4 Easy Steps to Get an Auto-Owners Insurance Quote

Get an Auto-Owners insurance quote when you connect with a local car insurance agent. Follow this guide to find an Auto-Owners insurance agent near you.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated September 2024

Shopping for car insurance is easy when you can get a free quote online with some basic information and some spare time. Auto-Owners Insurance is a popular choice for many drivers, but they don’t yet offer free quotes online.

Instead, their website is designed to help you learn all about them and their policies and get in touch with a qualified agent who can help calculate a car insurance rate.

Looking to save a little legwork? Enter your zip code above after you follow this guide and give just a few details so we can match you up with a list of providers and customized quotes to cut your search time and save you money.

- Auto-Owners Insurance doesn’t offer online quotes, but the company’s site makes it easy to find a local independent agent

- Auto-Owners Insurance is rated A++ (Superior) by the A.M. Best Company

- Auto-Owners Insurance employs over 44,000 independent agents and insures over 3 million people throughout the nation

About Auto-Owners Insurance

Auto-Owners Insurance is a simple company – their transparency is part of their charm. It’s not always easy knowing exactly how much car insurance you need, so Auto-Owners has a site filled with information on different types of coverages.

The company doesn’t offer online quotes, but you can still use their website to get connected with a local agent.

There’s also plenty of information available on the site to learn about the company and determine whether or not you’d be interested in getting a policy from them.

Read more: Compare Best Car Insurance Companies That Beat Quotes

Step #1 – Gather Necessary Information

Before you get a car insurance quote, there is some information you’ll want to gather that will allow you to move as quickly as possible through a provider’s quote wizard without skipping a beat. You’ll need to provide some personal information in order to get an accurate quote.

Be prepared to provide at least your first and last names, date of birth, and residential address. You should also have your current or previous insurance card, driver’s license, and vehicle registration on hand before you bring up a search engine.

Whether you apply for a quote online, over the phone or in-person with an agent, these details are key to getting a good estimate.

Step #2 – Explore the Auto-Owners Insurance Website

From the homepage, you can use the top menu bar to check out various categories and find answers to common questions you might have.

If you scroll down, you’ll find a menu with the types of policies Auto-Owners offers. Click “Car” to visit their site’s Auto section and learn more about their offerings.

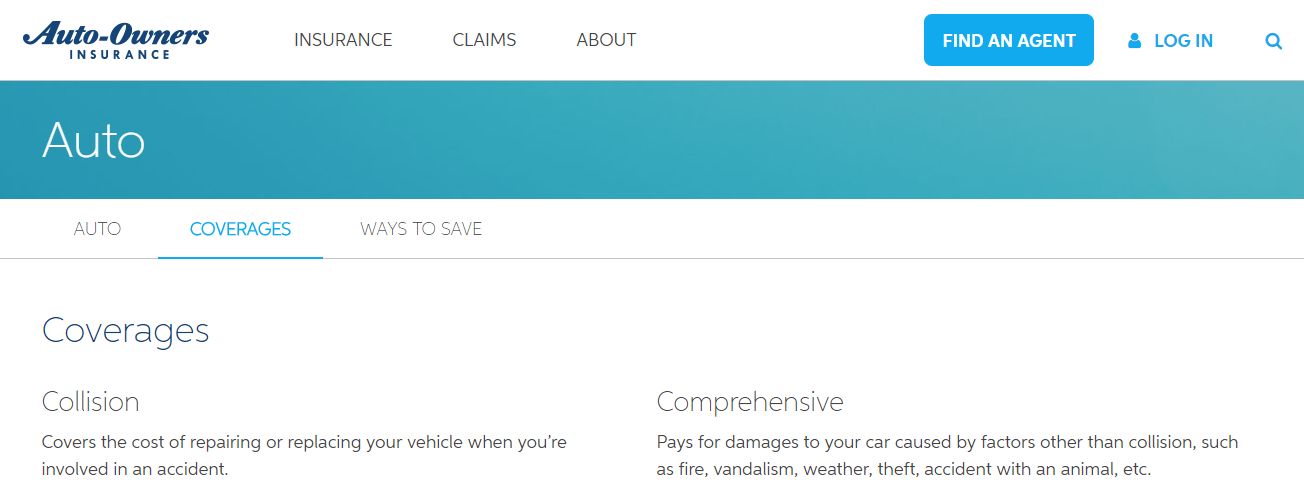

Step #3 – Read About Auto-Owners Insurance Coverage

You can visit the company’s Coverages page to learn all about their policies. In addition to the staples like liability, comprehensive, and collision, there are unique packages and policies you can purchase like Personal Automobile Plus Package, a bundle of 10 optional coverages that protect your vehicle from a multitude of risks and your bank account from lofty expenses.

Auto-Owners also offers special benefits on their policies such as Collision Coverage Advantage, which waives your deductible if you’re ever involved in an accident with someone who is also insured by the company, and a Common Loss Deductible, which saves you money in the event your Auto-Owners-insured home and car are both damaged.

