL car insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Florida car insurance company rates?” We cover that as well.

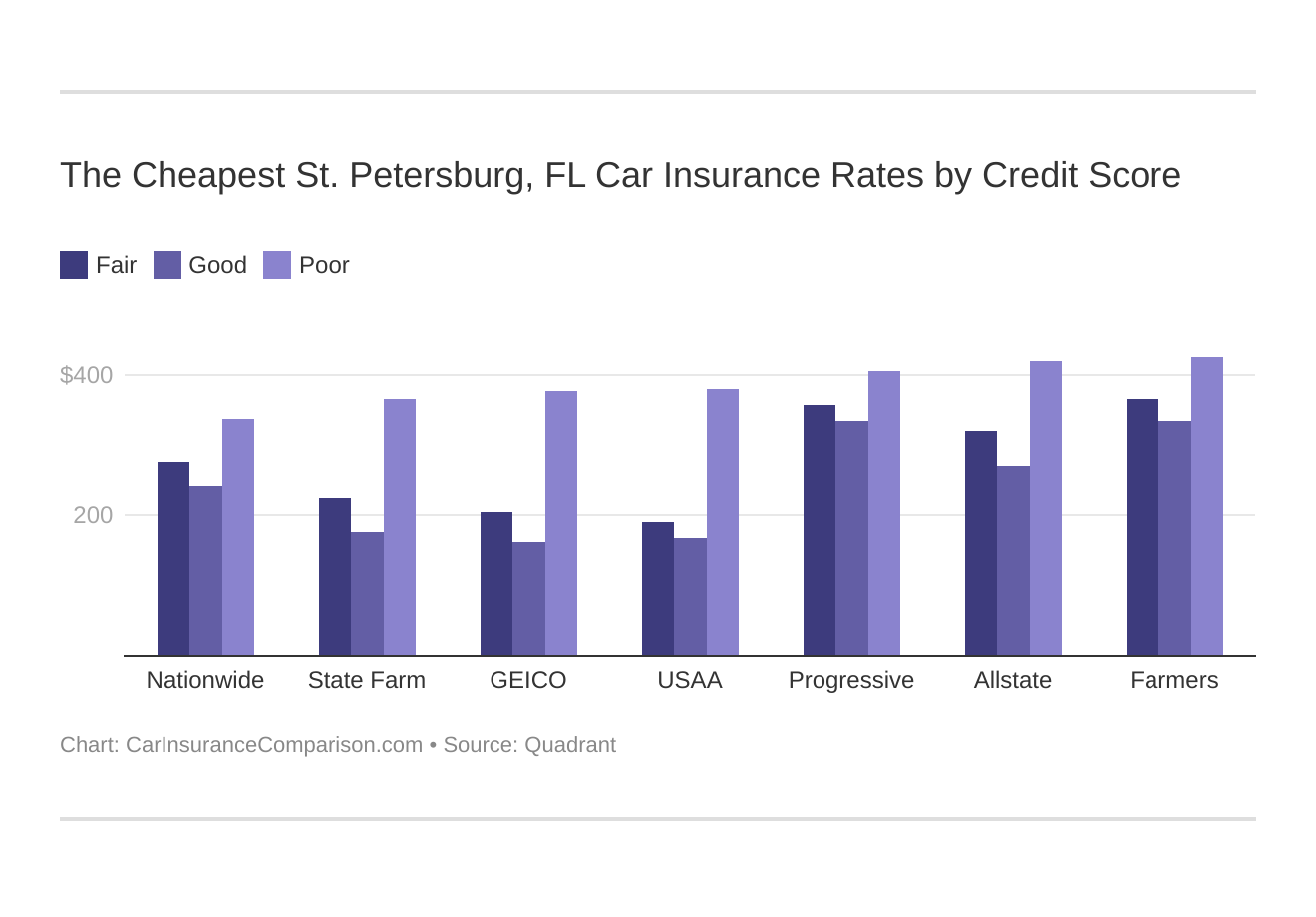

The Cheapest St. Petersburg, FL Car Insurance Rates by Credit Score

Your credit score will play a major role in your St. Petersburg, FL car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. If your credit is good, you may be able to get a good credit discount. Find the cheapest St. Petersburg, Florida car insurance rates by credit score below.

