Cheapest Maine Car Insurance Rates in 2026 (Save Big With These 10 Companies!)

Geico, Erie, and State Farm are the top providers for cheapest Maine car insurance rates at $15/month. These companies offer competitive pricing and coverage options. Geico excels in affordability, Erie in financial stability, and State Farm in local agent support. Compare Maine car insurance rates to save.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business own...

Laura Kuhl

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated January 2025

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Maine

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Maine

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Maine

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe top pick overall for the cheapest Maine car insurance rates are Geico, Erie, and State Farm, offering competitive rates starting at $15/month. Geico leads with affordability, making it the best choice for budget-conscious drivers.

Erie stands out for its strong financial stability, ensuring reliable coverage. State Farm excels in local agent support, providing personalized service across Maine.

Our Top 10 Company Picks: Cheapest Maine Car Insurance Rates

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $15 | A++ | Online Tools | Geico | |

| #2 | $22 | A+ | Financial Stability | Erie |

| #3 | $23 | B | Local Agent | State Farm | |

| #4 | $25 | A++ | Flexible Coverage | Travelers | |

| #5 | $34 | A | Loyalty Discounts | American Family | |

| #6 | $35 | A+ | Multi-Policy Discount | Nationwide |

| #7 | $38 | A+ | Snapshot Program | Progressive | |

| #8 | $43 | A+ | Safe-Driving Discounts | Allstate | |

| #9 | $47 | A | Personalized Service | Farmers | |

| #10 | $48 | A | Many Discounts | Liberty Mutual |

Learn more in our “What is the best car insurance?”

No one likes to pay too much for anything, let alone paying too much for car insurance. This guide will tell you everything you need to know from the cheapest rates to Maine car insurance laws and so much more.

Start comparison shopping today for Maine car insurance rates using our free online tool. Enter your ZIP code above to get started.

- Geico is the top pick for the cheapest Maine car insurance rates

- Maine requires uninsured motorist and MedPay coverage

- Compare quotes to find the best rates tailored to your needs

- Compare Maine Car Insurance Rates

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico offers one of the lowest monthly rates at $15, making it an attractive option for Maine residents seeking budget-friendly car insurance. Learn more in our Geico car insurance review.

- User-Friendly Website: The comprehensive online tools make managing policies easier for Maine drivers who prefer digital interactions.

- Top Financial Strength: With an A++ rating from A.M. Best, Geico ensures reliable claims processing, a crucial factor for policyholders in Maine.

Cons

- Limited Local Agent Support: Geico’s primarily online operation may be a drawback for Maine residents who prefer in-person service.

- Basic Coverage Options: While affordable, Geico’s policies might lack some additional coverages available from competitors, which could be a consideration for Maine drivers needing extensive coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for Financial Stability

Pros

- Strong Financial Stability: Erie’s A+ rating from A.M. Best ensures reliable claims handling, important for Maine drivers.

- Competitive Rates: As mentioned in our Erie car insurance review, Erie offers monthly rates at $22, Erie is competitive in Maine’s insurance market.

- Excellent Customer Service: Known for outstanding satisfaction, Erie provides excellent support for Maine policyholders.

Cons

- Limited Availability: Erie’s insurance products are not available in all states, so availability in Maine should be confirmed.

- Fewer Online Tools: Maine residents who prefer digital self-service might find Erie’s online offerings less robust.

#3 – State Farm: Best for Local Agent

Pros

- Bundling Policies: Significant discounts for bundling insurance policies, beneficial for Maine drivers with multiple insurance needs.

- High Low-Mileage Discount: Offers substantial discounts for low-mileage usage, which could be advantageous for Maine residents who drive less.

- Wide Coverage: State Farm provides various coverage options tailored for different needs, suitable for diverse driving conditions in Maine. Unlock details in our State Farm car insurance review.

Cons

- Limited Multi-Policy Discount: The discount for bundling policies might be lower compared to competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher, affecting cost-conscious drivers in Maine.

#4 – Travelers: Best for Flexible Coverage

Pros

- Flexible Coverage Options: Customizable coverage to suit individual needs, beneficial for Maine drivers with specific requirements.

- Strong Financial Rating: A++ rating reflects solid financial health, ensuring reliability in claims handling.

- Comprehensive Discounts: Various discounts to help lower premium costs, appealing to budget-conscious Maine residents. See more details on our Travelers car insurance review.

Cons

- Higher Monthly Rates: At $25 per month, Travelers’ rates are higher, which could be a consideration for Maine drivers seeking cheaper options.

- Complex Discounts: Navigating the range of discounts might require assistance, potentially complicating the process for Maine policyholders.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Loyalty Discounts

Pros

- Loyalty Discounts: American Family car insurance review provides discounts for long-term customers, rewarding loyalty among Maine policyholders.

- Personalized Service: Known for exceptional customer service and personalized solutions, beneficial for Maine residents.

- Strong Financial Health: An A rating from A.M. Best ensures reliable claims processing.

Cons

- Limited Online Presence: The company’s online tools and resources are not as extensive, which might be a drawback for tech-savvy Maine drivers.

- Higher Premiums: Monthly rates at $34 are higher compared to some other providers, impacting affordability.

#6 – Nationwide: Best for Multi-Policy Discount

Pros

- Multi-Policy Discounts: Nationwide offers substantial discounts for bundling various types of insurance, beneficial for Maine residents with multiple insurance needs. Check out insurance savings in our complete Nationwide car insurance discount.

- Strong Financial Rating: An A+ rating indicates financial reliability, ensuring claims are handled effectively.

- Comprehensive Coverage Options: A wide range of coverage options to meet diverse needs, suitable for Maine drivers.

Cons

- Moderate Rates: Monthly rates at $35 are not the lowest but offer good value with discounts.

- Limited Local Presence: Fewer local agents might affect in-person service availability, important for Maine residents preferring face-to-face interactions.

#7 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Rewards safe driving with potential discounts, encouraging safer driving habits among Maine residents.

- Competitive Rates: Offers competitive rates with an average of $38 per month. Delve into our evaluation of Progressive car insurance review.

- Strong Financial Stability: An A+ rating signifies robust financial health, ensuring reliable claims processing.

Cons

- Mixed Customer Reviews: Varying experiences with customer service might be a consideration for Maine drivers.

- Complex Discounts: The Snapshot program might be complex for some users to understand and maximize benefits.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Significant discounts for safe driving habits, encouraging responsible driving in Maine.

- Strong Financial Rating: An A+ rating ensures claims are handled reliably.

- Wide Range of Coverage: Allstate car insurance review provides extensive coverage options and add-ons to meet diverse needs.

Cons

- Higher Premiums: Monthly rates at $43 are higher than many competitors, impacting affordability.

- Mixed Online Reviews: Some customers have reported dissatisfaction with online customer service experiences.

#9 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Known for personalized customer service and agent support, beneficial for Maine drivers.

- Comprehensive Coverage: Offers a wide array of coverage options to meet individual needs.

- Solid Financial Rating: An A rating indicates strong financial health. Learn more in our Farmers car insurance review.

Cons

- Higher Monthly Rates: Rates at $47 per month might be higher than other options, impacting cost-conscious drivers in Maine.

- Limited Online Tools: The company’s online resources and self-service options are not as robust, which might be a drawback for tech-savvy Maine residents.