Step #4 – Research Auto-Owners Insurance Discounts

https://www.youtube.com/watch?v=OV2rpx7BK1U

Reading about car insurance discounts can save you money no matter who you decide to go with. When you know what discounts are out there, you can make sure the ones you qualify for are applied to any policy you buy in the future.

Some of the discounts offered by Auto-Owners are:

- Multi-Policy Discount

- Payment History

- Green Discount

- Life Multi-Policy Discounts

- Paid-in-Full Discount

- Advance Quote

Sometimes, you have to take matters into your own hands and speak up on potential savings.

If you find a discount at one company but don’t ultimately like their final quote, you could bring up the discount package you liked to a company you are interested in and see if you can get a better deal on your premiums since many providers are active competitors.

Read more: Auto-Owners Car Insurance Discounts

Step #4 – Find an Auto-Owners Insurance Agent

This speaks to Auto-Owners focus on the personal touch with their customers. It’s a business model for quotes that not many are using today.

Shop Online for Car Insurance and Save

Although working with an agent can help tailor your quote request a bit more, not everyone wants to reach out directly to someone when they can get the information themselves online.

That’s what we’re here for. Explore our site to learn all the ins, outs, and in-betweens of car insurance; then enter your zip code in one of our search boxes and answer a few questions to receive free auto insurance quotes from multiple providers all in one place.

Frequently Asked Questions

Can I get an Auto-Owners insurance quote online?

No, Auto-Owners Insurance does not offer online quotes. You can contact a local agent to get a quote.

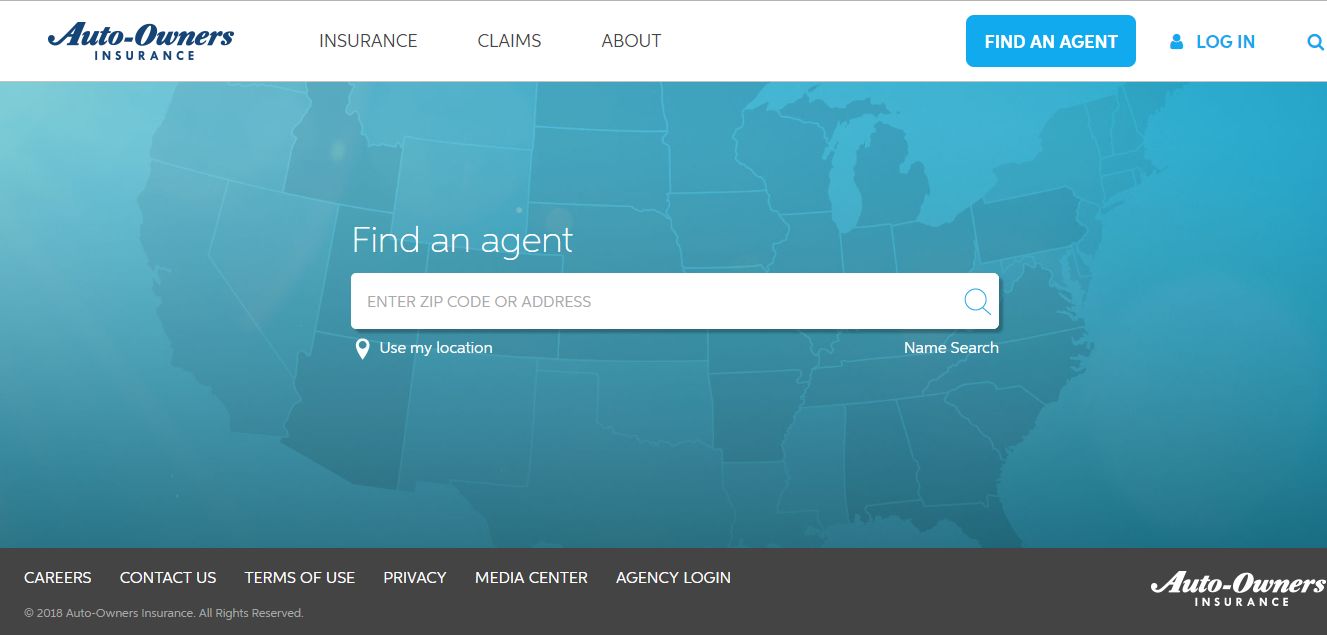

How can I find an Auto-Owners insurance agent near me?

To find an Auto-Owners insurance agent near you, you can visit their website and click on the “Find an Agent” button. Enter your zip code to locate an agent in your area.

What information do I need to gather before getting a car insurance quote?

Before getting a car insurance quote, you should have your first and last names, date of birth, residential address, current or previous insurance card, driver’s license, and vehicle registration on hand.

Does Auto-Owners Insurance offer any unique coverage options?

Yes, Auto-Owners Insurance offers unique coverage options such as the Personal Automobile Plus Package, which is a bundle of 10 optional coverages, and the Collision Coverage Advantage, which waives your deductible if the other party involved in an accident is also insured by Auto-Owners.

How can I save money on car insurance with Auto-Owners Insurance?

Auto-Owners Insurance offers various discounts. You can research their discounts and mention any applicable ones when requesting a quote to potentially lower your premiums.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.