Best Daytime Running Lights Car Insurance Discounts in 2026 (Get up to 10% Off With These 10 Companies)

The best daytime running lights car insurance discounts can save you up to 10% on premiums, with top providers like Geico, State Farm, and Allstate offering competitive rates. These companies reward drivers with safety feature discounts, making them the best choices for affordable coverage and safety benefits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated February 2026

The best daytime running lights car insurance discounts come from Geico, State Farm, and Allstate, offering top savings for safety-conscious drivers.

These companies provide discounts of up to 10% for vehicles equipped with DRLs, making them the most affordable options for reducing premiums.

Our Top 10 Company Picks: Best Daytime Running Lights Car Insurance Discounts

Company Rank Savings Potential A.M. Best Who Qualifies?

![]()

#1 10% A++ Drivers with factory-installed DRLs

![]()

#2 10% B Policyholders with cars equipped with DRLs

#3 8% A+ Customers with vehicles featuring DRLs

#4 7% A+ Drivers who have cars with DRLs

#5 6% A Policyholders with daytime running lights

#6 5% A+ Vehicles equipped with DRLs

#8 5% A Drivers with DRL-equipped vehicles

#7 5% A++ Customers with cars that have DRLs

#9 4% A++ Military families with DRL-equipped cars

#10 4% A Policyholders with vehicles featuring DRLs

DRLs enhance visibility, lowering accident risks and insurance claims. By choosing these top providers, drivers benefit from both increased safety and cost savings.

Explore your car insurance options by entering your ZIP code above and finding which companies have the lowest rates.

- Geico is a top pick for affordable rates and great DRL discount options

- Save up to 10% with the best daytime running lights car insurance discounts

- Top providers like Geico, State Farm, and Allstate offer the best DRL discounts

How to Maximize Daytime Running Lights Discounts on Your Car Insurance

To maximize your car insurance savings, it’s essential to explore and leverage discounts for daytime running lights.

By understanding and applying these discounts, you can enhance your vehicle’s safety and potentially reduce your car insurance premiums.

Check DRL Discounts With Your Current Insurer

Reach out to your insurance provider to ask about any available discounts for vehicles equipped with daytime running lights, and provide details about your vehicle’s DRL features. Carefully review your current policy to confirm that DRLs are noted as part of your vehicle’s safety features. Explore our guide, “Safety Features Car Insurance Discounts“, to broaden your understanding of insurance coverage.

If DRLs are not listed, update your policy to include this information, ensuring you are eligible for any potential discounts related to this safety feature.

Upgrade to DRLs if Needed

If your vehicle doesn’t already have daytime running lights, consider having them installed. DRLs are often available as aftermarket additions and can enhance your vehicle’s visibility, potentially qualifying you for insurance discounts. For a comprehensive analysis, refer to our detailed guide titled “Compare Car Insurance Rates by Vehicle Make and Model.”

Once installed, make sure to obtain a certificate or proof of installation from the installer. This documentation is crucial for verifying the upgrade with your insurance company and ensuring you receive the associated discount.