#10 – Liberty Mutual: Best for Many Discounts

Pros

- Many Discounts: Liberty Mutual car insurance review offers a wide variety of discounts to help reduce premiums, appealing to budget-conscious Maine residents.

- Strong Financial Rating: An A rating signifies reliability in financial strength.

- Comprehensive Coverage Options: Extensive coverage choices to fit diverse needs.

Cons

- Higher Monthly Rates: Monthly premiums at $48 are among the highest, impacting affordability.

- Mixed Customer Reviews: Issues with claims processing and customer service have been reported, which might be a consideration for Maine drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maine Car Insurance Coverage and Rates

The median household income in Maine in 2016 was over $54,221. In 2015, drivers, on average paid over $704 for car insurance. Now, we’re no math genius or anything, but however you work it out, consumers in the Pine Tree State are spending way too much of their hard-earned money on car insurance.

Maine Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $43 | $108 |

| American Family | $34 | $84 |

| Erie | $22 | $58 |

| Farmers | $47 | $117 |

| Geico | $15 | $37 |

| Liberty Mutual | $48 | $120 |

| Nationwide | $35 | $87 |

| Progressive | $38 | $94 |

| State Farm | $23 | $59 |

| Travelers | $25 | $61 |

There has to be a better way. Below, we have provided information and helpful advice so you can get the best coverage options for your needs.

Maine Minimum Car Insurance Requirements

| Coverages | Limits |

|---|---|

| Body Injury Liability (Coverage) | $50,000 per one person $100,000 per accident |

| Property Damage Liability (Coverage) | $25,000 minimum |

Okay, you’ve read the numbers, but what do they mean? What is 50/100/25?Bodily injury? Accidents? We hope you never have to deal with any of these situations. But if you do, the basic minimum requirements in Maine that all motorists must have for liability insurance.

Liability car insurance pays all individuals — drivers, passengers, pedestrians, etc. — who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes.

If you cause a wreck, liability insurance pays everyone affected by the accident other than you. This minimum can cost more or less depending on the state you live in.

These required amounts are only for the minimum amounts. Since these coverages pay you rather than the other driver, you may want to carry additional coverage because in the event of an accident your payout to injured victims could quickly run out.

Further below, we will show you additional coverage options to help you make the best decision.

Required Forms of Financial Responsibility in Maine

What is financial responsibility? Basically, financial responsibility is proof that you have Maine’s minimum liability coverage. Maine law requires every driver and owner of a vehicle to have proof of financial security at all times. Here are a few acceptable forms of proof of financial security in Maine:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Picture of proof of insurance on your smartphone

Read more: Car Insurance Binder: Explained Simply

Important: Maine law requires drivers to have at least one form of proof of financial security on their person when operating a vehicle. Fortunately, for those who are constantly misplacing papers, Maine now accepts a smartphone picture as proof of financial responsibility. You must provide proof of financial responsibility in the following situations:

- A traffic stop

- Registering your vehicle

- A collision

- Reinstating your license

Not having the minimum requirements of car insurance in Maine may result in fines and other penalties. Make sure to purchase the minimum insurance amount required by the state before driving your car.

Average Monthly Car Insurance Rates in ME (Liability, Collision, Comprehensive)

Maine’s average monthly car insurance rates for liability, collision, and comprehensive coverage vary based on factors such as driving history, vehicle model, and coverage limits. Understanding these rates can help drivers in Maine make informed decisions about their insurance needs and costs.

Maine Car Insurance Monthly Rates by Coverage Type

| Coverages | Rates |

|---|---|

| Collision | $22 |

| Liability | $28 |

| Full Coverage | $58 |

| Comprehensive | $9 |

The National Association of Insurance Commissioners, a leading source on insurance coverage, is the source for the above data. Car insurance rates in Maine will likely be higher for 2019. Remember, Maine also requires Uninsured/Underinsured and MedPay insurance, so the overall cost will be higher than the one listed above.

Additional Liability Insurance

Additional Liability Insurance provides supplementary coverage beyond standard limits, offering financial protection against unforeseen circumstances that exceed typical policy caps. It can be crucial for individuals or businesses seeking added security and peace of mind against potentially high-cost legal claims.

These numbers can be very confusing. The MedPay loss ratio looks great, but the Uninsured and Underinsured loss ratios aren’t. Here’s why these numbers are good and bad.

- High Loss Ratio: If companies have high loss ratios (over 100 percent), they are losing money from paying out too many claims to customers and risk going bankrupt.

- Low Loss Ratio: If companies have low loss ratios, they are paying out too FEW claims to customers.

So while MedPay coverage is paying out a decent amount of claims, Uninsured and Underinsured coverages are paying out too few claims. The top companies usually have loss ratios over 90 percent, and MedPay coverage in Maine is steadily reaching that number.

Now that we’ve tackled loss ratios, let’s look into why the state of Maine requires you to have these coverages, ensuring financial protection for all parties involved in an accident.

- MedPay Coverage: This coverage will cover your medical expenses after an accident. It pays a limit that you choose per person for you and anyone in the vehicle with you.

- Uninsured/Underinsured Coverage: Uninsured/underinsured coverage will protect you if you’re in an accident with someone who either has no insurance or not enough insurance. If they are at fault, they will be unable to pay your accident costs, which is where this coverage comes into play.

Now that we’ve covered the liability and additional liability insurance Maine requires, let’s look at some optional coverages.

Add-ons, Endorsements, and Riders

Have you considered adding extra coverages to your policy? Do you even know what is available? Choosing from a list of options can be daunting, and we know you want the best options for your family at the best price. To help you decide, we’ve made a list of affordable options to add to your policy. Click on the selections below to learn more about them:

- Guaranteed Auto Protection

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Low-Mileage Discount

Any of the above coverages would be great to add to a policy, so make sure to discuss any options you are interested in with your insurance provider.

Average Monthly Car Insurance Rates by Age & Gender in ME

You may be surprised to learn that gender plays a large role in deciding how much your car insurance rates are? In fact, females typically pay more than males for car insurance, but Maine is one of five states that this isn’t the case. In fact, gender discrimination in car insurance rates is such a problem that California and other states banned gender discrimination and created gender neutral insurance plans.

Maine Full Coverage Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Female (Age 35) | Male (Age 35) | Female (Age 60) | Male (Age 60) | Female (Age 17) | Male (Age 17) | Female (Age 25) | Male (Age 25) |

|---|---|---|---|---|---|---|---|---|

| Allstate | $150 | $154 | $134 | $146 | $375 | $502 | $163 | $182 |

| Bristol West Select | $142 | $144 | $133 | $143 | $448 | $497 | $167 | $173 |

| Geico | $85 | $88 | $85 | $85 | $206 | $268 | $92 | $99 |

| Liberty Mutual | $249 | $249 | $237 | $237 | $528 | $790 | $249 | $350 |

| Progressive | $159 | $156 | $159 | $156 | $662 | $744 | $185 | $209 |

| State Farm | $109 | $109 | $103 | $103 | $349 | $435 | $122 | $134 |

| Travelers | $97 | $101 | $88 | $90 | $391 | $528 | $96 | $111 |

| USAA | $72 | $71 | $72 | $70 | $237 | $261 | $92 | $97 |

In addition to gender and age, where you live can affect your car insurance rates, as insurers consider the local crime rate, traffic density, and accident statistics.

