Cheapest Iowa Car Insurance Rates in 2026 (10 Most Affordable Companies)

The cheapest Iowa car insurance rates start as low as $14 per month with top providers like USAA, State Farm, and Progressive. These companies offer competitive rates and tailored benefits, making them ideal choices for budget-conscious drivers in Iowa. Compare quotes to find the best coverage for you today.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated October 2024

Company Facts

Min. Coverage in Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

Discover the cheapest Iowa car insurance rates with USAA, State Farm, and Progressive, offering rates as low as $14 per month. These insurers stand out for their competitive pricing and comprehensive coverage options. USAA particularly shines for its military savings and exceptional customer satisfaction, making it the top choice among budget-conscious drivers.

Iowa drivers enjoy some of the lowest average car insurance rates both for best full coverage and minimum insurance.

Our Top 10 Company Picks: Cheapest Iowa Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $14 A++ Military Savings USAA

#2 $16 B Student Savings State Farm

#3 $18 A+ Coverage Options Progressive

#4 $20 A Safe-Driving Discounts Farmers

#5 $23 A++ Comprehensive Coverage Travelers

#6 $23 A Loyalty Rewards American Family

#7 $27 A Online Tools Safeco

#8 $28 A Add-on Coverages Liberty Mutual

#9 $31 A+ Infrequent Drivers Allstate

#10 $32 A Roadside Assistance AAA

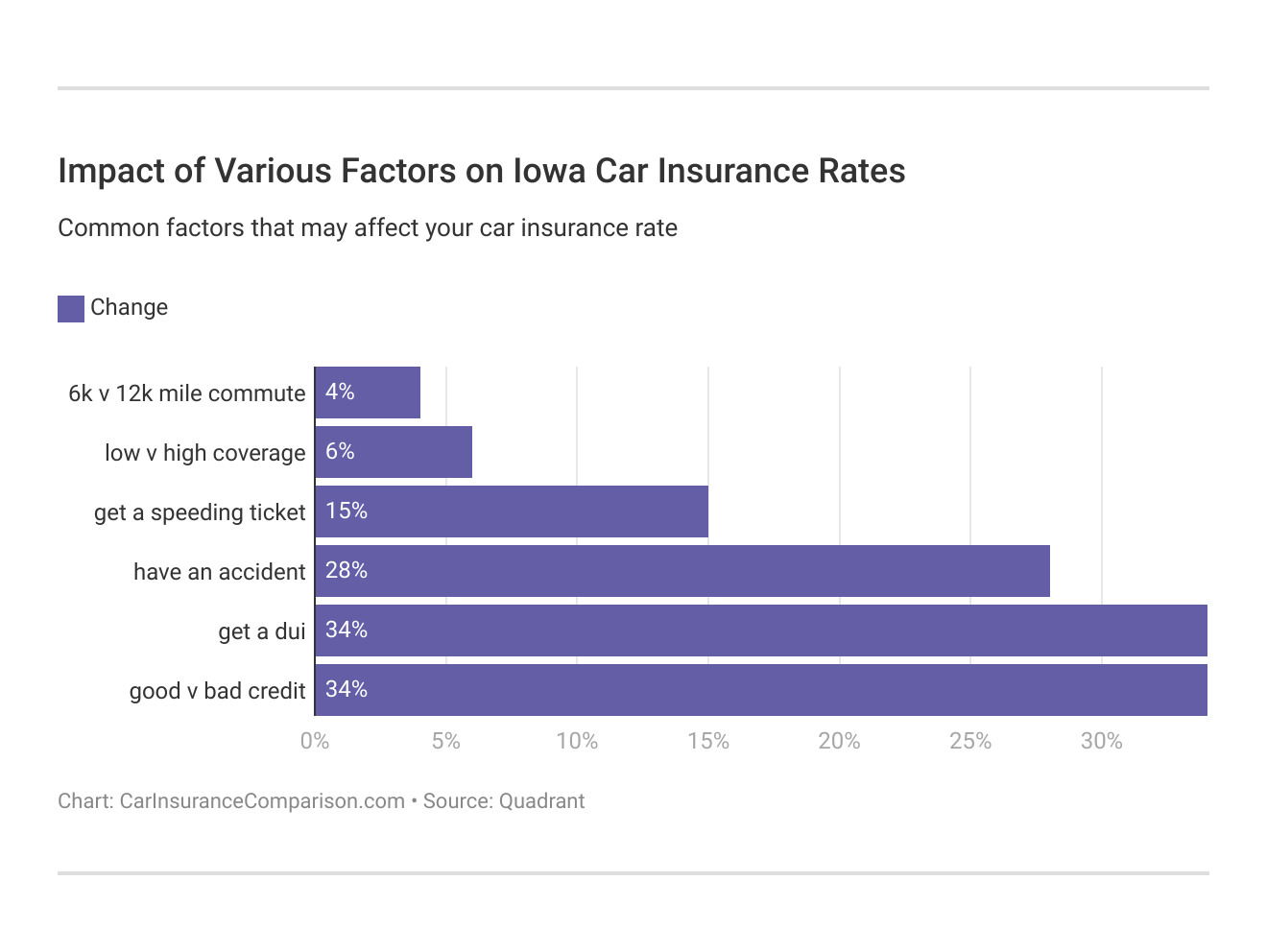

While Iowa car insurance quotes are usually affordable, several factors can affect your overall prices. Things like your age, location, driving history, and even credit score can impact your rates.

See how much you’ll pay for car insurance by entering your ZIP code above into our free comparison tool.

- Iowa law mandates financial responsibility for coverage decisions

- Factors like age, location affect pricing

- USAA offers military savings, top satisfaction

- Compare Iowa Car Insurance Rates

- Best Tripoli, IA Car Insurance in 2026

- Best Spirit Lake, IA Car Insurance in 2026

- Best Sioux City, IA Car Insurance in 2026

- Best Rock Valley, IA Car Insurance in 2026

- Best North Liberty, IA Car Insurance in 2026

- Best Grimes, IA Car Insurance in 2026

- Best Denison, IA Car Insurance in 2026

- Best Bellevue, IA Car Insurance in 2026

- Best Ankeny, IA Car Insurance in 2026

#1 – USAA: Top Overall Pick

Pros

- Lowest Premium: USAA offers the lowest average premium of $14 for car insurance in Iowa, making it the most affordable option for residents looking to save on insurance costs.

- Comprehensive Coverage: USAA provides extensive coverage options, including liability, collision, and comprehensive insurance for drivers in Iowa, which are beneficial even with the lowest premium rate.

- Exceptional Discounts: As mentioned in our USAA car insurance review, USAA offers several discounts, including those for safe driving and bundling policies, which can further reduce the already low rates for Iowa drivers.

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families, limiting access to its competitive rates for those outside this group in Iowa.

- Limited Local Offices: With fewer local offices in Iowa, policyholders may find it less convenient to get in-person assistance compared to insurers with more widespread physical locations.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Student Savings

Pros

- Affordable Rates: State Farm’s average premium of $16 for Iowa car insurance is among the most competitive, offering significant savings for policyholders.

- Wide Range of Discounts: State Farm provides a variety of discounts, including multi-car and good driver discounts, which can further lower the cost of insurance for Iowa policyholders.

- User-Friendly Digital Tools: State Farm offers a robust mobile app and online tools for easy policy management and claims processing, enhancing the convenience for policyholders in Iowa. Learn more about their rates in our State Farm car insurance review.

Cons

- Standard Coverage Options: While affordable, State Farm’s coverage options may be more basic compared to some competitors in Iowa, which might not meet the needs of drivers looking for more extensive protection.

- Variable Customer Service: Customer service experiences can vary widely, with some customers reporting slower response times or less satisfactory support compared to other insurers in Iowa.

#3 – Progressive: Best for Coverage Options

Pros

- Competitive Premiums: At an average of $18, Progressive offers a cost-effective solution for Iowa drivers seeking affordable car insurance.

- Snapshot Program: Progressive’s Snapshot program rewards safe driving habits with potential discounts, which can reduce premiums even further for Iowa policyholders.

- Customizable Coverage: Progressive allows for a high degree of customization in policy options, enabling Iowa drivers to tailor their coverage to their specific needs. Read more about their discounts in our Progressive car insurance review.

Cons

- Higher Rates for Certain Drivers: While generally affordable, Progressive may have higher premiums for Iowa drivers with certain risk profiles, such as those with a history of accidents or violations.

- Complex Pricing Structure: The various discounts and pricing options can be confusing, making it challenging for some customers in Iowa to fully understand how their premiums are determined.

#4 – Farmers: Best for Safe-Driving Discounts

Pros

- Affordable Premiums: Farmers’ average rate of $20 for car insurance in Iowa is competitive, providing good value for drivers seeking budget-friendly options.

- Wide Range of Coverage Options: Farmers offers a broad array of coverage options for drivers in Iowa, including unique add-ons like accident forgiveness, which can enhance the value of their policies.

- Flexible Payment Plans: As mentioned in our Farmers car insurance review, Farmers provides flexible payment options for Iowa drivers, including monthly and quarterly plans, which can help manage insurance costs more effectively.