Compare Quotes From Multiple Insurers

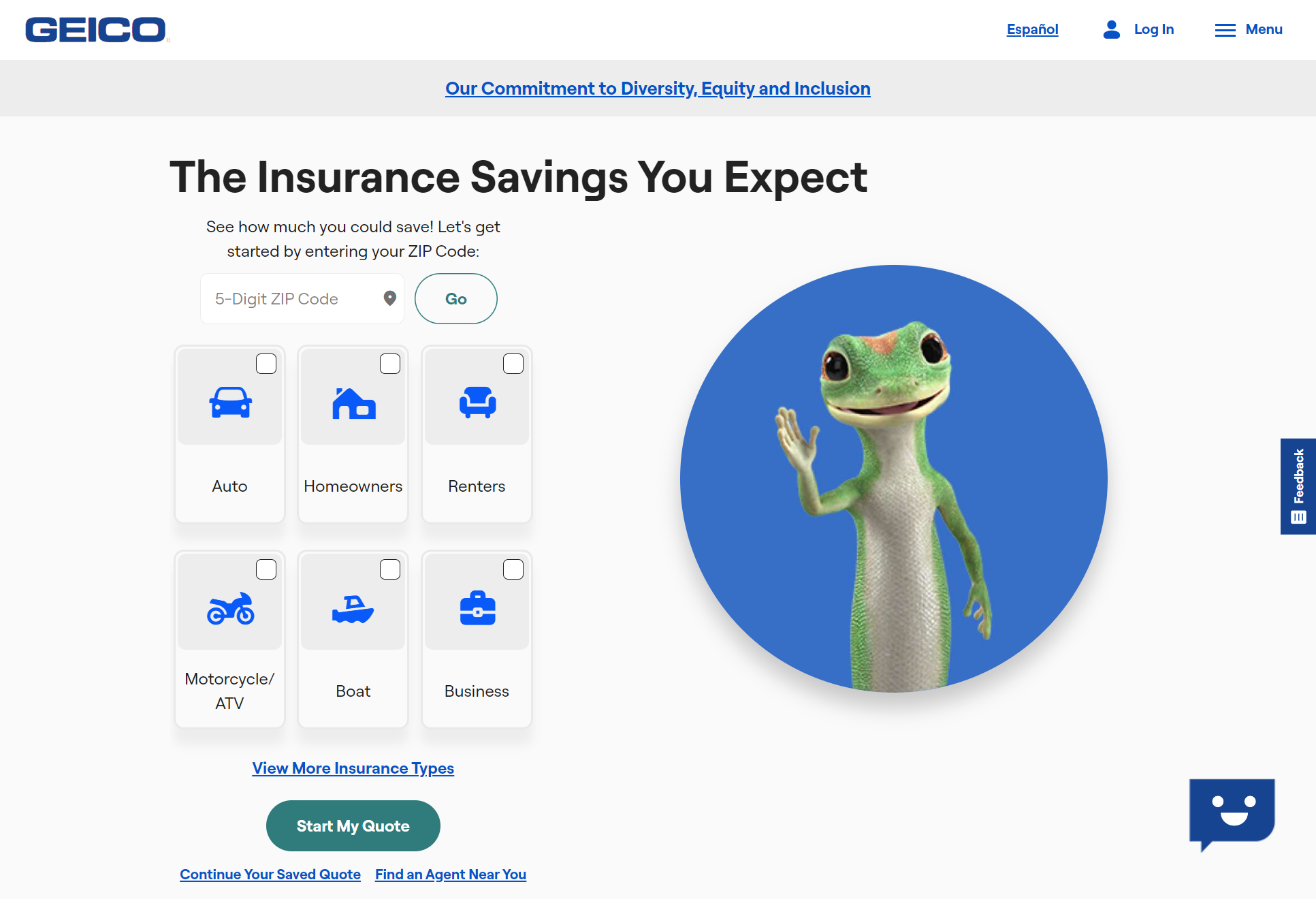

Use online car insurance comparison tools by entering your ZIP code to gather quotes from various insurers. These tools will reveal which companies offer DRL discounts and the amount of those discounts.

Evaluate both the DRL discounts and the overall policy rates, and compare them with other discounts and coverage options to find the most cost-effective and comprehensive policy for your needs. For detailed information, refer to our comprehensive report titled “Compare Car Insurance by Coverage Type.”

Stay Updated and Review Annually

Keep an eye on your insurance discounts, as providers often update their offerings. Regularly review any new or revised discounts, particularly those related to daytime running lights, to ensure you’re benefiting from the latest opportunities for savings. To enhance your understanding, explore our comprehensive resource on insurance titled “16 Ways to Lower the Cost of Your Insurance.”

Make sure to perform an annual review of your insurance policy. Compare it with current market offerings to confirm that you’re receiving all applicable discounts, including potential savings from multi-policy discounts. If you find a more competitive rate or better discount with a different provider, consider switching to secure the best value for your coverage.

By checking for DRL discounts with your current insurer, upgrading your vehicle if needed, comparing quotes from multiple providers, and staying updated with policy changes, you can effectively enhance your savings. Regularly reviewing your insurance ensures you’re always benefiting from the best rates and discounts available, helping you make the most of your coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Insurance Providers Offering Discounts for Daytime Running Lights

So what is a daytime running lights discount? It’s exactly as it sounds, a discount given for your vehicle having daytime running lights. However, not all insurance companies present daytime running light discounts to customers.