We’ve collected data on the most and least expensive ZIP codes, so search to see where your ZIP code lands on the list. You will also see providers’ costs next to your ZIP code, providing a helpful snapshot into what you should be paying.

Highest and Lowest Maine Car Insurance Rates by ZIP Code

In Maine, car insurance rates can vary significantly depending on your ZIP code, with some areas experiencing higher premiums due to factors like population density and local traffic patterns.

Understanding these variations can help drivers in Maine make informed decisions about their insurance coverage and costs.

We have also collected data on car insurance rates by city. Below is a list of the most expensive and least expensive cities for car insurance. Simply enter your city in the search box to see your city’s cost.

Most Expensive Maine Car Insurance Monthly Rates by City

| Rank | City | Rates |

|---|---|---|

| #1 | Surry | $176 |

| #2 | Danville | $176 |

| #3 | Auburn | $173 |

| #4 | Lewiston | $173 |

| #5 | Grand Lake Stream | $172 |

| #6 | Ellsworth | $172 |

| #7 | Steuben | $168 |

| #8 | Brooklin | $167 |

| #9 | Penobscot | $166 |

| #10 | Castine | $166 |

| #11 | Brooksville | $164 |

| #12 | Sargentville | $161 |

| #13 | Blue Hill | $160 |

| #14 | Sedgwick | $159 |

| #15 | Isle Of Springs | $156 |

| #16 | Milbridge | $155 |

| #17 | Harborside | $154 |

| #18 | Bucksport | $154 |

| #19 | East Blue Hill | $150 |

| #20 | Machias | $149 |

| #21 | Orland | $149 |

| #22 | Portland | $144 |

| #23 | Frenchboro | $144 |

| #24 | Hulls Cove | $143 |

| #25 | Brookton | $143 |

| #26 | Danforth | $142 |

| #27 | Meddybemps | $141 |

| #28 | East Orland | $139 |

| #29 | Eastport | $138 |

| #30 | Cherryfield | $134 |

| #31 | Princeton | $134 |

| #32 | Little Deer Isle | $133 |

| #33 | Lambert Lake | $133 |

| #34 | Vanceboro | $133 |

| #35 | Cutler | $132 |

| #36 | Waite | $131 |

| #37 | Fairfield | $130 |

| #38 | Winter Harbor | $130 |

| #39 | Wesley | $126 |

| #40 | Lubec | $126 |

| #41 | Franklin | $126 |

| #42 | Birch Harbor | $125 |

| #43 | Stonington | $125 |

| #44 | Hancock | $123 |

| #45 | Baileyville | $122 |

| #46 | Columbia Falls | $122 |

| #47 | Beals | $120 |

| #48 | Jonesport | $120 |

| #49 | Portland | $120 |

| #50 | Dennysville | $120 |

Maine is a great place to live for cheaper car insurance rates. Surrey is the most expensive, while Fort Fairfield is the least expensive, and only $382 separates the highest and lowest rates.

Compare Car Insurance Rates in Your City

Discover the variations in car insurance rates across different cities. Explore the differences in Calais, ME, Norway, ME, Farmington, ME, Oakland, ME, Lincoln, ME, and Wilton, ME.

Maine Car Insurance Cost by City

Uncover the factors influencing insurance costs and make informed decisions for your coverage to ensure optimal protection and value.

Maine Car Insurance Companies

You’ve seen the commercials. You’ve seen the ads. But what’s really behind the curtain of most insurance companies? Can you really save money with a 10-minute phone call? But who wants to spend time doing all of that searching?

That’s why we’ve researched the best car insurance companies in Maine, so you can make the best choice for your situation. We’ve looked at companies’ financial ratings, AM’s best ratings, and which companies have the most complaints. Below are also the largest companies’ market shares in Maine.

Keep reading to learn about Maine’s auto insurance providers, discover the best coverage options for your needs, compare rates and benefits, and make an informed decision to ensure you and your vehicle are well-protected.

Ratings of the Largest Car Insurance Companies in Maine

What does an A.M. Best rating mean? Essentially, an A.M. Best rating measures the financial health of an insurance company. From the below table, you can see that every company has a loss ratio above 50 percent. A large part of a company’s success is its loss ratio, which we covered earlier in this guide.

Customer service is an important part of any company, from restaurants to car insurance providers. That’s why we have looked at companies with the best customer satisfaction ratings. Allstate ranks near the top of the list — showing that Allstate is great at customer satisfaction.

One thing to consider, cost shouldn’t be your only concern when searching for car insurance. You should also be looking at how the insurance provider treats its customers and resolves claims and complaints.

Companies with the MOST Complaints in Maine

The Department of Professional and Financial Regulation collected data on complaint ratios for Maine’s car insurance companies. The complaint index means the following:

- Average: complaint index of one

- Better Than Average: complaint index LESS than one

- Worse Than Average: complaint index GREATER than one

Keep in mind that a high complaint index doesn’t necessarily mean you should avoid a company. Make sure to also look at a company’s customer satisfaction ratings because how a company deals with complaints is also important.

Maine Car Insurance Rates by Company

In order to save money on car insurance, make sure you are shopping around for rates. Below is information about rates across different companies. Looking at different companies can save a lot of money.

For example, State Farm is more than $400 BELOW the state average, which over time, could add up to over several thousand dollars. Read our State Farm car insurance review for more information.

Cost of Different Annual Commutes by Maine Companies

At some companies, how far you drive each day influences your insurance rates, potentially leading to higher premiums for longer commutes. Additionally, this factor can significantly impact your annual expenses, as increased mileage not only raises insurance costs but also contributes to higher fuel consumption and more frequent vehicle maintenance.

Maine Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $226 | $236 |

| American Family | $243 | $203 |

| Erie | $200 | $183 |

| Farmers | $231 | $256 |

| Geico | $128 | $147 |

| Liberty Mutual | $368 | $382 |

| Progressive | $304 | $374 |

| State Farm | $189 | $273 |

| Travelers | $188 | $203 |

| USAA | $125 | $167 |

Most company rates don’t change when the drive is shortened to a 10-mile commute, except for Geico and Liberty Mutual, both of whom have rate reductions over a $100.Commute is just one of a number of factors that could increase your rates.

Understanding these variables is crucial for budgeting and making informed decisions about your daily travel habits. Up next, a break-down of coverage level rates in Maine.

Coverage Level Rates

The more you pay, the better coverage you will receive. Don’t let higher rates discourage you from purchasing better coverage, as some companies have economical increases in rates. For example, the data below shows Geico has only an $80 increase from low to high coverage.

By comparing these rates, drivers can find the balance between affordability and comprehensive insurance that best suits their needs and budget.

Credit History Rates

The quality of your credit score impacts your insurance rates. In Maine, the average credit score is 689, which is slightly above the countrywide average of 675.Specifically, this means Maine residents have a better chance of getting great rates because of their above average credit scores.