Cons

- Limited Discounts: Compared to some competitors in Iowa, Farmers may offer fewer discounts, potentially missing opportunities for further reducing premiums.

- Mixed Customer Satisfaction: Customer service reviews for Farmers can be mixed, with some Iowa policyholders reporting less satisfactory experiences compared to other insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Comprehensive Coverage

Pros

- Reasonable Premiums: Travelers’ average rate of $23 is competitive in the Iowa market, offering a balance between cost and coverage. Learn more about their rates in our Travelers car insurance review.

- Comprehensive Coverage Choices: Travelers provides extensive coverage options and additional features such as roadside assistance and rental car coverage for Iowa policyholders.

- Discount Opportunities: Travelers offers multiple discounts, including those for bundling policies and maintaining a clean driving record, for drivers in Iowa which can help lower costs.

Cons

- Higher Rates for Some Drivers: While generally affordable, Travelers’ rates may be higher for Iowa drivers with a history of claims or traffic violations.

- Complex Policy Options: The range of coverage options and discounts can be overwhelming, making it difficult for some Iowa customers to find the best fit for their needs.

#6 – American Family: Best for Loyalty Rewards

Pros

- Competitive Premiums: American Family’s average rate of $23 is competitive for Iowa drivers looking for affordable car insurance options.

- Extensive Coverage Options: American Family offers a wide range of coverage options and add-ons, including accident forgiveness and new car replacement for policyholders residing in Iowa.

- Strong Customer Service: Known for good customer service in Iowa, American Family provides accessible support and responsive assistance for policyholders.

Cons

- Limited Discounts: The range of discounts offered by American Family might be less comprehensive compared to some competitors in Iowa, potentially limiting additional savings. Learn more about their discounts in our Nationwide car insurance discounts article.

- Variable Premiums: Premiums can vary significantly based on individual factors, which might result in higher rates for some drivers in Iowa compared to others.

#7 – Safeco: Best for Online Tools

Pros

- Affordable Rates: Safeco’s average premium of $27 is competitive for Iowa, offering a balance between cost and coverage.

- Good Discounts: Safeco provides various discount opportunities, including multi-policy and safe driver discounts, which can help reduce overall insurance costs for policyholders in Iowa.

- Flexible Coverage Options: As mentioned in our Safeco car insurance review, they provide customizable coverage options, allowing Iowa drivers to tailor their policies to better fit their needs.

Cons

- Limited Local Presence: Safeco may have fewer local agents and offices in Iowa, which can impact accessibility and personalized service.

- Customer Service Concerns: Some customers in Iowa report issues with customer service responsiveness and support, which can be a drawback for those needing frequent assistance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Add-on Coverages

Pros

- Competitive Premiums: Liberty Mutual’s average rate of $28 provides a cost-effective option for Iowa drivers seeking affordable car insurance.

- Diverse Coverage Options: Liberty Mutual offers a wide range of coverage options, including unique features like accident forgiveness and new car replacement for policyholders in Iowa.

- Discount Opportunities: Liberty Mutual provides various discounts, including those for bundling and safe driving, which can help lower Iowa drivers’ insurance costs. For more information, read our Liberty Mutual car insurance review.

Cons

- Higher Premiums for Some Drivers: Liberty Mutual’s rates may be higher for drivers in Iowa with certain risk profiles, such as those with a history of claims or traffic violations.

- Mixed Customer Service: Reviews of Liberty Mutual’s customer service are mixed, with some policyholders in Iowa experiencing less satisfactory support.

#9 – Allstate: Best for Infrequent Drivers

Pros

- Reasonable Premiums: Allstate’s average premium of $31 is competitive for Iowa, offering a good balance of affordability and coverage. Learn more in our Allstate car insurance review.

- Comprehensive Coverage: Allstate provides a wide range of coverage options, including add-ons like roadside assistance and rental car reimbursement for Iowa policyholders.

- Numerous Discounts: Allstate offers a variety of discounts, such as safe driving and multi-policy discounts, which can help reduce Iowa drivers’ overall insurance costs.

Cons

- Higher Premiums: Allstate’s premiums might be higher compared to some competitors in Iowa, which can be a drawback for those seeking the absolute lowest rates.

- Customer Service Variability: Customer service experiences with Allstate can vary, with some Iowa policyholders reporting slower response times or less satisfactory support.

#10 – AAA: Best for Roadside Assistance

Pros

- Affordable Rates: AAA’s average premium of $32 is competitive for Iowa, providing a cost-effective solution for car insurance. Learn more in our AAA car insurance review.

- Roadside Assistance: AAA includes roadside assistance as part of its insurance packages, offering additional value beyond standard coverage for policyholders in Iowa.

- Discounts for Members: AAA members in Iowa can benefit from various discounts and benefits, which can further reduce insurance costs.

Cons

- Higher Premiums Compared to Others: While competitive, AAA’s premiums in Iowa are higher than some other options, which might not be ideal for those seeking the lowest rates.

- Limited Coverage Options: AAA’s coverage options in Iowa may be less extensive compared to other providers, potentially missing some add-on features and benefits.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Iowa Car Insurance Rates

Iowa requires all drivers to have car insurance. Yet it can be confusing to understand the multiple different coverages and rates available to you. How do you know which coverages you actually need? After all, you don’t want to pay for coverage that’s unnecessary or overly expensive.

The table below compares monthly rates for minimum and full coverage car insurance in Iowa from various providers.

Iowa Car Insurance Monthly Rates by Coverage Level & Providers

Insurance Company Minimum Coverage Full Coverage

AAA $32 $86

Allstate $31 $126

American Family $23 $95

Farmers $20 $82

Liberty Mutual $28 $116

Progressive $18 $75

Safeco $27 $71

State Farm $16 $65

Travelers $23 $94

USAA $14 $55

That’s why we have explained the different coverages and rate statistics in Iowa so that you can feel confident in your decision. We want you to be knowledgeable so that you can purchase the best coverage and rates possible. Keep scrolling to learn everything you need to know about before how to purchase the right car insurance.

Iowa Car Insurance Requirements

While Iowa does not have a compulsory car insurance law, Iowa does have the Motor Vehicle and Financial Safety Act. This means that Iowa doesn’t require drivers to have car insurance, but if you are in an accident you must provide proof of financial responsibility.

This proof could be your own liability insurance or Iowa’s minimum liability insurance amount. There are a few other forms of financial responsibility you can provide, which we will cover in the next section.

The last thing you want is to be in an accident without insurance, as the most likely result is that you will be unable to pay off medical bills and property damage.

Iowa requires drivers to have the following minimum liability insurance if their license has been suspended or revoked:

- $20,000 to pay for the injuries of one person

- $40,000 to pay for the injuries of more than one person

- $15,000 to pay for property damage

It is important to note that these requirements are only the minimum amounts. If costs go beyond these amounts, you will be stuck paying the bills yourself. That’s why we recommend purchasing more than the minimum liability amount, as you never know when an accident may happen and start eating into your savings. If you compare liability car insurance quotes, you can find the best companies for you.

You can take a look at how the rates for minimum coverage in Iowa compare across the country. Whether you are a resident of a bustling metropolis or a quieter suburban area, this analysis will help you navigate the complexities of car insurance rates and requirements across different states.

By comparing the average monthly rates for minimum coverage across the U.S., you can identify potential savings opportunities and better anticipate your insurance expenses based on your location. This information is particularly useful for those considering relocation, as it provides a glimpse into how moving to a different state or city might impact their insurance costs.

Forms of Financial Responsibility

If you live in Iowa, the state law requires you to have a form of financial responsibility. A form of financial responsibility proves that you have valid insurance on your car or are able to pay for costs in an accident.

Anytime you are pulled over by an officer or are in an accident, you must provide proof of financial responsibility. Some acceptable forms of financial responsibility are the following:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

There is a catch to the minimum liability insurance policy. According to the DMV, if you are in an accident and don’t have minimum liability car insurance coverage, you may avoid having your license suspended by providing one of the acceptable forms of financial responsibility below:

- Provide proof of liability insurance at the time of the accident

- Pay Driver & Identification Services in Iowa

- Obtain release forms from all involved parties or provide a settlement agreement

- Promise to cover costs for injured or damaged parties (installment plan if needed)

- Receive a civil damage action decision or complete a warrant for confession of judgment with a payment schedule

Iowa insurance and driving laws get even trickier because there are few ways you can get out of completing the above actions. According to the DMV, there are a few exceptions to the above accident rules:

- “At the time of the accident, your vehicle was legally standing, stopped, or parked.”

- “Someone was driving your vehicle without your permission at the time of the accident.”

- “You were the only person to incur injuries or property damage as a result of the accident.”

Confused? Just remember that you must have proof of financial responsibility on your person when operating a vehicle. If you do not provide proof of financial responsibility after an accident, you will face fines and suspension of your license and car’s registration unless you provide proof of financial security.

In summary, the easiest way to avoid penalties and navigate tricky laws is to find out the state required car insurance.

Compare Iowa Car Insurance Rates as a Percentage of Income

What is per capita disposable income? You might have heard this term used before, and it basically refers to the amount of money someone has left to spend or save after taxes.