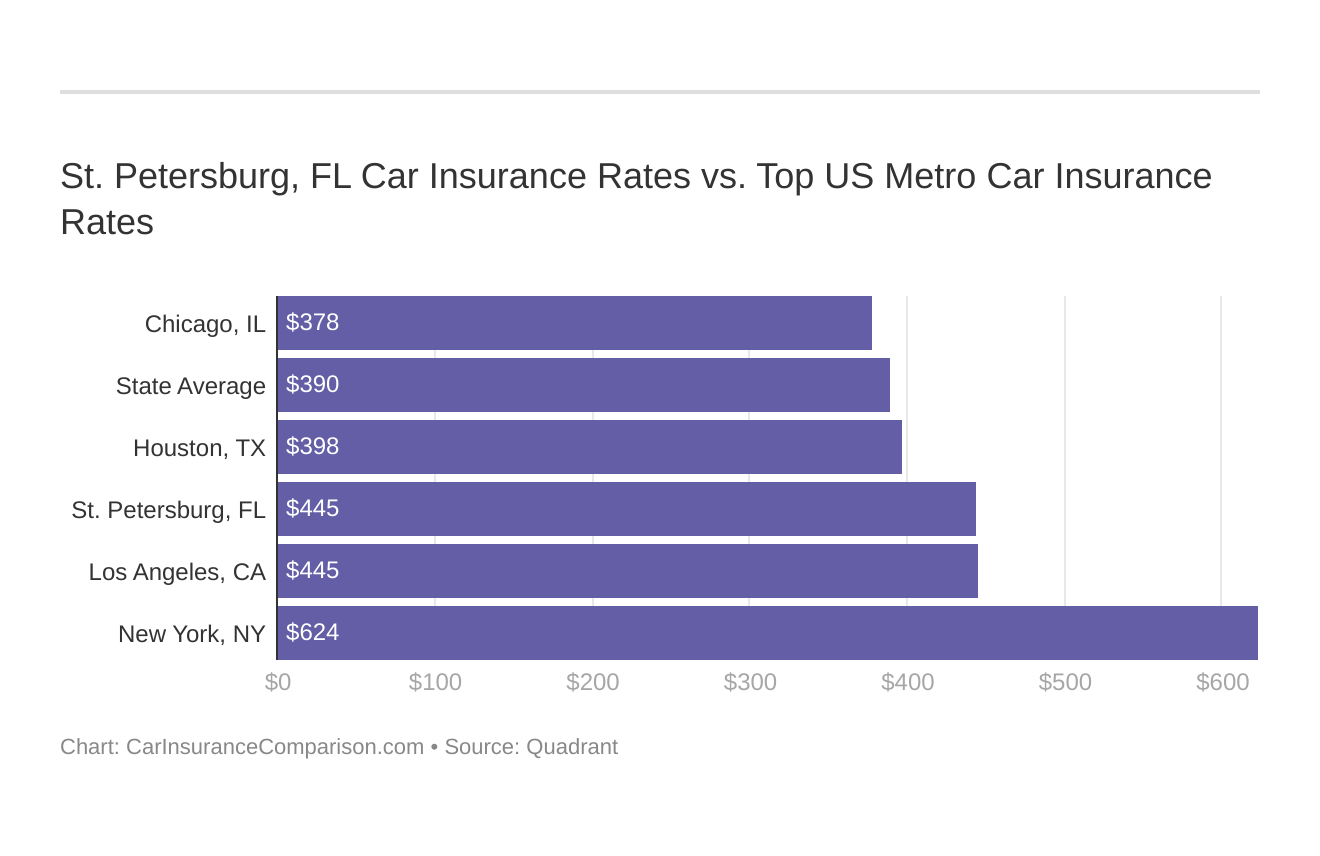

St. Petersburg, FL Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s vital to compare St. Petersburg, FL against other top US metro areas’ auto insurance rates.