Maine Full Coverage Car Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $257 | $241 | $261 |

| American Family | $275 | $220 | $250 |

| Erie | $290 | $205 | $230 |

| Farmers | $250 | $208 | $223 |

| Geico | $192 | $102 | $183 |

| Liberty Mutual | $536 | $303 | $411 |

| Nationwide | $300 | $210 | $240 |

| Progressive | $327 | $289 | $312 |

| State Farm | $200 | $183 | $192 |

| Travelers | $243 | $203 | $218 |

As you can see from the table above, poor credit scores can add thousands to your annual cost. A bad credit score at Liberty Mutual changes your annual cost from $3056 to $6031.That’s an extra $3000 a year. Read our Liberty Mutual car insurance review for more information.

Driving Record Rates

A clean driving record is the easiest way to keep rates down. As you can see from the information below, at Liberty Mutual, just one DUI can raise your rate by over three thousand dollars.

Maine Full Coverage Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | One Accident | One Ticket | One DUI |

|---|---|---|---|

| Allstate | $257 | $241 | $261 |

| American Family | $275 | $220 | $250 |

| Erie | $290 | $205 | $230 |

| Farmers | $250 | $208 | $223 |

| Geico | $192 | $102 | $183 |

| Liberty Mutual | $536 | $303 | $411 |

| Nationwide | $300 | $210 | $240 |

| Progressive | $327 | $289 | $312 |

| State Farm | $200 | $183 | $192 |

| Travelers | $243 | $203 | $218 |

| USAA | $211 | $129 | $171 |

Additionally, some insurers offer discounts for drivers with a history of safe driving, further incentivizing the importance of maintaining a clean record. A better record equals better rates. We encourage you to NOT drink and drive.

Read more: What are the DUI insurance laws in Maine?

Number of Insurers in Maine

In Maine, there are only nine domestic insurance providers but 696 foreign insurance providers. What is the difference? Honestly, there isn’t much of one. Domestic insurance means a company is formed under Maine’s state laws.

Whereas a foreign provider is formed under the laws of any state in the U.S.You might think of the difference as an insurance company chain that is in multiple states (foreign) versus a local, small-town provider that is located only in Maine (domestic).

Maine State Laws

We all enjoy celebrating the holidays every year, but it’s against state law in Maine to keep your festive lights up after January 14. And if you decide you no longer want to fly on a plane once it’s in-flight…well, that’s against the law, too. State laws are confusing and vary from state to state.

New residents may sometimes receive tickets for laws they didn’t know existed. Well, nobody should have to worry about any of those outdated laws, and the same thing goes for Maine’s driving laws. We’ve done the work for you, scroll down to read our roundup of Maine’s state driving laws.

Maine Car Insurance Laws

Forms and rates have to be filed with Maine’s state insurance department and approved before they can be used. This is to make sure that Maine’s residents are meeting the minimum insurance requirements.

So make sure that your insurance is valid and approved BEFORE driving in Maine. Now that you know how the filing process works, let’s look at the different types of insurance and how they can affect your rates.

High-Risk Insurance

In certain instances, Maine will require drivers to fill out an SR-22 form to purchase high-risk insurance. We have listed the main reason below for why you may need to purchase high-risk insurance.

Drivers who commit serious traffic-related incident will need to fill out an SR-22 form. These traffic incidents include the following: driving under the influence, driving with a suspended license, and driving without insurance in Maine.

You’ll need to contact your insurance company to have your company include an SR-22 form on your policy. Your company may require you to pay higher rates because of the SR-22. If you DO NOT file an SR-22 form you won’t have your driving privileges reinstated.

Your license will be suspended, additional fines will be assessed, and your vehicle’s registration will be suspended. If you are a high-risk driver, remember to fill out an SR-22 form. Not doing so will result in the loss of the right to drive altogether.

Low-Cost Insurance

Maine doesn’t have a low-cost insurance program, unlike some other states. However, there are additional ways to cut back on insurance costs. The DMV recommends asking Maine insurers about the following discounts:

- Good student discount and honor roll discounts

- Safety device discount

- Anti-theft device discount

- Low mileage discount

- Multiple vehicles discount

- Multiple policies (auto and home) discount

- Driver education discount

For those seeking affordable car insurance in Maine, exploring options based on ZIP code can lead to finding the best rates tailored to local conditions.

You can also reduce rates by shopping around for an economical provider in your area. Just make sure that economical rates doesn’t equal poor coverage.

By comparing these options, drivers can secure cost-effective coverage that meets their needs and budget. This allows them to make informed decisions, ensuring they get the best value for their money. Understanding the nuances of different policies can help drivers avoid unnecessary expenses and select a plan that offers the optimal balance of coverage and cost.

Windshield Coverage

In Maine, state law does NOT require insurers to replace cracked or broken windshields. However, comprehensive coverage usually covers the cost of a windshield repair or replacement (yet another reason why more complete coverage is the best option). Listed below are some of the particular requirements for windshield replacement in Maine.

- Insurers can use aftermarket (used) parts unless you want to pay the price difference for a new part

- You may choose the repair vendor but may have to pay the price difference

Repairing your windshield is important because driving with a cracked or broken windshield is illegal under the following circumstances:

- The repair blocks/obstructs a driver’s view of the road

- The crack is greater than six inches

- The crack blocks/obstructs a driver’s view of the road

Any of the violations listed above can result in fines and your vehicle not passing inspection. Additionally, repeated offenses may lead to the suspension of your driver’s license and increased insurance premiums.

Automobile Insurance Fraud in Maine

What is automobile insurance fraud?

- Adding “extra” costs onto a claim that is legitimate

- Creating a claim for damages or injuries that NEVER occurred (such as faking an accident)

Committing insurance fraud can result in fines and/or jail time. Don’t risk it.

Statute of Limitations

In Maine, if you’re in an automobile accident, there is a statute of limitations if you want to file a claim.

Basically, a statute of limitations is the amount of time you have to file a claim after an accident. This ticking clock starts the day of your accident, so make sure that you are familiar with Maine’s statute of limitations.

Vehicle Licensing Laws

We all love the feeling of driving down the open road with the windows down and the smell of the Maine coastline wafting in on an ocean breeze. But if you’re not careful, that bright light you see in your rearview mirror won’t be from one of Maine’s many lighthouses, but a highway patrol officer pulling you over for speeding, or worse, driving while uninsured.

For a first offense, you will have to pay a fine of $100-$500. Authorities will also suspend your license and registration until you can provide proof of insurance.

Let’s review what types of documents are acceptable for proving financial security in the state of Maine. Any time you are pulled over or are in an accident, you must provide one of the following:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Electronic proof from a smartphone is acceptable

If you violate car insurance laws in Maine, the state can also suspend your car’s registration. You will receive notification of the intent to suspend registration.

Teen Driver Laws

Teenagers in Maine can apply for a learner’s license (also known as a learner’s permit) at age 15.After teenagers have gone through the mandatory learner’s license period and met all the requirements, they can apply for a regular or restricted license.

By staying informed about these laws, families can foster responsible driving habits and promote safer road environments for everyone.

Older Driver License Renewal Procedures

Older residents in Maine (65 years old and older) must renew their licenses every four years. This is more often than the general population, who are only required to renew their licenses every six years.Here are two more rules for older drivers that differ from the general population.

- Drivers 62 years old and older MUST have proof of adequate vision at every renewal

- Drivers 62 years old and older are NOT allowed to renew their licenses online or through the mail

To sum it up, older drivers must visit-in-person every four years to renew their licenses and have proof of adequate vision.