In Iowa, the average per capita disposable income is $39,820. This means the average Iowan has $3,318 to spend each month.

So how much of this money is going to car insurance? The following number may make you happy, as it is considerably less than other states’ average premiums.

In Iowa, the average monthly amount spent on car insurance is $683.

This isn’t too bad, considering that it only subtracts $56 out of your monthly budget. If you compare these numbers to the national average, it looks even better. The average monthly amount spent on car insurance across the U.S. is $981 or $81 per month, which means Iowa is significantly less than the countrywide average.

That extra few hundred a year can be well spent on groceries, rent, and other household necessities. It also means that if you desire, you have a little extra to spend on better coverage 2the minimum liability amount.

Calculate your car insurance rates compared to your income to see how you compare to the average.

Compare Iowa Car Insurance Rates by Coverage

In this section, we provide a detailed comparison of car insurance rates by coverage type in Iowa. This information is crucial for understanding the cost of maintaining different types of insurance coverage and for making informed decisions about your insurance needs.

Remember, while it is important to have the required insurance, you should have additional coverage. That’s why we are going to dive into additional liability coverage and add-ons.

Additional Liability Insurance

The coverages below are optional in the state of Iowa. This doesn’t mean you shouldn’t have them. These optional coverages provide valuable protection in case of an accident.

Iowa Loss Ratio by Coverage Type

| Loss Ratio | 2021 | 2022 | 2023 |

|---|---|---|---|

| Medical Payments (Med Pay) | 65% | 68% | 70% |

| Uninsured/Underinsured Motorist | 75% | 77% | 80% |

For example, if you are in an accident with uninsured or underinsured drivers and they are at fault, they will likely be unable to pay for your medical bills and property damage before going bankrupt. This is where the above insurances help save you from expensive bills.

In the state of Iowa, 8.7 percent of drivers are uninsured. This percentage ranks Iowa as 38th in the nation for uninsured drivers.

This number of individuals driving without insurance isn’t terrible, but you do not want to risk having an accident with an uninsured driver. These accidents can quickly drain both drivers of their resources. You might be wondering what the loss ratios in the table mean. Here’s a simple breakdown.

- High Loss Ratio — If a company has high loss ratios (over 100 percent), it is losing money from paying out too many claims and risks going bankrupt.

- Low Loss Ratio — If a company has low loss ratios, it is paying out too few claims.

The top companies in the U.S. have loss ratios that range from 94 to 112 percent. In 2015, Iowa’s Uninsured and Underinsured Motorist coverage was well below these optimal ratios but has started to increase over the years to a better percentage.

MedPay loss ratios in Iowa have also increased, which is good news. So if you are an Iowan looking to purchase the recommended MedPay, PIP insurance, and Uninsured/Underinsured Motorist coverages, you can feel comfortable that the loss ratios are headed in a good direction.

Add-ons, Endorsements, and Riders

We know we’ve already talked about additional liability coverage, but there are a few other options to round out your coverage policy. These options are great add-ons, as they are effective and affordable. These coverages are useful in case of an accident or other mishaps.

- Guaranteed auto protection

- Personal umbrella policy (PUP)

- Rental reimbursement

- Mechanical breakdown insurance

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

- Pay-as-you-drive or usage-based insurance

Add any of the above options to your coverage for protection that is tailored to your specific needs. Next up, a closer look at the impact demographic information has on your rates.

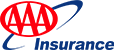

Compare Iowa Car Insurance Rates by Age and Gender

At most companies, gender does play a role in your rates. Our researchers found that in Iowa, females pay more than males for car insurance even if they have the same driving record and background as males.

Iowa Car Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $266 | $236 | $92 | $89 | $79 | $82 | $74 | $73 |

| American Family | $304 | $217 | $98 | $81 | $81 | $81 | $73 | $73 |

| Farmers | $202 | $190 | $91 | $85 | $64 | $63 | $62 | $56 |

| Geico | $165 | $177 | $68 | $74 | $70 | $78 | $64 | $70 |

| Nationwide | $220 | $170 | $91 | $84 | $76 | $74 | $71 | $66 |

| Progressive | $195 | $172 | $92 | $85 | $68 | $70 | $60 | $58 |

| Safeco | $481 | $427 | $110 | $100 | $96 | $88 | $94 | $78 |

| State Farm | $207 | $163 | $77 | $68 | $61 | $61 | $53 | $53 |

| Travelers | $722 | $453 | $125 | $106 | $104 | $102 | $99 | $99 |

| USAA | $148 | $140 | $69 | $62 | $53 | $52 | $49 | $48 |

Age also influences rates. Teenage drivers pay thousands more for car insurance. This statistic is true across most states, with only three states having equal rates.

This is why you should compare car insurance rates for teen drivers to find the most affordable. Otherwise, a teenager’s minimum wage summer job wouldn’t be enough to pay for car insurance.

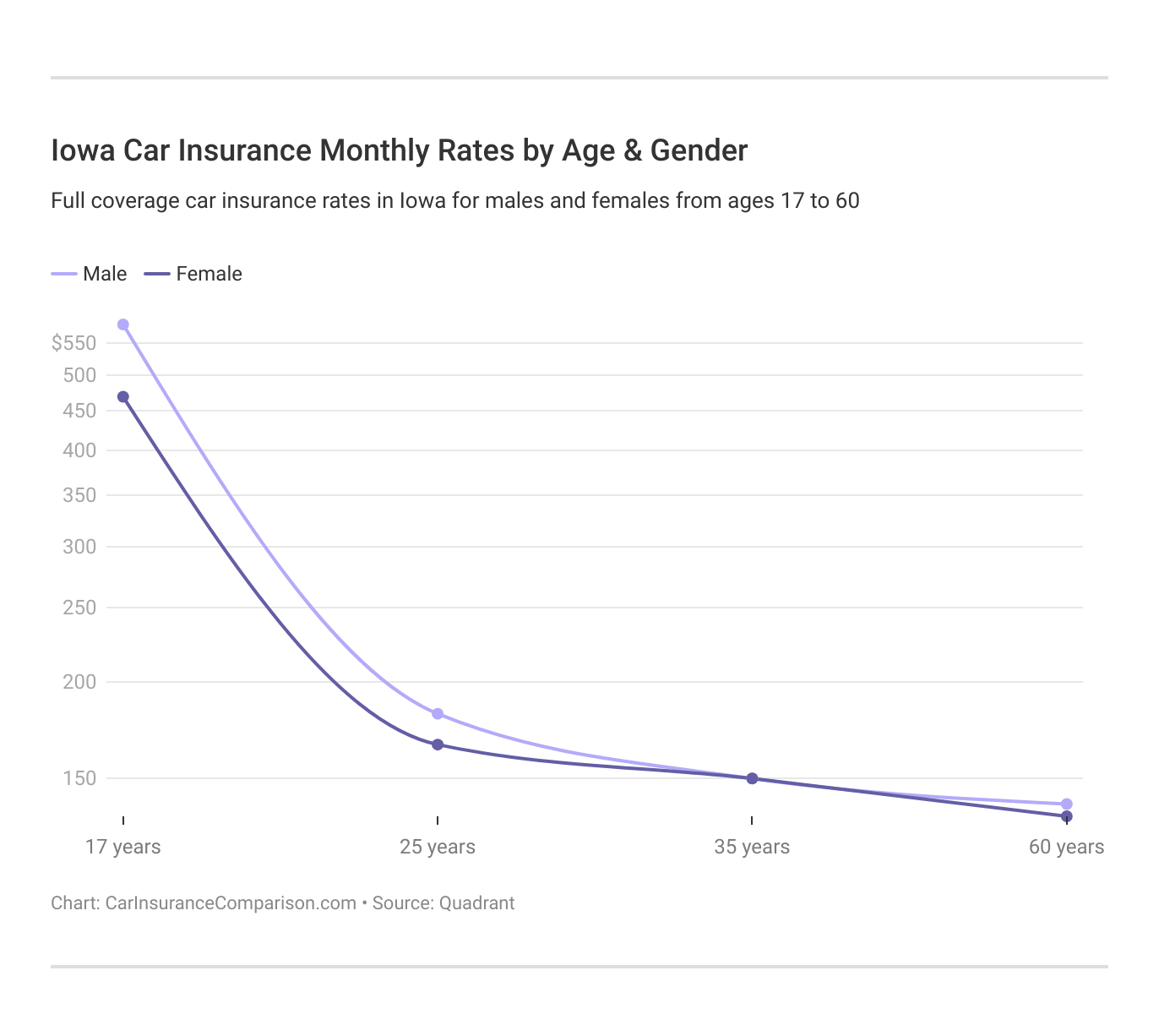

Compare Iowa Car Insurance Rates by ZIP Code

The area you live in is also an important factor in car insurance rates. Surprisingly, Iowa City is also one of the biggest cities in Iowa, but Iowa City car insurance is one of the top twenty cheapest cities for car insurance in Iowa

Compare Ankeny, IA car insurance rates and see how they compare with where you live. Clearly, the size of the city doesn’t play a big role in determining car insurance costs, as two of the largest cities have extremely different costs.