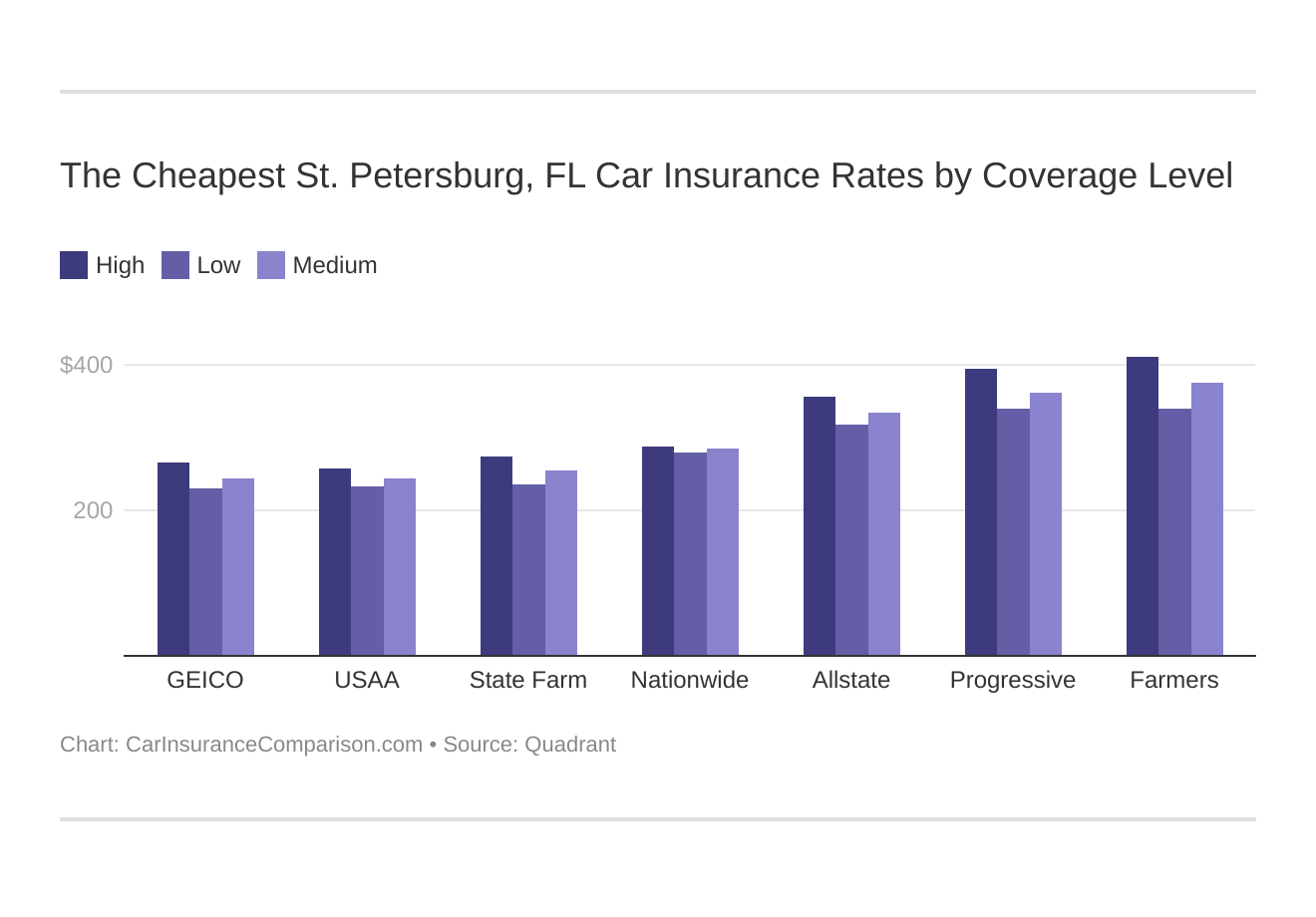

The Cheapest St. Petersburg, FL Car Insurance Rates by Coverage Level

How much car insurance you need will play a major role in your St. Petersburg, FL insurance rates. Find the cheapest St. Petersburg, Florida car insurance rates by coverage level below:

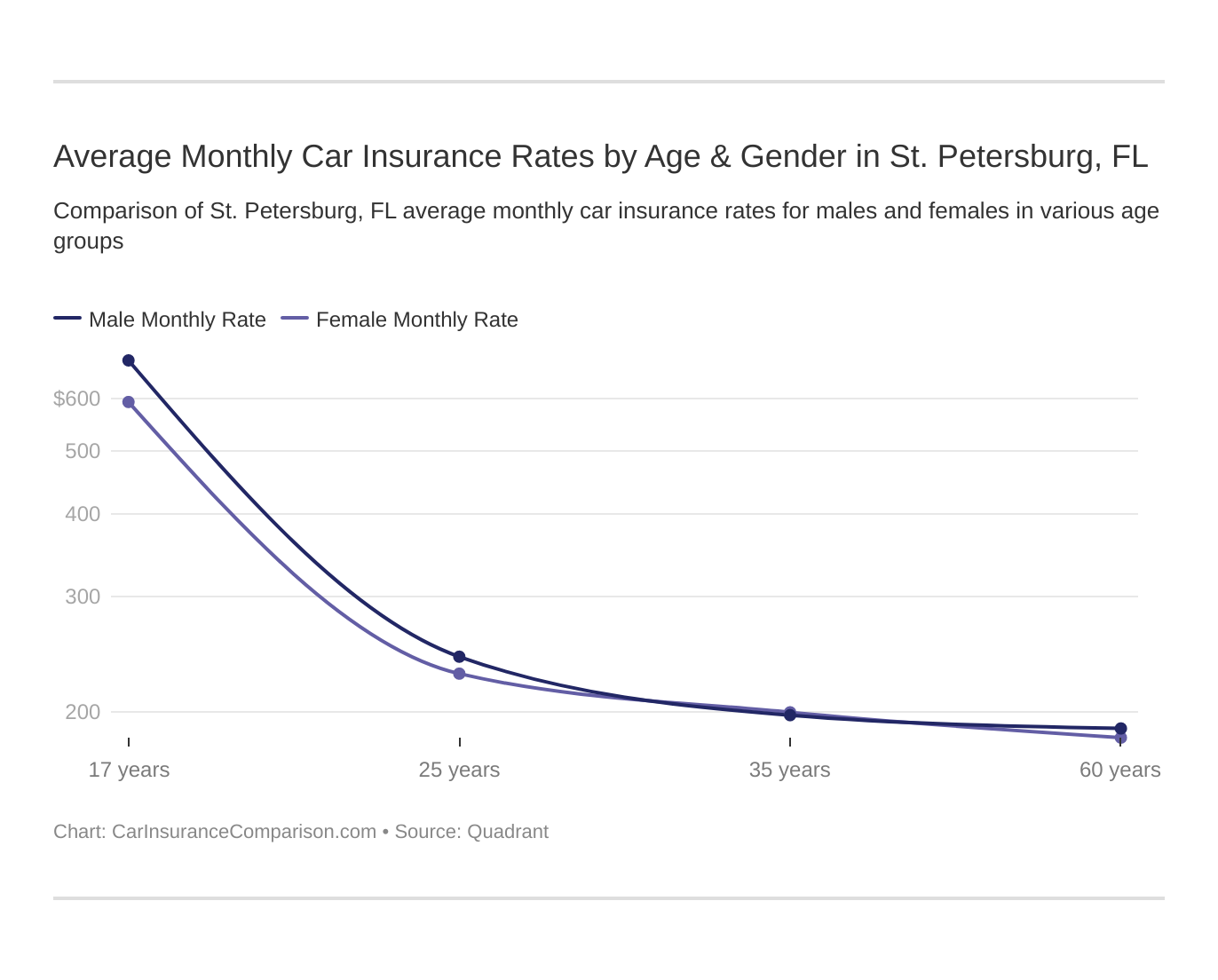

Average Monthly Car Insurance Rates by Age & Gender in St. Petersburg, FL

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a large factor because young drivers are considered high-risk drivers in St Petersburg. FL does use gender, so check out the average monthly car insurance rates by age and gender in St. Petersburg, FL.