This table highlights the impact of discounts on monthly car insurance rates for policies that include daytime running lights. It ranks ten major insurance companies based on their rates before and after applying the discount.

Top Daytime Running Light Savings: Min. Coverage Insurance Monthly Rates

| Insurance Company | Rank | Monthly Rates |

|---|---|---|

| #1 | $45 | |

| #2 | $48 | |

| #3 | $50 | |

| #4 | $47 | |

| #5 | $49 |

| #6 | $46 |

| #8 | $52 | |

| #7 | $51 | |

| #9 | $44 | |

| #10 | $53 |

Geico offers the lowest rate at $45, while Safeco’s is the highest at $53. The average discount saves drivers $5 per month, with the biggest savings from Geico, State Farm, and Nationwide. Different insurance companies make their own decisions regarding what discounts to provide. The companies currently offering the discount are:

- AAA car insurance

- Allstate car insurance

- American Family car insurance

- Farmers car insurance

- Geico car insurance

- Liberty Mutual car insurance

- Progressive car insurance

- The Hartford car insurance

- Travelers car insurance

- USAA car insurance

This list ranks top car insurance companies offering discounts for vehicles with daytime running lights DRLs. Geico leads with rates dropping from $110 to $95, followed by State Farm and Allstate. USAA offers the lowest rate at $90. These discounts provide significant savings for drivers with DRLs installed.

Top Daytime Running Lights Savings: Full Coverage Insurance Monthly Rates

| Insurance Company | Rank | Monthly Rates |

|---|---|---|

| #1 | $95 | |

| #2 | $100 | |

| #3 | $105 | |

| #4 | $98 | |

| #5 | $110 |

| #6 | $102 |

| #8 | $108 | |

| #7 | $106 | |

| #9 | $90 | |

| #10 | $112 |

Interestingly, this discount seems to be very common throughout the industry. Few companies do not offer it. However, not every insurance company employs the same rules for accessing a discount.

With Geico, this particular discount is only available in Louisiana and New York. The other insurance companies do not currently present any restrictions. Still, it is a good idea to check on requirements when reviewing quotes.

One thing worth pointing out: unless you tell your insurance company you have daytime running lights, the company won’t issue a discount.

In fact, it would be a good idea to look over all the discounts your current provider offers. Ask for as many as you are eligible for. Even a small decrease in premium prices can help a budget, so take advantage of the discounts available.

Monthly Car Insurance Rates by Provider: Impact of Driving History and Safety Features