Compare Car Insurance Rates in Iowa

Iowa Car Insurance Companies

With over three million drivers in the state of Iowa, it makes sense that there is an equally overwhelming amount of top car insurance companies. It can be difficult to pick out the best Iowa car insurance company from the various insurance companies clamoring for customers’ attention. Who will give you the best coverage and the best rate?

Insurance companies all promise to deliver fantastic rates and coverages, but not all of them do. That’s why we have done the hard work of looking through companies for you.

We will cover companies’ financial ratings, customer reviews, and much more. So keep reading to learn everything you need to know in order to pick out the company that is right for you.

The Largest Companies’ Financial Ratings

If you recall, the best companies don’t have high or low loss ratios. Since an A.M. best rating determines a company’s financial security, you can see that the best-rated companies have decent loss ratios.

A.M. Best Financial Strength Ratings From the Top Iowa Car Insurance Providers

| Insurance Company | A.M. Best |

|---|---|

| Allstate | A+ |

| American Family | A |

| Geico | A++ |

| Grinnell | A |

| IMT Mutual | A |

| Iowa Farm | A- |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | B |

| West Bend | A |

None of the companies are at risk of going bankrupt, though a few could work on increasing their loss ratios by paying out more claims.

Companies With the Most Complaints in Iowa

Keep in mind that complaints don’t necessarily mean a company is terrible and should be avoided. Rather, it is how a company handles complaints that should matter when you shop around for car insurance.

Iowa Customer Complaints: NAIC Score by Car Insurance Provider

| Insurance Company | Complaint Ratio | Total Complaints |

|---|---|---|

| Allstate | 0.70 | 12 |

| American Family | 0.52 | 8 |

| Geico | 1.05 | 20 |

| Grinnell Mutual | 0.45 | 4 |

| IMT Mutual Holding | 0.38 | 3 |

| Iowa Farm | 0.65 | 9 |

| Nationwide | 0.80 | 10 |

| Progressive | 1.10 | 22 |

| State Farm | 0.60 | 15 |

| West Bend | 0.50 | 7 |

That’s why we’ve taken a closer look NAIC’s data on the largest car insurance companies in Iowa to see how they handle complaints.

Rates by Commute Distance in Iowa

In addition to the insurance company, factors such as your commute distance can also affect your car insurance rates. We will explore how different commute distances impact insurance costs at various companies, along with other influencing factors. At some companies, your commute distance does create different rates, as do many other factors.

As you can see, at companies like Geico, the more you drive the more you pay. Luckily, a few of the companies on the list don’t increase costs based on distance and car insurance miles.

Iowa Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $152 | $160 |

| American Family | $88 | $93 |

| Amica | $130 | $137 |

| Farmers | $103 | $108 |

| Geico | $86 | $90 |

| Liberty Mutual | $356 | $375 |

| Progressive | $96 | $101 |

| State Farm | $63 | $67 |

| The Hartford | $143 | $150 |

| USAA | $65 | $68 |

| U.S. Average | $118 | $124 |

If you drive more, check out companies where distance doesn’t matter. On the other hand, if you drive less, it might be worth looking into companies that have lower rates for a shorter commute.

Number of Insurers in Iowa

There are 73 domestic and 860 foreign insurance providers in Iowa. You might be wondering what the difference is between the two. Basically, domestic insurance is formed under Alaska law, but foreign insurance is formed under the laws of any state in the U.S.

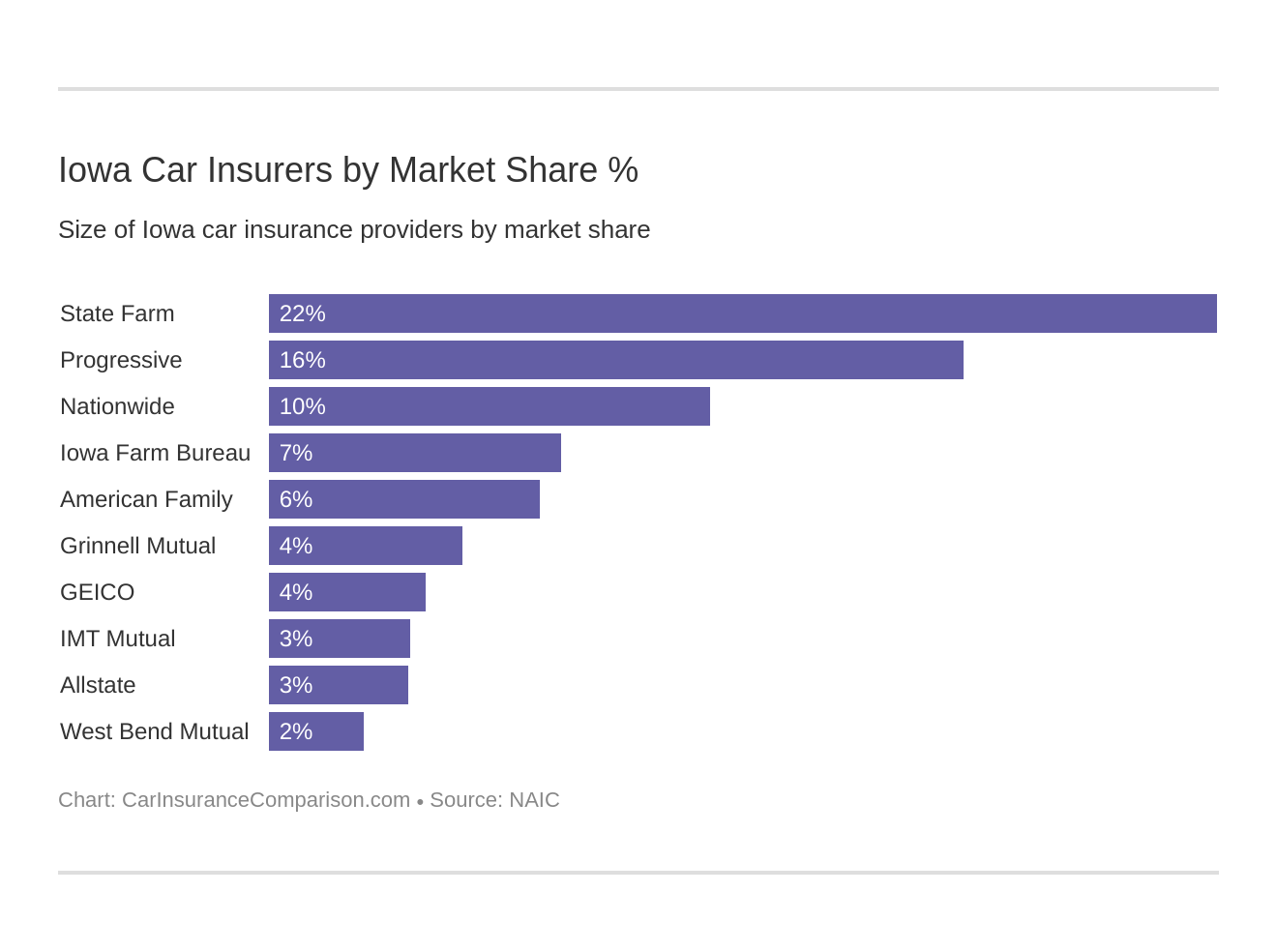

We can see above just how large the top ten insurers in Indiana are based on their market percentage. Now that we’ve tacked insurers, let’s move on to another important part of car insurance — state laws.

Iowa State Laws

Everyone knows that breaking the law leads to consequences. But it can be extremely confusing to know every single state law in your area. Not to mention that driving laws change from state to state. If you are new to Iowa, we want to help you avoid a driving ticket.

Bear with us because we are going to cover all the must-know driving laws in Iowa. We will look at both insurance and road laws so that you can feel comfortable and secure on the road.

Car Insurance Laws

How do insurance laws work? This may not be the first question on anyone’s mind, but knowing how Iowa law works is useful. Let’s rewind for a moment. Iowa doesn’t legally require car insurance, but the Motor Vehicle and Financial Safety Act makes sure that insurance is an attractive option to drivers.

If you are in an accident, insurance is the best way to prove financial responsibility. Not having proof of financial responsibility will result in penalties.

Bottom line? Purchase car insurance in Iowa, as not having car insurance comes with risks. Hang on, because we are going to dive into the different types of insurance.

Will a single vehicle accident affect car insurance rates? In most cases, it will.

High-Risk Insurance

High-risk car insurance is likely the last thing you want to purchase. Sometimes, though, accidents happen and the law will require you to have high-risk insurance. If you are required to have high-risk insurance, you must fill out an SR-22 form.

An SR-22 form requires you to have the minimum amounts of liability insurance in Iowa. We know, Iowa law is confusing. To restress Iowa’s laws, drivers aren’t necessarily required to have minimum car insurance — just proof of financial responsibility if they are in an accident.

Luckily, the cost of minimum car insurance in Iowa is significantly less than other states. Not to mention that we highly recommend never driving without car insurance in Iowa (or anywhere in the U.S.), so purchasing the minimum amount for high-risk insurance should have already been done before the accident.