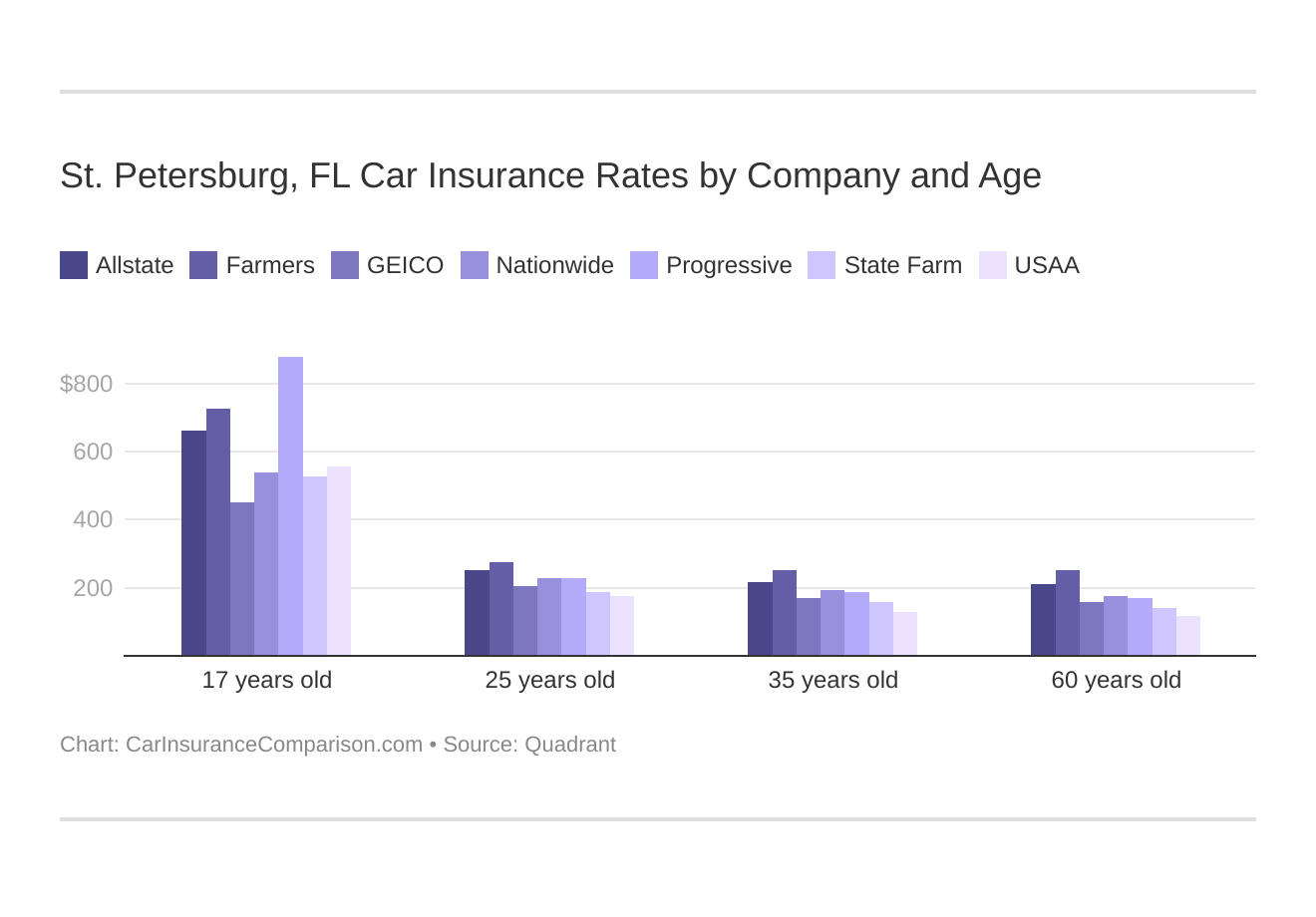

St. Petersburg, FL Car Insurance Rates by Company and Age

St. Petersburg, Florida car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

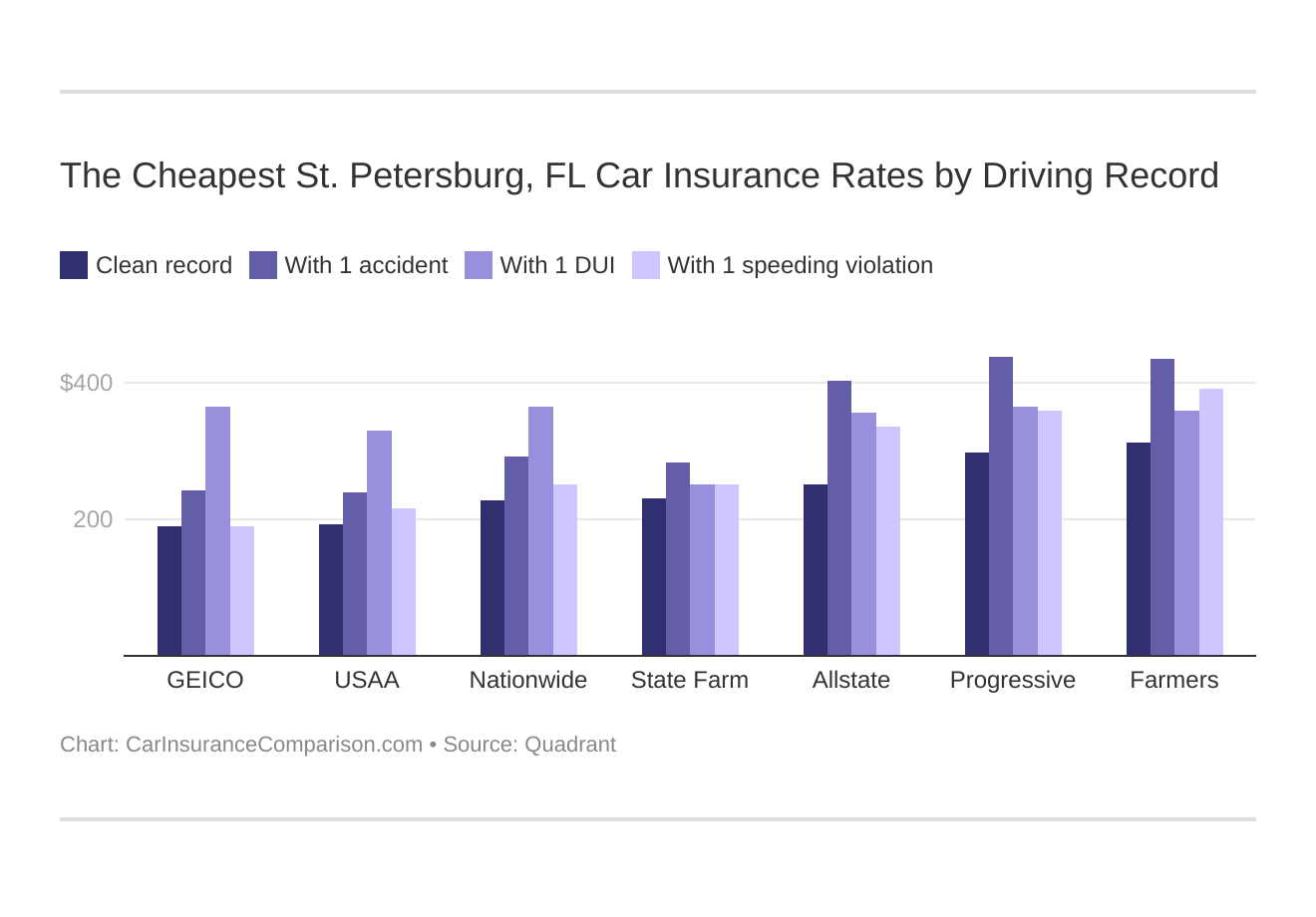

The Cheapest St. Petersburg, FL Car Insurance Rates by Driving Record

Your driving record will affect your St. Petersburg car insurance rates. For example, a St. Petersburg, Florida DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest St. Petersburg, Florida car insurance rates with a bad driving record.