New Residents

If you are a new resident in the state of Maine, you must contact your current insurance provider for updated rates and updated insurance id cards. One thing to remember: you need Maine’s minimum liability insurance, NOT the minimum liability rates of your last state.

Maine requires bodily injury, property damage, uninsured motorist, and medical payments coverage.

Make sure to also get an updated license and car registration, which are both basic items on most peoples’ moving to-do list.

License Renewal Procedures

The basic renewal procedures for the general population are as follows.

- Renewal Cycle: You must renew your license every SIX years if under the age of 65 years old

- Online/Mail Renewal: You MAY renew your license online or through the mail if under the age of 62 years old,

- Proof of Adequate Vision: You must provide at first renewal after age 40 and at every other renewal until 62 years old

Maine’s online and mail renewal system means you can go many years without standing in line at the DMV. Just remember that you must provide proof of adequate vision at every other renewal (every 12 years) if you are older than 40.

Maine Rules of the Road

Everyone has to follow the rules, but if you’re new to the Pine Tree State, there may be laws you’re unfamiliar with. That’s why we’ve compiled a list of several important laws to keep you in good standing and on the road.

Fault vs. No-Fault

Maine is an at-fault state. This means that if you are at-fault in an accident, you may be held liable for injury and property damage costs. The at-fault driver will have to pay all medical expenses, damages, and other costs that occurred from the accident.This means that if you don’t have insurance OR the right coverage, your resources will quickly be drained. The last thing you want is to go bankrupt due to an accident.

Keep Right and Move Over Laws

Maine’s keep right law is easy to follow. Drivers must stay in the right lane unless they are passing another vehicle in an area where the speed is greater than 65 mph OR when they are making a left turn.The move over law is important to understand and follow.

All motorists must move over to safely pass by vehicles that are on the side of the road. Emergency responders in Maine have started deploying temporary speed bumps to slow drivers down. The vehicles you need to move over for include the following:

- Law enforcement

- Firefighters

- Ambulances

- Utility workers

- Tow-truck drivers

- Drivers with hazard lights on

Respect the safety of others and move over as soon as you can.

Read more: Compare Emergency Service Worker Car Insurance Rates

Speed Limits in Maine

Every state has differing speed limits, and violating a state’s speed limits may result in tickets and fines.

Remember, these are the MAXIMUM speed limits. Speed limits will vary from road to road and your speed could vary due to specific road and weather conditions.

Seat Belt and Car Seat Laws

Do you know Maine’s seat belt laws? Different states have different laws, and knowing Maine’s laws will help you avoid a fine.

Primary enforcement means law enforcement officers can pull you over if they see you aren’t following the seat belt laws. There are also important rules in place regarding the safety of children.

Maine also has restrictions on riding in the cargo areas of pickup trucks. You may not ride in the cargo area of a pickup truck unless you meet the following exceptions:

- People aged 19 years old and older

- Agricultural workers and hunters aged 18 years old and younger

- Parades

- People in OEM installed seats outside the passenger compartment

Follow the rules above to stay safe and keep you and your family on the road.

Ridesharing

You may be familiar with ridesharing companies like Uber and Lyft. If you want to rideshare, you must purchase ridesharing insurance from one of the following providers in Maine:

- Geico

- State Farm

In addition to ridesharing insurance, it’s also important to have the state minimum coverage Maine requires. Ridesharing companies will also require that your vehicle is currently registered/inspected and is safe to drive. After all, you aren’t just driving yourself around. So make sure you meet all the requirements for ridesharing by following a company’s guidelines carefully and purchasing ridesharing insurance.

Automation on the Road in Maine

With increasing implementation of automated driving systems and smart traffic management technologies. What is automation? IIHS defines it as the following:

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. One example is adaptive cruise control, which maintains a set speed.”

In Maine, the only law required if you have an autonomous vehicle is liability insurance. Start your search for insurance by entering your ZIP code in our FREE online search tool.

Safety Laws

Drunk driving has catastrophic results for everyone involved, that’s why strict laws are in place to prevent such occurrences.

DUI Laws

In Maine alone, drunk driving caused 50 deaths in 2017. Each state is different in how they address drunk driving and therefore have different penalties. Below, we’ve listed the details about Maine’s impaired driving laws.

Please don’t drink and drive. As for marijuana-impaired driving in the state of Maine, there are no specific laws in place. This does NOT mean you can get away with using marijuana and driving.

Distracted Driving Laws in Maine

Distracted driving can happen at any time. If you’re distracted and not watching the road around you, an accident is bound to occur. Maine has restricted cellphone use inside the car, and there are also apps to prevent texting in the car. Maine has created the following cellphone use laws to help prevent accidents.

Maine Distracted Driving Law

| Hand-held Ban | Young Driver Cell Phone Ban | Texting Ban | Enforcement |

|---|---|---|---|

| No | Learner's permit and restricted license users | All drivers | Primary |

Remember, primary enforcement means an officer can pull you over just for being on your cellphone. Stay with us, because we’re going to jump into Maine’s can’t-miss facts next.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maine Can’t-Miss Facts

Now that you have a good understanding of the laws in Maine, let’s jump into Maines’s can’t-miss facts. These highlights will give you a deeper appreciation of what makes Maine truly unique.

You now know the rules of the road, but do you know the risks of owning and operating a vehicle in Maine?

It’s difficult to remember all of the risks associated when driving your favorite sports car, and really, who wants to? While insurance is important, it’s also crucial to know what to keep your eyes out for on the road. We’ve laid out everything you need to know about the risk factors in Maine, from vehicle theft to crash reports, so that you can be aware of what’s around you and get home safely.

Vehicle Theft in Maine

In every state, there are certain vehicles that are stolen more than others. In Maine, the frequency and types of vehicles targeted can differ significantly from national trends due to regional factors. Understanding which vehicles are most at risk can help residents take appropriate preventative measures.

Most Stolen Cars in Maine by Make, Model, & Year 2024

| Make & Model | Rank | Vehicle Year | Total Stolen |

|---|---|---|---|

| Chevrolet Pickup (Full Size) | #1 | 2004 | 145 |

| GMC Pickup (Full Size) | #2 | 2005 | 132 |

| Jeep Cherokee/Grand Cherokee | #3 | 2000 | 120 |

| Ford Pickup (Full Size) | #4 | 2006 | 110 |

| Toyota Corolla | #5 | 2010 | 98 |

| Toyota Camry | #6 | 2009 | 87 |

| Honda Civic | #7 | 2008 | 75 |

| Chevrolet Impala | #8 | 2011 | 64 |

| Ford Focus | #9 | 2012 | 53 |

| Chevrolet Cobalt | #10 | 2007 | 42 |

Where you live also plays a role in the number of vehicle thefts. The FBI created a 2013 report on Maine’s vehicle thefts by cities, which are listed below (Read More: Compare GMC Car Insurance Rates).