Low-Cost Insurance

While Iowa doesn’t have a low-income car insurance program for low-income families, don’t let this discourage you from purchasing car insurance. There are plenty of ways to lower costs by shopping around for the best coverages and rates. Most insurers will provide discounts. Ask insurers if they offer the following discount options:

- Being a home-owner

- Having insurance on multiple cars

- Paying your premium in full

- Being a good student (it pays to study)

- Switching insurance providers often comes with a discount

- An accident-free record

Having an accident-free record is the best way to have reduced rates. Accidents will greatly increase your premiums, especially if you are at fault. Discover the variety of car insurance discounts offered by top providers in Iowa to help you save on your premiums:

Windshield Coverage

Sometimes, a windshield can crack for what appears to be no reason at all. A stray pebble may have glanced off earlier, the crack going unnoticed until it spread halfway across your windshield.

If this happens to you, you want your windshield repaired as soon as possible.

Is Iowa one of the states that has full glass coverage? Iowa law does not require insurers to replace windshields if they are cracked or broken. Now it’s time for the good news.

Improper installation and extreme temperatures can also contribute to windshields that unexpectedly crack.

Brad Larson LICENSED INSURANCE AGENT

If you have comprehensive insurance, there is a good chance your insurer will cover the cost of repairs. See? Having good insurance does pay off. Otherwise, you will be stuck paying for that broken windshield yourself.

Automobile Insurance Fraud in Iowa

Did you know that in the state of Iowa, insurance fraud is classified as a crime? The result is that Iowa has a fraud bureau working to catch people who commit insurance fraud. There are two main ways to commit insurance fraud:

- Intentionally faking an accident or making a false claim

- Adding extra compensation onto a claim

Insurance Research Council’s 2008 study reported that automobile fraud added between $4.8 billion and $6.8 billion to claims in the U.S. Even using a fake address for cheap car insurance is a form of fraud.

With high numbers like this, it is no wonder that Iowa is working to prevent insurance fraud. If you commit insurance fraud, you risk fines and jail time. Don’t do it. Honesty on claims will prevent you from being charged with insurance fraud.

Statute of Limitations

If you are in an accident, there is a limited amount of time to file, whether it’s a claim against someone else’s insurance or a claim with your own provider. This amount of time is called the statute of limitations, and it makes sure that claims don’t drag on years past the date of an accident.

The statute of limitations starts counting from the day of your accident, so don’t wait. File a claim as soon as you can to make sure you get the money you are owed.

- Personal Injury: Two years

- Property Damage: Five years

Iowa’s statute of limitations is fairly generous. Other states, like Louisiana, only allow one year to file for personal injury and property damage claims. Just make sure to not put off filing that claim for too long.

Iowa’s Clean Claim Law

In Iowa, the law requires insurers to respond to claims that their customers submit. Insurers that don’t respond to claims can be legally pursued. It is important to note that while the law requires insurers to respond to claims, insurers may “conveniently” forget benefits that you are privy to.

You want the coverage you paid for. So to receive all the benefits that you are due, make sure to familiarize yourself with your policy. This way you will know what you are owed in case of an accident.

Vehicle Licensing Laws

As we covered before, the state of Iowa does not require all drivers to have car insurance. If you are in an accident, though, you must provide proof of financial responsibility.

If you don’t provide proof of financial responsibility after an accident, the Iowa Department of Transportation will suspend your license and registration. As a reminder, here are the acceptable forms of financial responsibility in Iowa:

- Provide proof of liability insurance at the time of the accident

- Pay Driver & Identification Services in Iowa

- Obtain release forms from all involved parties or provide a settlement agreement

- Promise to cover costs for injured or damaged parties (installment plan if needed)

- Receive a civil damage action decision or complete a warrant for confession of judgment with a payment schedule

If you are in a car accident, you must also fill out an accident form within 72 hours (unless the police file a form). If you are in an accident without insurance or another form of financial responsibility, you will face fines of $500.

You may also have your license and registration suspended and possible impoundment of your vehicle. Anytime you are pulled over, you must provide proof of financial responsibility or face penalties. If you’re considering canceling car insurance after an accident, be sure to have new coverage lined up.

Teen Driver Laws

Teens must be at least 14 years old to receive a learner’s license (or permit) in the state of Iowa. In order to apply for a license or restricted license, though, teen drivers must meet the requirements below.

Iowa Teen Driver Requirements

| Requirements | Limits |

|---|---|

| Mandatory holding period | 12 months |

| Minimum supervised driving time | 20 hours (2 of which must be at night) |

| Minimum age | 16-years-old |

During the intermediate or restricted license state, there are certain rules teen drivers must follow.Iowa Teen Driver Restricted License

| Restrictions | Details | Limits |

|---|---|---|

| Nighttime Restrictions | 12:30 a.m. to 5 a.m. | May be lifted after 12 months and age 17 or until age 18 (whichever occurs first) |

| Passenger Restrictions (family members excepted) | At parental discretion | May be changed at parental discretion |

Up next we cover the restrictions in place for older drivers, another group that has different driving requirements.

Car insurance is higher for teenage boys than teenage girls in most situations.

Older Driver License Renewal Procedures

If you are over 72 years old, Iowa law requires you to renew your license every two years. There are a few other rules in place, which we have listed below.

- Proof of adequate vision is required at every visit

- Online or mail renewal is not permitted for those aged 70 and older

If you are an older driver in Iowa, it is crucial to plan ahead for these requirements. Regular visits to the eye doctor will help you stay prepared for the vision test, and scheduling your DMV appointments every two years will ensure you remain in compliance with state regulations.

New Residents

If you want to drive in the state of Iowa, you need car insurance or proof of financial responsibility. You can opt out of uninsured and underinsured motorist coverage, but you should have bodily injury and property damage liability insurance. As a reminder, here are the minimum amounts in Iowa.

- Bodily Injury Liability: $20,000 per person and $40,000 per accident

- Property Damage Liability: $15,000 per accident

- Uninsured/Underinsured Motorist Coverage: $20,000 per person and $40,000 per accident

Make sure to contact your current provider to change the rates to match Iowa’s minimum. You will also need updated insurance cards with your new address. Remember, while car insurance isn’t technically legally required in the state of Iowa, there are penalties for driving without it. So make sure you are covered when you move to Iowa.

License Renewal Procedures

If you are under the age of 70, we have great news. The Iowa DMV only requires the general population to renew their licenses every eight years. It gets even better, too, as Iowans are allowed to renew by mail or online every other renewal.

This means Iowans under the age of 70-years-old can go 16 years without a trip to the DMV.

One last thing. When you are renewing in person at the DMV, the law requires proof of adequate vision. So you will have to take a vision test or provide proof of one when you renew in person.

Reckless Driving

In Iowa, reckless or negligent driving is against the law. Reckless driving is when a person’s driving endangers other people and property. Usually, reckless driving is classified as a misdemeanor.

Iowa’s is not one of the states with the most reckless drivers, but there are still more than there should be.

Possible penalties for reckless driving:

- 30 days in jail and/or fines that range from $25 to $625

- 5-day to 30-day license suspension

For more serious cases of reckless driving, in which a driver causes the death of another person through reckless driving, the penalties are much more severe. The consequences of such actions can be devastating and life-altering, not just for you, but for victims and their families as well. Always adhere to traffic laws and drive responsibly to ensure safety on the road.

Iowa Reckless Driving Homicide Penalties

| Homicide Offense | Felony Type | Jail time | License Revocation | Additional Penalties |

|---|---|---|---|---|

| Reckless driving while intoxicated | Class B Felony | Up to 25 years | 6 years | Complete drinking and driving program; may have to complete substance abuse program |

| Recklessness and/or fleeing from an officer | Class C Felony | Up to 10 years | Up to 1 year | $1,000 to $10,000 in fines |

| Drag racing | Class D Felony | Up to 5 years | Up to 1 year | $750 to $7,000 in fines |

Reckless driving endangers not only yourself but everyone around you. Don’t drive recklessly — the result may be an unintentional homicide. Remember, your actions behind the wheel can have far-reaching impacts on the lives of others.

Rules of the Road

Every driver must know the rules of the road. Not only do the rules keep drivers safe, but it prevents you from racking up fines and points on your record. We are going to dive right into the most important rules you need to know. Scroll down to learn how to avoid breaking the law.

Fault vs. No-Fault

Iowa is an at-fault state. What does this mean? The person who caused the accident is liable for all personal injury and property damage claims. Because of that, no-fault insurance covering first-party injuries is not required in Iowa

If you don’t have insurance and are at-fault, an accident will quickly use up your savings.

If you don’t have insurance in an accident, additional fines and penalties will also be added. Don’t risk it. Even though Iowa doesn’t legally require you to have insurance, the Motor Vehicle Financial and Safety Responsibility Act has strict penalties for those in accidents without insurance.

Keep Right and Move Over Laws

Iowa’s keep right law is fairly simple.

If you are driving slower than the speed of the traffic around you, keep to the right lane.

Everyone knows to pass on the left, but there are certain instances where you can pass on the right. We have outlined them below.

- If a vehicle is about to or is making a left turn

- If there are four or more lanes of traffic moving in the same direction

If you do pass on the right when it isn’t safe to do so, you could be convicted of a misdemeanor. So exercise caution when passing on the right, as with any driving maneuver. As for the move over law, this law is also common sense.