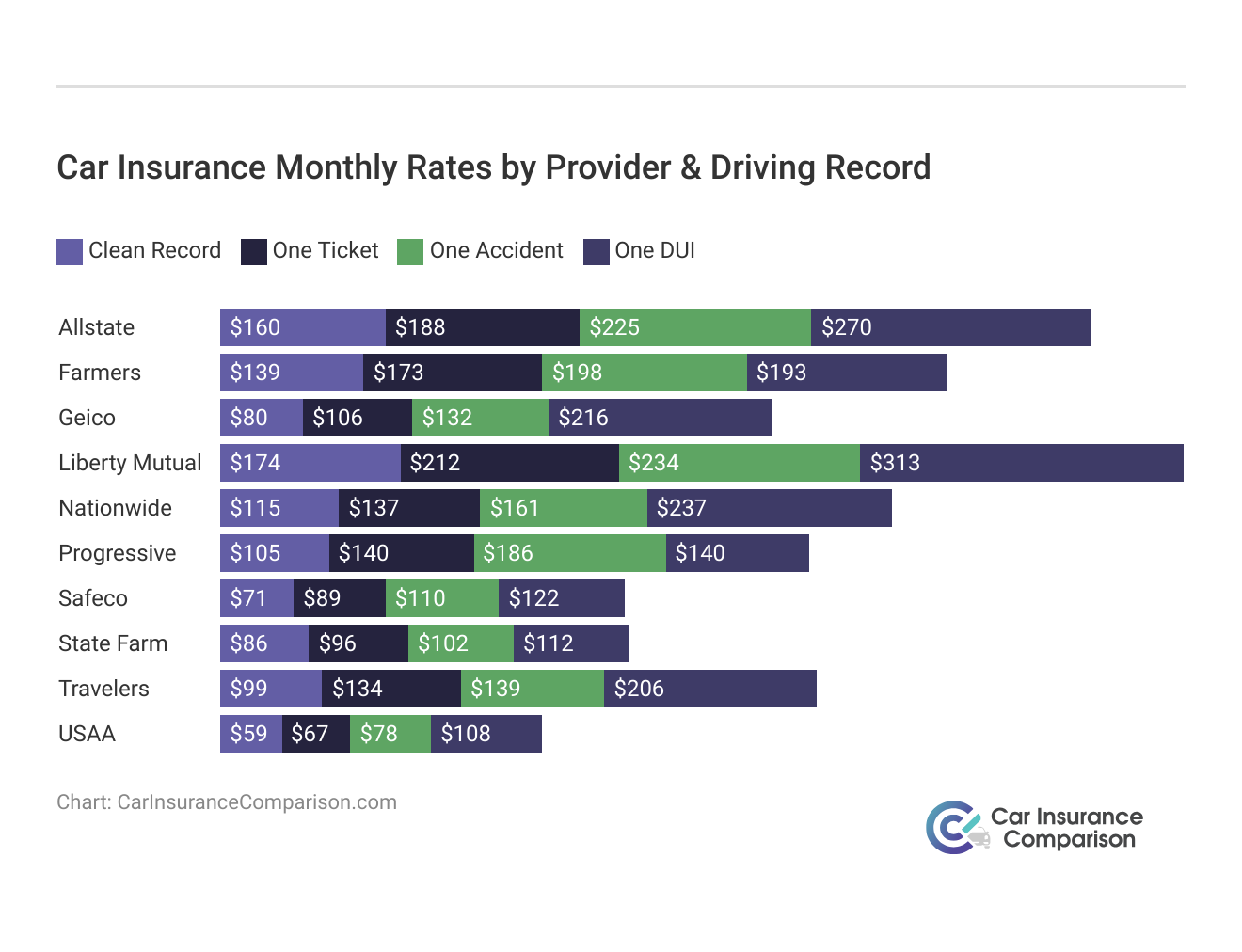

This table provides a breakdown of monthly car insurance rates from various providers, considering the presence of Daytime Running Lights and different driving records. It highlights how insurance premiums fluctuate based on a driver’s history, offering insights into potential costs across various scenarios.

The table compares monthly car insurance rates from various providers based on driving records and Daytime Running Lights. Geico, State Farm, and Safeco offer the lowest rates for clean records, while Liberty Mutual has the highest for DUIs. Allstate, Farmers, and Nationwide provide mid-range premiums. Take a look at our list of the leading providers: Cheap Car Insurance After a DUI

Overall, the data shows that a clean driving record results in the lowest rates, while offenses like DUIs lead to significantly higher premiums. By comparing rates across providers, drivers can make more informed decisions when selecting an insurance plan that best fits their situation.

The Impact of Daytime Running Lights on Visibility in Inclement Weather

Fog and rain can reduce visibility on the road. Drivers might not be able to see the road clearly when the rain starts pouring. Seeing other vehicles might prove difficult as well. You should learn about how to drive safely in bad weather. One of the best tips is to make yourself visible.

Even during the morning or afternoon hours, rain can hamper the ability to see oncoming traffic. The addition of daylight running lights won’t guarantee that pedestrians and other drivers will be able to see a vehicle, but having daytime driving lights is still a good precaution.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Daytime Running Lights Car Insurance Discounts

Exploring real-world examples can highlight the tangible benefits of daytime running lights and the associated car insurance discounts. These case studies showcase how drivers have utilized DRLs to enhance their safety and achieve substantial savings on their insurance premiums.

- Case Study #1 – SafeDrive Insurance: John, a diligent driver, discovered through SafeDrive Insurance that installing daytime running lights could lower his premium. After installing DRLs and providing proof, he received a substantial discount, leading to significant long-term savings and reinforcing his commitment to road safety.