Maine Vehicle Thefts by City 2024

| City | Thefts |

|---|---|

| Ashland | 1 |

| Auburn | 17 |

| Augusta | 31 |

| Baileyville | 1 |

| Bangor | 37 |

| Bar Harbor | 1 |

| Bath | 2 |

| Belfast | 1 |

| Berwick | 2 |

| Biddeford | 18 |

| Boothbay Harbor | 1 |

| Brewer | 3 |

| Bridgton | 2 |

| Brownville | 2 |

| Brunswick | 10 |

| Bucksport | 5 |

| Buxton | 5 |

| Calais | 0 |

| Camden | 1 |

| Cape Elizabeth | 2 |

| Caribou | 6 |

| Carrabassett Valley | 0 |

| Clinton | 2 |

| Cumberland | 1 |

| Damariscotta | 0 |

| Dexter | 4 |

| Dixfield | 0 |

| Dover-Foxcroft | 6 |

| East Millinocket | 0 |

| Eastport | 1 |

| Eliot | 0 |

| Ellsworth | 8 |

| Fairfield | 5 |

| Falmouth | 3 |

| Farmington3 | 3 |

| Fort Fairfield | 2 |

| Fort Kent | 1 |

| Freeport | 4 |

| Fryeburg | 0 |

| Gardiner | 1 |

| Gorham | 7 |

| Gouldsboro | 0 |

| Greenville | 0 |

| Hallowell | 2 |

| Hampden | 4 |

| Holden | 0 |

| Houlton | 1 |

| Islesboro | 0 |

| Jay | 3 |

| Kennebunk | 2 |

| Kennebunkport | 0 |

| Kittery | 3 |

| Lewiston | 56 |

| Limestone | 2 |

| Lincoln | 5 |

| Lisbon | 4 |

| Livermore Falls | 2 |

| Machias | 0 |

| Madawaska | 1 |

| Madison | 9 |

| Mechanic Falls | 1 |

| Mexico | 3 |

| Milbridge | 0 |

| Millinocket | 1 |

| Milo | 3 |

| Monmouth | 5 |

| Mount Desert | 0 |

| Newport | 0 |

| North Berwick | 1 |

| Norway | 2 |

| Oakland | 6 |

| Ogunquit | 0 |

| Old Orchard Beach | 5 |

| Old Town | 3 |

| Orono | 1 |

| Oxford | 4 |

| Paris | 4 |

| Phippsburg | 0 |

| Pittsfield | 3 |

| Portland | 69 |

| Presque Isle | 2 |

| Rangeley | 1 |

| Richmond | 1 |

| Rockland | 7 |

| Rockport | 1 |

| Rumford | 3 |

| Sabattus | 3 |

| Saco | 12 |

| Sanford | 26 |

| Scarborough | 11 |

| Searsport | 3 |

| Skowhegan | 26 |

| South Berwick | 3 |

| South Portland | 26 |

| Southwest Harbor | 0 |

| Swan's Island | 1 |

| Thomaston | 0 |

| Topsham | 10 |

| Van Buren | 2 |

| Veazie | 0 |

| Waldoboro | 0 |

| Washburn | 1 |

| Waterville | 15 |

| Wells | 3 |

| Westbrook | 20 |

| Wilton | 1 |

| Windham | 12 |

| Winslow | 5 |

| Winter Harbor | 0 |

| Winthrop | 2 |

| Wiscasset | 1 |

| Yarmouth | 1 |

| York | 5 |

While vehicle theft rates in Maine are generally lower compared to national averages, it remains crucial for residents to take preventive measures such as using anti-theft devices and parking in well-lit areas. Being informed about local trends and maintaining vigilance can further reduce the risk of car theft in the state.

Traffic Fatalities

Road type does affect the number of fatalities. Generally, rural roads see more fatalities than urban roads. This is partly because of the greater speeds reached on rural roads, which mean the impacts are far greater and far deadlier.

Another factor that shows trends in fatalities is the type of person. We don’t mean demographic information, but rather the type of vehicle that is being driven and if the person is an occupant in the car, a pedestrian, or a cyclist. Did you know speeding is a major cause of driving fatalities? Below, are listings by county of the most speed-related fatalities in Maine.

Maine Speed-Related Fatalities by County and Year

| County | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Androscoggin | 4 | 5 | 6 |

| Aroostook | 3 | 4 | 5 |

| Cumberland | 10 | 12 | 13 |

| Franklin | 2 | 3 | 4 |

| Hancock | 3 | 4 | 5 |

| Kennebec | 7 | 8 | 9 |

| Knox | 2 | 3 | 4 |

| Lincoln | 2 | 3 | 4 |

| Oxford | 5 | 6 | 7 |

| Penobscot | 8 | 10 | 11 |

| Piscataquis | 1 | 2 | 3 |

| Sagadahoc | 1 | 2 | 3 |

| Somerset | 3 | 4 | 5 |

| Waldo | 2 | 3 | 4 |

| Washington | 2 | 3 | 4 |

| York | 9 | 11 | 13 |

Have you ever wondered about the amount of drunk driving going on in your county? Check out the table below to see fatalities in crashes that involved an alcohol-impaired driver with a BAC over .08.

Maine DUI Fatalities by County and Year

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Androscoggin | 5 | 6 | 7 |

| Aroostook | 3 | 4 | 5 |

| Cumberland | 12 | 14 | 15 |

| Franklin | 2 | 3 | 4 |

| Hancock | 4 | 5 | 6 |

| Kennebec | 8 | 9 | 10 |

| Knox | 3 | 4 | 5 |

| Lincoln | 2 | 3 | 4 |

| Oxford | 6 | 7 | 8 |

| Penobscot | 10 | 12 | 13 |

| Piscataquis | 1 | 2 | 3 |

| Sagadahoc | 2 | 3 | 4 |

| Somerset | 4 | 5 | 6 |

| Waldo | 2 | 3 | 4 |

| Washington | 3 | 4 | 5 |

| York | 10 | 12 | 14 |

Let’s move onto the last depressing statistics — teen drinking and driving. In 2016, law enforcement arrested 28 teenagers (under the age of 18) for drunk driving.

This number places Maine as the 19th worst state in the U.S. for underage drinking and driving.

In the U.S. the average number of underage drinking deaths per 100,000 people is 1.2 deaths. Maine has 2.3 underage drinking and driving deaths per 100,000 people. This number is nearly two times the national average, and it places Maine within the top ten WORST states for underage drinking and driving fatalities.

EMS Response Time

If you or someone you know is in an accident, you want help to arrive as FAST as possible. Response times in Maine are excellent. It takes less than 50 minutes in both rural and urban settings to arrive at the hospital.