If you see a parked vehicle with flashing lights parked on the highway or road, slow down or move over a lane. Additionally, you must move over to the right and stop for vehicles that are driving with flashing lights, such as police officers and emergency vehicles. Below are some examples of vehicles to move over for.

- Parked emergency vehicle with flashing lights

- Stationary tow, recovery, maintenance, waste, etc. vehicle that has flashing lights

- Any motor vehicle that has its hazard lights flashing

Remember, Iowa intends for these laws to keep people parked on the side of the road safe. The last thing you want is to hit someone because you failed to slow down or move over.

Speed Limits

The speed limits shown below are simply the max speeds on road types. Speed limits may vary, so make sure to follow road sign speed limits to avoid a ticket. It’s crucial to always be aware of and adhere to posted speed limits, as they are designed to ensure the safety of all road users and adapt to varying road conditions.

Iowa Speed Limits by Road Type

| Road Type | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 55 mph |

| Other Limited Access Roads | 75 mph |

| Other Roads | 65 mph |

Tickets can lead to paying for insurance with points on your license, which can be expensive. Driving within speed limits not only helps you avoid fines and penalties but also contributes to a safer driving environment for everyone. Always stay alert and comply with speed regulations to maintain a clean driving record and promote road safety.

Seat Belt and Car Seat Laws

Advertisers created the slogan “buckle up” for a reason. Safety seat belts can save lives in a crash. Iowa has mandatory seat belt laws that every driver needs to follow. If you don’t, law enforcement will fine you.

Iowa Seat Belt Laws

| Rules | Details |

|---|---|

| Effective Since | July 1, 1986 |

| Primary Enforcement | Yes |

| Age/Seats Applicable | 18+ years old in all seats |

| 1st Offense Fine | $25 plus fees |

Primary enforcement simply means an officer can pull you over and give you a ticket for not wearing a seat belt — that is, an officer doesn’t need a different reason to pull you over. Do seatbelt laws affect your insurance? They may if you’re found in violation.

Up next is car seat laws, which are important in keeping children safe in the car. If you have kids, make sure to follow the law to keep them as safe as possible.

Iowa Child Seat Laws

| Requirements | Age |

|---|---|

| Rear-Facing Seat | Younger than 1-year-old and less than 20 pounds |

| Child Restraint or Booster Seat | 1 through 5-years-old |

| Adult Seat Belt Allowed | 6 through 17-years-old |

Finally, there are no state laws about riding in the cargo areas of pickup trucks. This doesn’t mean that you should just throw everyone in the back of your pickup and drive off. Be cautious to keep everyone (including yourself) safe in the back of a pickup.

Ridesharing

If you are thinking of joining a ridesharing service, you will need to purchase ridesharing insurance. The following providers offer ridesharing insurance in Iowa.

- Farmers

- State Farm

- USAA

Iowa requires ridesharing drivers to have properly registered vehicles with the minimum liability insurance amount and ridesharing insurance. Ridesharing companies will also check your driving record, and any accidents or suspended licenses within the last three years will disqualify you.

If you’re a rideshare driver, you need rideshare insurance.

Automation on the Road

Iowa is not one of the states that have created laws and restrictions for driving automated vehicles. BMW explains the different levels of automated driving in the video below.

Automated vehicles may bring to mind self-driving cars, but automated vehicles can also include features like cruise control. Stick with us, because next, we are going to jump into safety laws about DUIs and DWIs.

DUI Laws

Did you know that in 2017, there were 88 alcohol-related fatalities in Iowa? Drunk driving is a significant problem all across the U.S., which is why states have taken individual steps to penalize drunk driving. Below are the details of Iowa’s classification of drunk driving.

Iowa DUI Laws

| Requirements | Details |

|---|---|

| BAC Limit | 8% |

| High BAC Categories | 15% |

| Criminal Status | - 1st serious misdemeanor - 2nd aggravated misdemeanor - 3rd+ class D felony |

| Look Back Period | 12 years |

For each offense, the penalties grow steadily worse.

Iowa DUI Offenses

| Offense | Penalties |

|---|---|

| 1st Offense | 180-day suspension (may apply for temporary restricted license), IID if crash or BAC > .10, 48 hours to 1 year jail, $625 to $1,250 or community service, substance abuse evaluation and treatment, possible reality education program |

| 2nd Offense | 2-year suspension (no temporary restricted license for 45 days), 7 days to 2 years jail, $1,875 to $6,250 fine, same additional requirements as 1st offense |

| 3rd Offense | 6-year suspension (no temporary restricted license for 45 days), 30 days to 5 years jail, $3,125 to $9,375 fine, same additional requirements as 1st offense |

Having that extra drink will reward you with fines, jail time, treatment programs, and a suspended license. Simply put, don’t drive drunk and this won’t happen to you.

For more information, read our guide for DUI and reckless driving laws.

Marijuana-Impaired Driving Laws

Smoking a joint before driving has many of the same consequences as drunk driving. The state of Iowa is one of the few states with ZERO tolerance for THC-impaired driving.

If officers suspect you of using marijuana and have you give a urine sample, they can still charge you with an OWI even if you used weeks before. Why? Marijuana, like other drugs, can be present in your urine for up to a month. It can also be detected in your hair for several months. The long-lasting evidence of marijuana use means officers can charge you with an OWI even if you aren’t high when driving.

While this law has its issues (for example, what if you used in a legal state weeks before?), avoid the possibility of an OWI by never driving under the influence of marijuana.

Distracted Driving Laws

Equally as dangerous as impaired driving is distracted driving. The main cause of distracted driving is smartphone use, which is why Iowa has the following restrictions in place.

Iowa Cell Phone Use Laws While Driving

| Laws | Details |

|---|---|

| Hand-held ban | None |

| All use ban | Learner's permit and intermediate license holders |

| Texting ban | All drivers |

| Enforcement | Primary |

Remember, primary enforcement means an officer doesn’t need a different traffic violation to pull you over — officers can pull you over and ticket you for just texting.

A cellphone ticket will affect car insurance rates, so be sure to stay distraction-free behind the wheel.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Iowa Can’t-Miss Facts

Now that you have a solid understanding of Iowa’s laws, let’s move onto another important section. Every state has specific dangers to watch out for, and Iowa is no exception.

Iowa Stats Summary

| Statistics | Details |

|---|---|

| Road Miles | Total in State: 114,442 Vehicle Miles Driven: 33,161 million |

| Vehicles | Registered in State: 3,447,049 Total Stolen: 4,342 |

| State Population | 3,156,145 |

| Most Popular Vehicle | Chevrolet Silverado 1500 |

| Uninsured Motorists | 8.70% State Rank: 38th |

| Total Driving Fatalities | 2019-2023 Speeding: 612 Drunk Driving: 917 |

| Average Premiums | Liability: $25/mo Collision: $18/mo Comprehensive: $14/mo Full Coverage: $58/mo |

| Cheapest Providers | USAA and State Farm |

Iowa is home to beautiful nature reserves and wildlife, but nature also comes with drawbacks. Iowa is in the top five states for deer collisions. The video below provides some information and some driving safety tips to avoid hitting deer.

No one wants to hit a deer with their car. Hopefully, you can avoid potential accidents if you are aware of what is happening on Iowa’s roads. That’s why we’ve put together statistics detailing Iowa’s main risk factors beyond the wildlife population.

Continue reading to learn about Iowa’s vehicle theft, driving fatalities, teen drinking, and EMS response time.

Vehicle Theft in Iowa

Certain cars in Iowa are stolen more than others. If your car is stolen, comprehensive insurance will cover the costs incurred by the theft. This is one of the reasons why it is so important to have car insurance.

Top 10 Iowa Car Thefts by Model

| Make & Model | Year | Total Thefts |

|---|---|---|

| Ford F-150 | 2018 | 1,321 |

| Hyundai Elantra | 2017 | 1,296 |

| Chevrolet Silverado 1500 | 2004 | 1,207 |

| Hyundai Sonata | 2013 | 1,060 |

| Honda Civic | 2000 | 921 |

| Kia Optima | 2015 | 719 |

| Honda Accord | 1997 | 296 |

| GMC Pickup (Full Size) | 2005 | 294 |

| Toyota Camry | 2021 | 278 |

| Honda CR-V | 2001 | 276 |

The FBI has also created a 2013 report detailing vehicle theft by cities. It makes sense that where you live can impact vehicle theft, as crime rates are higher in some areas.