- Case Study #2 – Guardian Auto Insurance: Sarah, a budget-conscious young driver, was excited to find that Guardian Auto Insurance offered a discount for DRLs. She installed DRLs and submitted the documentation, resulting in a significant premium reduction. This savings helped her manage her budget better while enjoying enhanced vehicle safety.

- Case Study #3 – RoadStar Insurance: Mark, a frequent long-distance commuter, installed DRLs after learning about them from RoadStar Insurance. His commitment to road safety earned him a significant insurance discount, highlighting the benefits of proactive safety measures.

These case studies demonstrate how daytime running lights can lead to significant savings on full coverage car insurance while enhancing road safety. Check out our ranking of the top providers: Best Full Coverage Car Insurance

By taking advantage of DRL discounts, drivers like John, Sarah, and Mark have not only enhanced their vehicle’s visibility but also enjoyed financial relief and greater peace of mind.

Save on Car Insurance With Daytime Running Lights Discounts

Daytime running lights can help reduce your car insurance premiums by up to 10%. Major insurers like Geico, State Farm, and Allstate offer discounts for vehicles equipped with DRLs due to their safety benefits. For a comprehensive overview, explore our detailed resource titled “Car Insurance Premium: What is it and how does it work?“

Geico stands out for offering top discounts of up to 10% for vehicles with daytime running lights, making it a leading choice for cost-effective car insurance.

Daniel Walker Licensed Insurance Agent

To take advantage of these savings, check with your current insurer, consider installing DRLs if your vehicle doesn’t have them, and compare quotes from various providers. Regularly review your policy to ensure you’re benefiting from all available discounts and updates.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Frequently Asked Questions

How do daytime running lights improve driving safety?

DRLs enhance your vehicle’s visibility to other drivers during daylight hours, making it easier for them to see you and reducing the likelihood of accidents.

Do all car insurance companies offer discounts for vehicles with DRLs?

Not all insurance companies offer discounts for DRLs. It’s important to check with your insurer to see if they provide this discount and what their specific requirements are.

You can find the cheapest insurance coverage tailored to your needs by entering your ZIP code below.

How can I find out if my current insurance policy includes a DRL discount?

Review your insurance policy details or contact your insurance provider directly to inquire about any available DRL discounts.

To expand your knowledge, refer to our comprehensive handbook titled “Understanding Your Car Insurance Policy (Complete Guide).”

Are there any specific states where DRL discounts are more commonly offered?

DRL discounts can vary by state and insurance company. For example, some insurers may offer DRL discounts in specific states like Louisiana and New York, while others may have broader availability.

What documentation do I need to provide to claim a DRL discount?

You may need to provide proof of DRL installation, such as an installation certificate or a vehicle feature list from your dealership, to qualify for the discount.

Do DRLs affect the comprehensive or collision coverage portions of my premium?

Discounts for DRLs typically apply to the comprehensive or collision portions of your premium. The exact impact depends on your insurance provider’s policies.

To learn more, explore our comprehensive resource on insurance titled “Compare Collision Car Insurance: Rates, Discounts, & Requirements.”

Can I install DRLs on a vehicle that didn’t come with them from the factory?

Yes, DRLs can often be installed as aftermarket additions. Ensure that they are properly installed and that you get a certificate of installation for insurance purposes.

How often should I check for updates on DRL discounts?

It’s a good idea to review your insurance policy annually and check for any updates on discounts, including those for DRLs, to ensure you are receiving all available savings.

Are there any other features similar to DRLs that might also qualify for insurance discounts?

Yes, some insurers offer discounts for other safety features such as advanced driver assistance systems (ADAS), adaptive headlights, and collision avoidance systems. Check with your insurer for a full list of available discounts.

For a thorough understanding, refer to our detailed analysis titled “Collision vs. Comprehensive: What is the difference?“

What should I do if my insurance company doesn’t offer a DRL discount but my vehicle has them?

If your current insurer does not offer a DRL discount, you might consider comparing quotes from other insurance companies to find one that provides this discount. Entering your ZIP code into a comparison tool can help you identify insurers that do offer DRL-related savings.

See how much you could save on coverage by entering your ZIP code into our free quote comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.