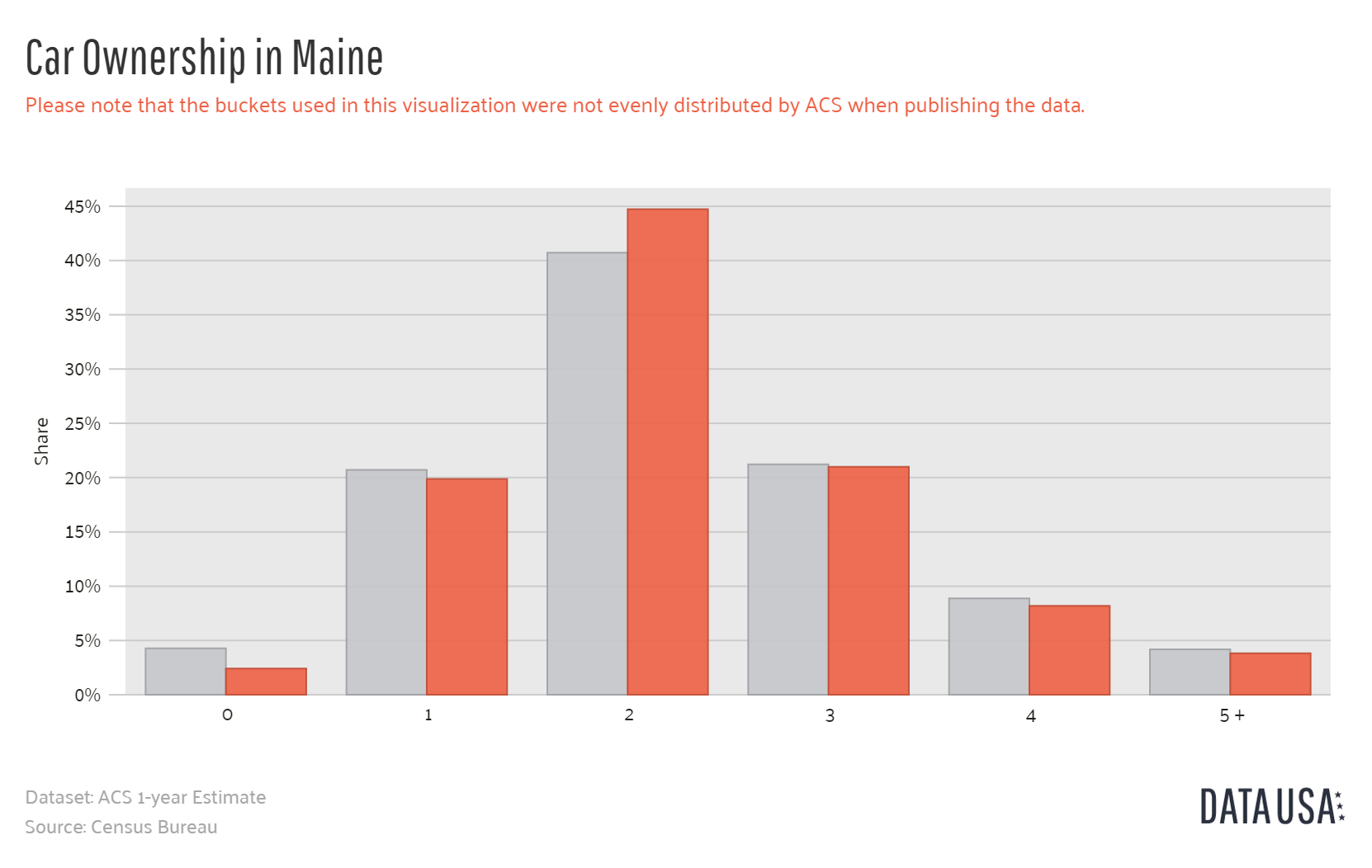

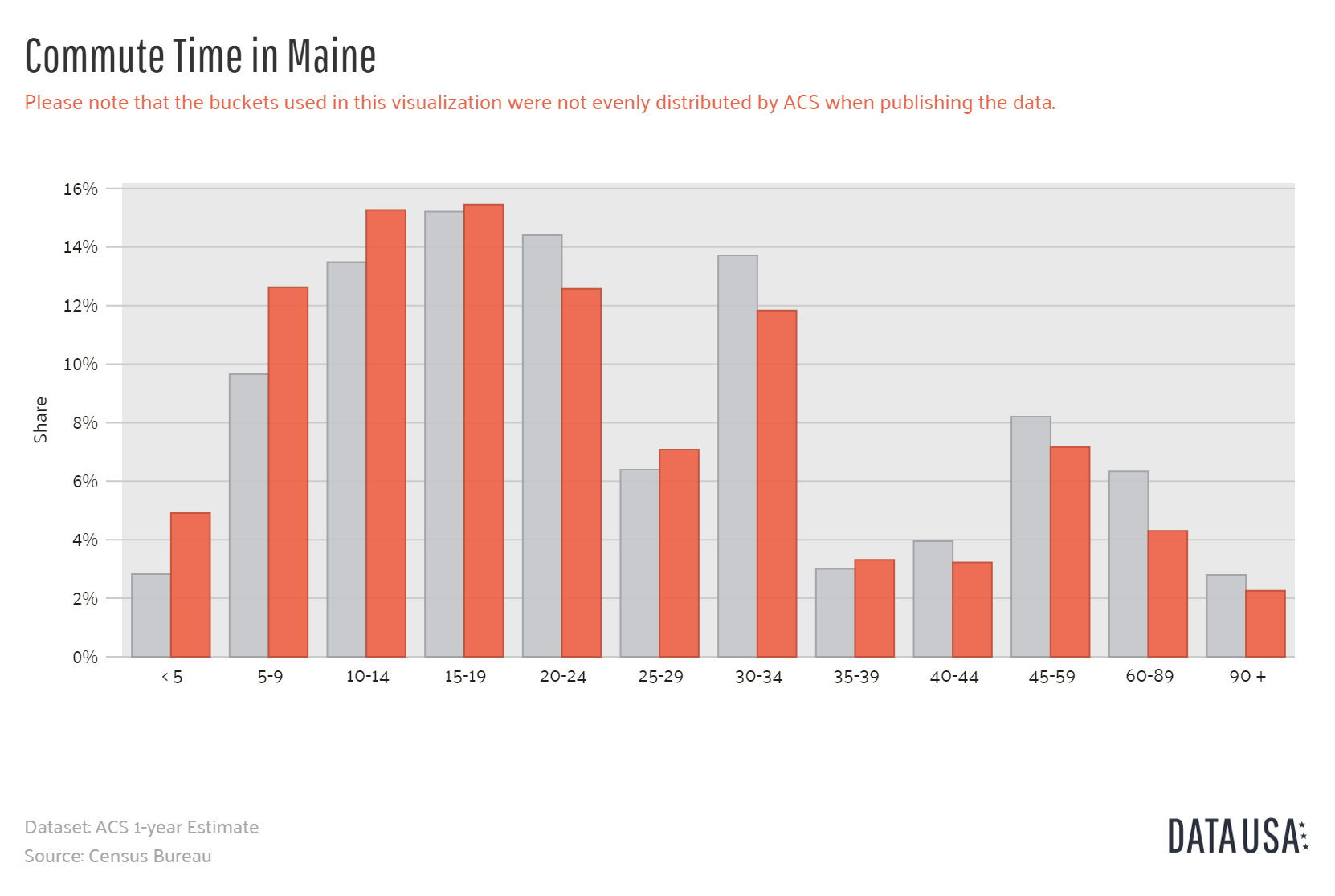

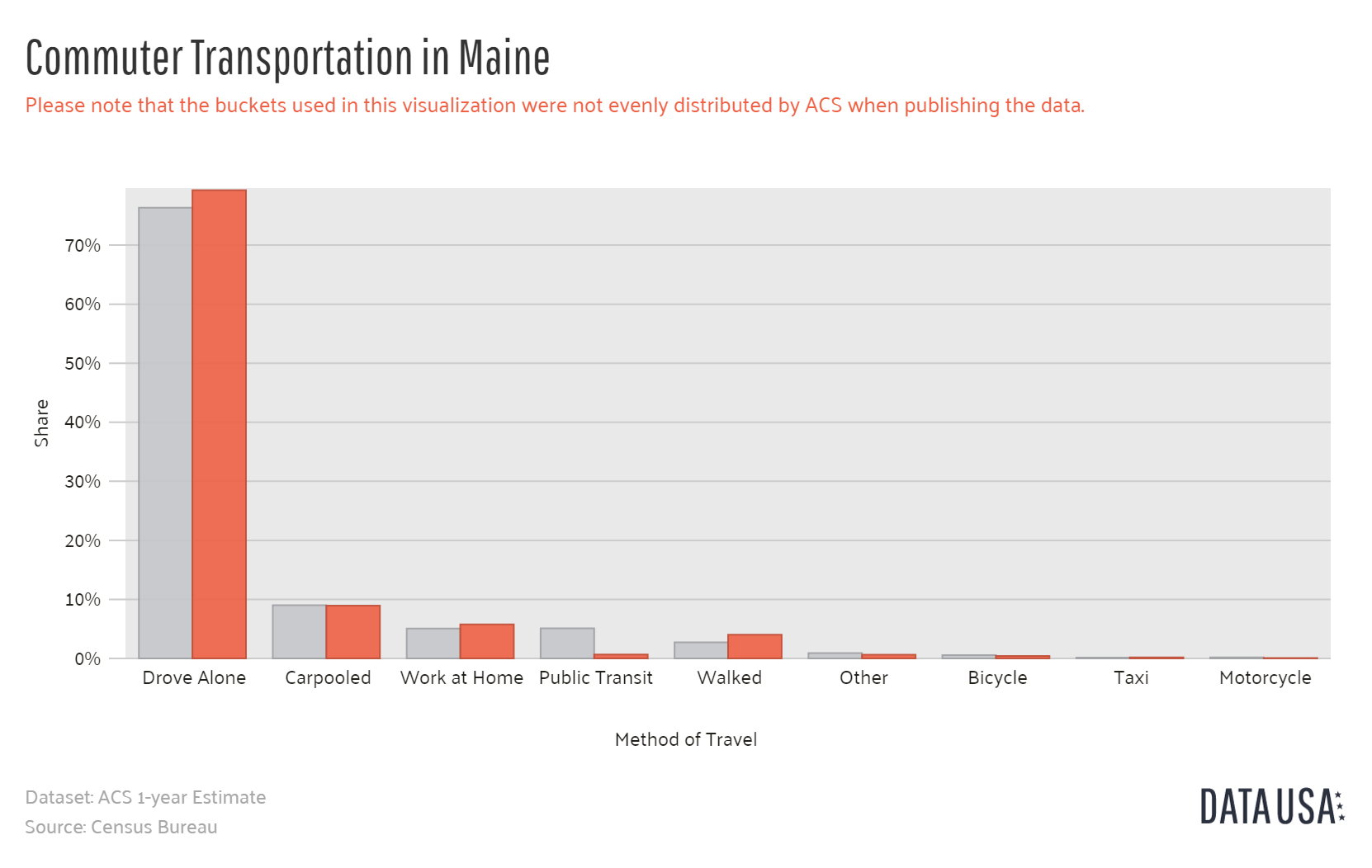

Transportation in Maine

When you drive through your neighborhood, do you ever take note of how many cars are sitting in your neighbors’ driveways? Usually, we can tell if someone is visiting by that extra car parked outside the house.

Case Studies: Real Savings on Maine Car Insurance

Finding the cheapest Maine car insurance rates can significantly impact your budget. Here are three real-life examples of how Geico, Erie, and State Farm helped individuals and families save on their car insurance while meeting their unique needs.

- Case Study #1 – Geico’s Affordability for New Drivers: New drivers often face high insurance rates, but John, a 20-year-old college student from Portland, Maine, found an affordable solution with Geico. By leveraging Geico’s competitive pricing and available discounts, he managed to secure a policy for just $15/month, significantly reducing his monthly expenses without compromising coverage.

- Case Study #2 – Erie’s Financial Stability for Families: The Thompson family from Bangor needed reliable insurance that wouldn’t break the bank. Erie provided them with a robust policy, combining affordability with excellent financial stability. Their comprehensive coverage included uninsured motorist and MedPay, offering peace of mind.

- Case Study #3 – State Farm’s Local Agent Support for Seniors: Eleanor, a retiree living in Augusta, sought personalized service for her car insurance needs. State Farm’s local agents offered her tailored advice and support, ensuring she got the best coverage at the lowest rates. By choosing State Farm, Eleanor benefited from a policy that fit her budget and lifestyle.

These case studies highlight how Geico, Erie, and State Farm cater to different needs, making them the top choices for the cheapest Maine car insurance rates. Read more: How do you get competitive quotes for car insurance?

Geico offers unbeatable affordability, making it the best choice for the cheapest Maine car insurance rates.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Whether you’re a new driver, a family, or a senior, comparing quotes from these providers can help you find the best coverage at the most affordable price. Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

Frequently Asked Questions

How can I compare car insurance rates in Maine?

Gather your vehicle and driving history details, then research reputable insurance companies in Maine. Request quotes, compare coverage options and prices, and consider the company’s reputation before making a decision. Learn more in our “Is it cheaper to purchase car insurance online?”