Iowa Car Thefts by City

| City | Total |

|---|---|

| Adel | 2 |

| Albia | 5 |

| Algona | 1 |

| Altoona | 14 |

| Ames | 34 |

| Anamosa | 2 |

| Ankeny | 36 |

| Bettendorf | 12 |

| Bloomfield | 6 |

| Blue Grass | 0 |

| Boone | 15 |

| Buffalo | 2 |

| Camanche | 0 |

| Carlisle | 3 |

| Carroll | 11 |

| Carter Lake | 25 |

| Cedar Falls | 24 |

| Cedar Rapids | 297 |

| Centerville | 13 |

| Chariton | 5 |

| Charles City | 3 |

| Cherokee | 2 |

| Clarinda | 11 |

| Clear Lake | 8 |

| Clinton | 45 |

| Clive | 18 |

| Coralville | 11 |

| Council Bluffs | 541 |

| Cresco | 0 |

| Davenport | 239 |

| Decorah | 3 |

| Denison | 10 |

| Des Moines | 850 |

| De Witt | 3 |

| Dubuque | 60 |

| Dyersville | 3 |

| Eagle Grove | 3 |

| Eldora | 2 |

| Eldridge | 4 |

| Emmetsburg | 1 |

| Estherville | 4 |

| Evansdale | 2 |

| Fairfield | 9 |

| Forest City | 4 |

| Fort Dodge | 84 |

| Fort Madison | 12 |

| Glenwood | 13 |

| Grinnell | 6 |

| Grundy Center | 0 |

| Hampton | 0 |

| Hawarden | 1 |

| Hiawatha | 7 |

| Humboldt | 10 |

| Indianola | 19 |

| Iowa City | 82 |

| Iowa Falls | 1 |

| Jefferson | 0 |

| Johnston | 9 |

| Keokuk | 27 |

| Le Claire | 1 |

| Le Mars | 10 |

| Leon | 1 |

| Lisbon | 0 |

| Manchester | 4 |

| Maquoketa | 6 |

| Marengo | 0 |

| Marion | 17 |

| Marshalltown | 37 |

| Mason City | 30 |

| Monticello | 2 |

| Mount Vernon | 1 |

| Muscatine | 23 |

| New Hampton | 0 |

| Newton | 18 |

| North Liberty | 11 |

| Norwalk | 1 |

| Oelwein | 6 |

| Orange City | 3 |

| Osage | 1 |

| Osceola | 14 |

| Oskaloosa | 8 |

| Ottumwa | 69 |

| Pella | 2 |

| Perry | 8 |

| Pleasant Hill | 8 |

| Prairie City | 1 |

| Red Oak | 6 |

| Sergeant Bluff | 1 |

| Sheldon | 4 |

| Shenandoah | 9 |

| Sioux City | 240 |

| Spencer | 4 |

| Spirit Lake | 5 |

| State Center | 1 |

| Storm Lake | 11 |

| Story City | 0 |

| Toledo | 2 |

| Urbandale | 25 |

| Vinton | 3 |

| Walcott | 0 |

| Washington | 7 |

| Waukee | 1 |

| Waukon | 0 |

| Waverly | 8 |

| Webster City | 12 |

| West Burlington | 8 |

| West Des Moines | 76 |

| West Liberty | 1 |

| Williamsburg | 0 |

| Wilton | 1 |

| Windsor Heights | 6 |

| Winterset | 2 |

You need comprehensive car insurance if you want collisions with deer, vandalism, and theft covered by your insurer.

Iowa’s Crash Report

Risky and harmful behavior contributes to multiple crashes in Iowa. That’s why we want to show you the statistics for the main factors that contribute to fatal crashes.

The National Highway Traffic Safety Administration included one of Iowa’s cities on its list of traffic fatalities by cities.Iowa Car Crash Fatalities by City

| City Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Des Moines | 20 | 22 | 24 |

| Cedar Rapids | 15 | 16 | 18 |

| Davenport | 14 | 15 | 16 |

| Sioux City | 13 | 14 | 15 |

| Waterloo | 10 | 11 | 12 |

| Iowa City | 9 | 10 | 11 |

| Council Bluffs | 8 | 9 | 10 |

| Ames | 7 | 8 | 9 |

| Dubuque | 6 | 7 | 8 |

| West Des Moines | 5 | 6 | 7 |

Road type also plays an important role in traffic fatalities. Generally, more fatalities happen on rural roads than on urban roads, so make sure to drive carefully both inside and and outside the city.

Below is the NHTSA’s data on moving averages of fatalities by road type. This information highlights how different types of roadways contribute to fatality rates, reflecting the varying risks associated with each road type. Understanding these patterns can help in developing targeted safety measures and policies to reduce traffic fatalities.

Iowa Traffic Fatalities by Area Type

| Type | Total |

|---|---|

| Rural | 345 |

| Urban | 82 |

Analyzing fatalities by road type is essential for identifying high-risk areas and implementing effective safety interventions. By addressing the specific dangers associated with each road type, we can work towards making all roads safer for everyone.

Iowa Traffic Fatalities by Person Type

| Type | Total |

|---|---|

| Bicyclist and Other Cyclists | 5 |

| Bus | 2 |

| Large Truck | 18 |

| Light Truck - Other | 0 |

| Light Truck - Pickup | 54 |

| Light Truck - Utility | 42 |

| Light Truck - Van | 17 |

| Non-Occupants | 2 |

| Other/Unknown Occupants | 10 |

| Passenger Car | 109 |

| Pedestrian | 23 |

| Total Motorcyclists | 48 |

| Total | 330 |

Analyzing fatalities by road type is essential for identifying high-risk areas and implementing effective safety interventions. By addressing the specific dangers associated with each road type, we can work towards making all roads safer for everyone.

Next up, how the type of crash impacts fatality rates. Different crash types have varying levels of severity and consequences. The table below outlines the fatality rates associated with various types of crashes, providing a clear picture of the most dangerous scenarios on the road.

Iowa Traffic Fatalities by Crash Type

| Type | Total |

|---|---|

| Involving a Large Truck | 67 |

| Involving a Roadway Departure | 207 |

| Involving a Rollover | 124 |

| Involving an Intersection (or Intersection Related) | 85 |

| Involving Speeding | 70 |

| Single Vehicle | 182 |

| Total Fatalities (All Crashes) | 330 |

Understanding the impact of different crash types on fatality rates is crucial for implementing specific safety measures and interventions. By addressing the unique risks of each crash type, we can improve overall road safety and save lives.

Next, is the top counties for traffic deaths in Iowa. These counties have some of the highest fatality rates in Iowa. Tracking these trends over time helps identify persistent safety issues and the effectiveness of ongoing safety measures.

Top 10 Iowa Car Crash Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Black Hawk | 10 | 11 | 8 |

| Cerro Gordo | 7 | 6 | 12 |

| Dubuque | 4 | 4 | 10 |

| Iowa | 5 | 8 | 9 |

| Johnson | 5 | 16 | 8 |

| Linn | 5 | 20 | 16 |

| Marshall | 4 | 4 | 12 |

| Polk | 20 | 28 | 27 |

| Pottawattamie | 13 | 13 | 12 |

| Scott | 21 | 19 | 8 |

Monitoring fatality trends in high-risk counties allows for targeted interventions and resource allocation. By focusing on these areas, we can work towards reducing fatalities and improving road safety across Iowa.

Speeding is a huge factor in fatality rates. The faster the vehicle is moving, the harder the impact. Speeding significantly increases the risk of severe injuries and fatalities in the event of a crash. The table below illustrates the correlation between speeding and fatality rates.

Iowa Speeding Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Adair | 0 | 3 | 1 |