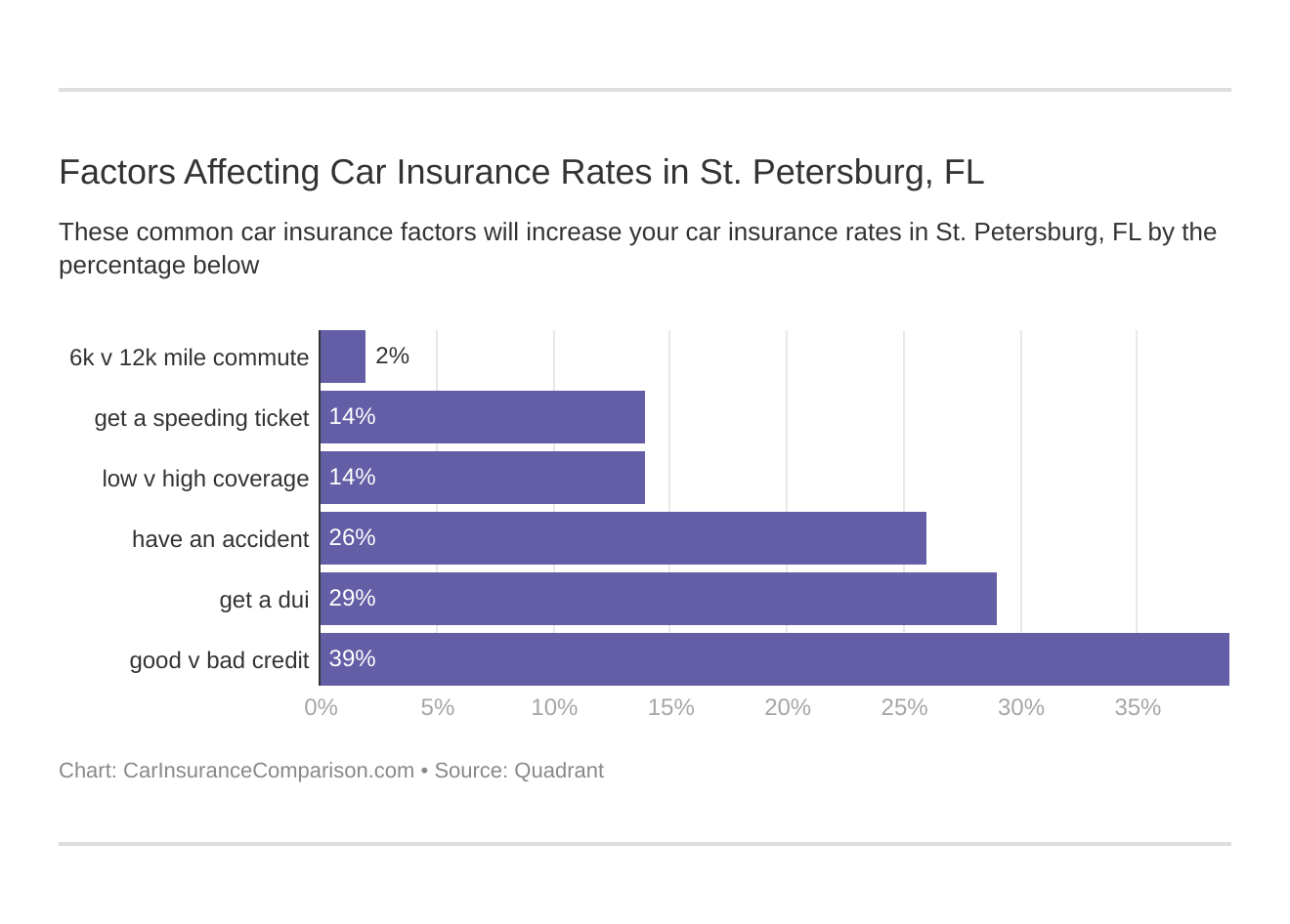

Factors Affecting Car Insurance Rates in St. Petersburg, FL

The factors that affect car insurance rates in St. Petersburg, FL may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest St. Petersburg, Florida car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Saint Petersburg Laws for Auto Insurance

Before registering a vehicle, St. Petersburg car insurance law requires one to obtain a minimum amount of car insurance and get the verification (VIN) number.

Additionally, the insurance must be purchased from a Florida Office of Insurance Regulation licensed company.

Drivers must have $10,000 in personal injury protection (PIP) and $10,000 in property damage liability (PDL).

Only drivers who have been convicted of certain prior offenses may be asked by the DMV to carry additional bodily injury liability insurance. Three examples are listed below:

- Property Damage Insurance – pays for one’s liability in cases where they damage another person’s car or some other property. It also provides for legal defense in case the party files a lawsuit

- Personal Injury Protection – sometimes also known as “no-fault” coverage and is designed to pay claims without regard to which party involved in an accident is at fault. The insured party’s premiums should not be increased after a PIP claim

- Bodily Injury Liability – designed to protect an individual from claims made against them by other people. It pays for the legal expenses, medical bills, loss of income out of pocket travel expenses for medical care, etc. It does not pay the insurance carrier or other people named on the policy; it pays the third party so the insurance policyholder does not have to pay out of pocket

Read More: Florida Car Insurance Regulations

Car Insurance Companies & Agencies in St. Petersburg

Car insurance is mandatory in St. Petersburg, but finding the right coverage that suits individual needs while providing the best protection possible can be daunting.

St. Petersburg car insurance companies can help one find that, without making it a costly process.

To attract new business and hold on their existing customers, each St. Petersburg insurance agency strives to build on their good reputation. They offer car insurance discounts and provide advice on how to keep car insurance premiums at their minimum.

Also, they make it easier for customers to compare policies online so that potential customers can find the best possible rates.

In addition to the three insurance plans mentioned above, St. Petersburg insurance agencies offer numerous other optional types of policies like:

- Uninsured

- Underinsured

- Collision car insurance, etc.

The rates of premiums are based on a large variety of different factors that include:

- An individual’s driving record

- Where they reside

- Type of car they drive

- The individual’s age

- Credit score

- Annual mileage

Drivers with less driving time on the road, mostly driving in less congested urban streets with good driving records, will generally be eligible for better premium rates, as opposed to drivers who are driving in less safe cars on congested city streets for long hours.

Car insurance companies use different criteria and employ varying formulas for determining premium rates. This is why different companies give different quotes for the same driver when comparisons are carried out online.

It is a good idea to compare car insurance rates frequently, even if one already has insurance, to make sure that they are not paying too much.

Average Rates for Auto Insurance

According to statistics, residents of Saint Petersburg pay $1,630 annually for Florida car insurance.

Auto rates are steadily rising at the rate of twice a year since 2009, in what was already one of the most expensive states in the country.