What factors can affect my car insurance rates in Maine?

Car insurance rates in Maine can be affected by your driving record, vehicle type, coverage levels, deductibles, location, age, gender, credit history, and claims history.

Are there any discounts available to lower car insurance rates in Maine?

Yes, common discounts include multi-policy car insurance discount, good driver, good student, safety features, low mileage, mature driver, and loyalty discounts. Check with your provider for available discounts.

Are car insurance rates in Maine regulated?

Yes, car insurance rates in Maine are regulated by the Maine Bureau of Insurance. Insurance companies must file their rates with the bureau, which reviews and approves them to ensure they are not excessive, inadequate, or unfairly discriminatory.

Can I get car insurance in Maine if I have a poor driving record?

Yes, even if you have a poor driving record, you can still obtain car insurance in Maine. However, insurance companies may consider you a higher risk, and as a result, your premiums may be higher compared to drivers with a clean driving record. Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

What are the minimum car insurance requirements in Maine?

Maine requires the following minimum coverage: Bodily Injury Liability – $50,000 per person/$100,000 per accident, Property Damage Liability – $25,000, Uninsured/Underinsured Motorist – $50,000 per person/$100,000 per accident, and Medical Payments – $2,000.

To learn more, explore our comprehensive resource on “What is the minimum amount of liability car insurance coverage required?“

How can I reduce my car insurance rates in Maine?

To reduce your car insurance rates in Maine, consider maintaining a clean driving record, opting for higher deductibles, bundling multiple policies, taking advantage of discounts, and regularly comparing quotes from different providers.

What should I do if I can’t afford car insurance in Maine?

If you can’t afford car insurance in Maine, look into state-sponsored programs or financial assistance options. Additionally, consider adjusting your coverage levels or shopping for more affordable providers to lower your premiums.

Can I use a smartphone picture as proof of insurance in Maine?

Yes, Maine law allows drivers to use a smartphone picture as proof of insurance. Ensure the image is clear and includes all necessary details such as your name, policy number, and coverage dates.

What is the penalty for driving without insurance in Maine?

Driving without insurance in Maine can result in fines, suspension of your driver’s license and vehicle registration, and possibly higher insurance premiums in the future. Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.