The reason for the steadily rising insurance rates is the spiraling PIP claims. There are allegations of PIP fraud.

It is claimed by state investigators and insurers that people stage minor accidents in which there are either no injuries or very negligible ones and they go to clinics for medical care.

Those clinics then collect the $10,000 insurance payouts.

Many St. Petersburg car insurance companies offer discounts for drivers that take steps to reduce their risks by:

- Protecting their car against theft

- Making sure the car is safe to drive

- Taking defensive driving courses and becoming better drivers

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Saint Petersburg Driving and Car Insurance Statistics

U.S Census data shows that:

- the population of St. Petersburg is made up of 47.70 percent males and 52.30 percent females

- 14 percent of the drivers are between the ages of 15 and 24 years of age

- 37 percent of drivers are between 25 and 44

- 49 percent of drivers are 45 years and over

In 2008, there was a total of 114 fatal car accidents reported in St. Petersburg with over 80 percent being caused by male drivers and a little below 20 percent being caused by female drivers.

The average speed of the car at the time of the crash was 35 mph.

Comparing Quotes for St. Petersburg Auto Insurance

From the multitude of insurance companies selling car insurance, how does one go about selecting the best one?

The signs of a top car insurance company include financial stability, its pricing, and its public reputation.

The ideal way to determine which company stands out above all the rest is to compare them online and find the one that offers low rates on car insurance.

By inserting your ZIP code, one is able to get multiple rates from different insurers. The whole process is very simple, fast, and free of charge.

The greater the number of companies one compares, the better the chances of one finding a company that will be ideally suited to their specific needs.

Find state car insurance by entering your ZIP code below now.

Frequently Asked Questions

How can I compare car insurance rates in St. Petersburg, FL?

To compare car insurance rates in St. Petersburg, FL, you have a few options. You can contact individual insurance companies directly and request quotes. Additionally, you can use online comparison tools that provide multiple quotes from different insurers. These tools typically require you to provide some personal information and details about your vehicle and driving history to generate accurate quotes.

What factors affect car insurance rates in St. Petersburg, FL?

Car insurance rates in St. Petersburg, FL, are influenced by several factors. Common factors include your driving record, age, gender, marital status, type of vehicle you drive, your credit history, and the coverage options you choose. Additionally, factors like the location where you live in St. Petersburg, FL, and the frequency of car thefts and accidents in that area can impact insurance rates.

Are car insurance rates higher in St. Petersburg, FL, compared to other areas?

Car insurance rates can vary depending on the location, and St. Petersburg, FL, may have different rates compared to other areas. Insurance companies consider factors like population density, crime rates, and accident statistics when determining rates for a specific area. It’s recommended to compare rates from multiple insurers to get a better understanding of how St. Petersburg, FL, compares to other areas.

Are there any discounts available for car insurance in St. Petersburg, FL?

Yes, many insurance companies offer various discounts that can help you save on car insurance in St. Petersburg, FL. Common discounts include safe driver discounts, multi-policy discounts (if you have multiple policies with the same insurer), good student discounts, low-mileage discounts, and discounts for having safety features installed in your vehicle. It’s worth checking with insurance providers to see which discounts you may qualify for.

How can I lower my car insurance rates in St. Petersburg, FL?

There are several strategies you can consider to lower your car insurance rates in St. Petersburg, FL. Maintaining a clean driving record, bundling multiple policies with the same insurer, opting for higher deductibles, and taking advantage of available discounts are some effective methods. You may also want to periodically compare quotes from different insurance companies to ensure you’re getting the best rate.

Is it necessary to have full coverage car insurance in St. Petersburg, FL?

Full coverage car insurance is not legally required in St. Petersburg, FL. However, if you have a loan or lease on your vehicle, your lender or leasing company may require you to have comprehensive and collision coverage. Even if it’s not mandatory, having full coverage can provide added protection for your vehicle in case of accidents, theft, or other covered events. It’s important to evaluate your personal circumstances and financial situation when deciding on the level of coverage you need.

What should I do if I can’t afford car insurance in St. Petersburg, FL?

If you’re struggling to afford car insurance in St. Petersburg, FL, there are a few options you can explore. First, consider adjusting your coverage limits or deductibles to lower your premium. You can also shop around and compare quotes from multiple insurers to find more affordable options. Additionally, some states offer low-cost or subsidized insurance programs for individuals with limited incomes. Contact your state’s insurance department or a local insurance agent to inquire about such programs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.