| Adams | 0 | 1 | 0 |

| Allamakee | 1 | 0 | 2 |

| Appanoose | 2 | 1 | 0 |

| Audubon | 0 | 0 | 0 |

| Benton | 2 | 1 | 1 |

| Black Hawk | 2 | 3 | 2 |

| Boone | 2 | 2 | 1 |

| Bremer | 1 | 2 | 1 |

| Buchanan | 1 | 1 | 0 |

| Buena Vista | 1 | 0 | 1 |

| Butler | 0 | 1 | 0 |

| Calhoun | 0 | 0 | 0 |

| Carroll | 1 | 2 | 1 |

| Cass | 1 | 1 | 1 |

| Cedar | 1 | 2 | 0 |

| Cerro Gordo | 2 | 1 | 2 |

| Cherokee | 1 | 0 | 0 |

| Chickasaw | 2 | 1 | 1 |

| Clarke | 0 | 1 | 1 |

| Clay | 1 | 0 | 1 |

| Clayton | 0 | 1 | 2 |

| Clinton | 1 | 2 | 3 |

| Crawford | 2 | 1 | 1 |

| Dallas | 3 | 2 | 3 |

| Davis | 1 | 0 | 0 |

| Decatur | 1 | 0 | 1 |

| Delaware | 2 | 1 | 2 |

| Des Moines | 2 | 3 | 2 |

| Dickinson | 1 | 0 | 0 |

| Dubuque | 3 | 2 | 2 |

| Emmet | 1 | 0 | 1 |

| Fayette | 1 | 2 | 1 |

| Floyd | 1 | 0 | 1 |

| Franklin | 0 | 0 | 1 |

| Fremont | 1 | 0 | 0 |

| Greene | 0 | 1 | 0 |

| Grundy | 1 | 0 | 0 |

| Guthrie | 0 | 1 | 1 |

| Hamilton | 1 | 2 | 0 |

| Hancock | 1 | 0 | 1 |

| Hardin | 1 | 1 | 2 |

| Harrison | 2 | 1 | 1 |

| Henry | 2 | 1 | 1 |

| Howard | 0 | 1 | 0 |

| Humboldt | 1 | 0 | 0 |

| Ida | 0 | 1 | 0 |

| Iowa | 1 | 1 | 1 |

| Jackson | 1 | 2 | 2 |

| Jasper | 3 | 2 | 2 |

| Jefferson | 1 | 1 | 1 |

| Johnson | 2 | 3 | 4 |

| Jones | 2 | 1 | 0 |

| Keokuk | 1 | 0 | 0 |

| Kossuth | 2 | 1 | 1 |

| Lee | 3 | 1 | 2 |

| Linn | 4 | 5 | 3 |

| Louisa | 1 | 0 | 0 |

| Lucas | 1 | 0 | 1 |

| Lyon | 0 | 1 | 0 |

| Madison | 1 | 0 | 1 |

| Mahaska | 2 | 1 | 1 |

| Marion | 2 | 2 | 1 |

| Marshall | 2 | 1 | 2 |

| Mills | 1 | 0 | 1 |

| Mitchell | 1 | 1 | 0 |

| Monona | 0 | 1 | 0 |

| Monroe | 0 | 1 | 0 |

| Montgomery | 1 | 0 | 1 |

| Muscatine | 3 | 1 | 2 |

| O Brien | 1 | 1 | 0 |

| Osceola | 0 | 0 | 1 |

| Page | 1 | 1 | 1 |

| Palo Alto | 1 | 0 | 0 |

| Plymouth | 1 | 2 | 1 |

| Pocahontas | 1 | 0 | 0 |

| Polk | 5 | 8 | 7 |

| Pottawattamie | 4 | 3 | 5 |

| Poweshiek | 2 | 1 | 2 |

| Ringgold | 1 | 0 | 1 |

| Sac | 1 | 0 | 1 |

| Scott | 5 | 3 | 4 |

| Shelby | 2 | 1 | 2 |

| Sioux | 1 | 2 | 1 |

| Story | 3 | 2 | 3 |

| Tama | 2 | 1 | 1 |

| Taylor | 1 | 0 | 1 |

| Union | 1 | 0 | 1 |

| Van Buren | 1 | 0 | 1 |

| Wapello | 2 | 2 | 2 |

| Warren | 2 | 1 | 2 |

| Washington | 2 | 1 | 2 |

| Wayne | 1 | 0 | 1 |

| Webster | 2 | 2 | 2 |

| Winnebago | 1 | 1 | 1 |

| Winneshiek | 2 | 1 | 1 |

| Woodbury | 4 | 3 | 4 |

| Worth | 1 | 0 | 1 |

| Wright | 1 | 1 | 1 |

Addressing speeding through stricter enforcement and public awareness campaigns is vital for reducing traffic fatalities. Slowing down saves lives, and promoting safe driving speeds can lead to safer roads for everyone.

Alcohol-impaired driving also contributes to fatality rates. This is why Iowa has strict penalties in place to prevent drunk driving. Below, you can see the yearly drunk driving deaths in each county. Understanding the prevalence of alcohol-impaired driving fatalities highlights the need for ongoing efforts to combat this dangerous behavior.

Iowa DUI Fatalities by County

| County Name | Total Fatalities (2021) | Total Fatalities (2022) | Total Fatalities (2023) |

|---|---|---|---|

| Adair | 0 | 2 | 0 |

| Adams | 0 | 0 | 0 |

| Allamakee | 1 | 2 | 1 |

| Appanoose | 1 | 3 | 0 |

| Audubon | 0 | 0 | 2 |

| Benton | 1 | 3 | 1 |

| Black Hawk | 2 | 1 | 1 |

| Boone | 1 | 1 | 0 |

| Bremer | 0 | 0 | 0 |

| Buchanan | 1 | 1 | 0 |

| Buena Vista | 1 | 0 | 0 |

| Butler | 0 | 0 | 1 |

| Calhoun | 0 | 1 | 3 |

| Carroll | 0 | 1 | 2 |

| Cass | 1 | 4 | 0 |

| Cedar | 1 | 0 | 1 |

| Cerro Gordo | 0 | 2 | 8 |

| Cherokee | 1 | 1 | 0 |

| Chickasaw | 0 | 1 | 0 |

| Clarke | 0 | 0 | 0 |

| Clay | 0 | 0 | 0 |

| Clayton | 1 | 1 | 0 |

| Clinton | 1 | 0 | 0 |

| Crawford | 0 | 0 | 0 |

| Dallas | 3 | 4 | 1 |

| Davis | 0 | 0 | 0 |

| Decatur | 0 | 0 | 2 |

| Delaware | 0 | 0 | 0 |

| Des Moines | 1 | 3 | 1 |

| Dickinson | 0 | 1 | 1 |

| Dubuque | 1 | 0 | 1 |

| Emmet | 0 | 0 | 0 |

| Fayette | 0 | 1 | 0 |

| Floyd | 0 | 0 | 0 |

| Franklin | 0 | 0 | 1 |

| Fremont | 0 | 1 | 2 |

| Greene | 0 | 2 | 0 |

| Grundy | 0 | 0 | 0 |

| Guthrie | 1 | 0 | 0 |

| Hamilton | 0 | 2 | 0 |

| Hancock | 0 | 0 | 2 |

| Hardin | 1 | 1 | 0 |

| Harrison | 1 | 0 | 0 |

| Henry | 1 | 1 | 0 |

| Howard | 0 | 0 | 0 |

| Humboldt | 0 | 1 | 1 |

| Ida | 1 | 0 | 0 |

| Iowa | 1 | 1 | 2 |

| Jackson | 0 | 1 | 0 |

| Jasper | 0 | 1 | 1 |

| Jefferson | 0 | 0 | 0 |

| Johnson | 0 | 7 | 1 |

| Jones | 1 | 0 | 0 |

| Keokuk | 0 | 0 | 0 |

| Kossuth | 1 | 0 | 0 |

| Lee | 3 | 3 | 1 |

| Linn | 0 | 4 | 1 |

| Louisa | 1 | 0 | 0 |

| Lucas | 0 | 1 | 1 |

| Lyon | 0 | 0 | 0 |

| Madison | 3 | 2 | 0 |

| Mahaska | 1 | 0 | 0 |

| Marion | 0 | 1 | 0 |

| Marshall | 0 | 1 | 5 |

| Mills | 0 | 1 | 1 |

| Mitchell | 0 | 1 | 0 |

| Monona | 2 | 2 | 2 |

| Monroe | 2 | 1 | 0 |

| Montgomery | 1 | 0 | 0 |

| Muscatine | 0 | 2 | 1 |

| O Brien | 1 | 0 | 0 |

| Osceola | 0 | 1 | 2 |

| Page | 0 | 0 | 0 |

| Palo Alto | 0 | 0 | 1 |

| Plymouth | 0 | 1 | 1 |

| Pocahontas | 0 | 0 | 1 |

| Polk | 7 | 10 | 6 |

| Pottawattamie | 3 | 3 | 5 |

| Poweshiek | 0 | 0 | 1 |

| Ringgold | 0 | 0 | 0 |

| Sac | 0 | 0 | 0 |

| Scott | 10 | 6 | 1 |

| Shelby | 0 | 0 | 0 |

| Sioux | 0 | 1 | 0 |

| Story | 1 | 0 | 1 |

| Tama | 0 | 0 | 3 |

| Taylor | 0 | 0 | 1 |

| Union | 0 | 2 | 0 |

| Van Buren | 0 | 0 | 0 |

| Wapello | 1 | 2 | 1 |

| Warren | 6 | 1 | 2 |

| Washington | 0 | 0 | 2 |

| Wayne | 0 | 0 | 2 |

| Webster | 0 | 2 | 2 |

| Winnebago | 0 | 0 | 0 |

| Winneshiek | 1 | 2 | 1 |

| Woodbury | 4 | 2 | 1 |

| Worth | 0 | 0 | 0 |

| Wright | 1 | 0 | 1 |

A sobering part of drunk driving is that many teenagers participate in it.

The good news is that in Iowa, the average number of underage drinking and driving deaths is only 0.8 deaths per 100,000 people. In comparison, the U.S. state average is 1.2 deaths per 100,000 people. So, Iowa is not one of the most dangerous states for drunk driving.

Still, Iowa has work to do in tackling underage drinking and driving, as Iowa ranked 20th in the U.S. for the number of underage alcohol-impaired arrests.

In 2016, Iowa law enforcement arrested 71 underage drivers for drinking and driving.

That’s quite a few teenagers driving drunk. Inexperience and alcohol quickly result in disaster, which is why it’s so important to lead by example and never drive impaired.

EMS Response Time

Accidents are everyone’s worst nightmare. If an accident happens to you and you are injured, help is a must. Prompt EMS response times can make a significant difference in the outcome of an accident. Below, we’ve listed Iowa’s EMS response times by the type of crash location to provide insight into how quickly help can arrive when needed.

Iowa EMS Response Time by Type

| Location | Notification | Arrival |

|---|---|---|

| Rural | 6 min | 12 min |

| Urban | 4 min | 6 min |

That’s why we’ve listed Iowa’s EMS response times, so you can feel confident help is on its way. Knowing the response times can reassure you that emergency services are prepared to respond swiftly, whether you are in a rural or urban area. This information highlights the importance of quick and efficient emergency response to improve survival rates and outcomes for accident victims.

Transportation

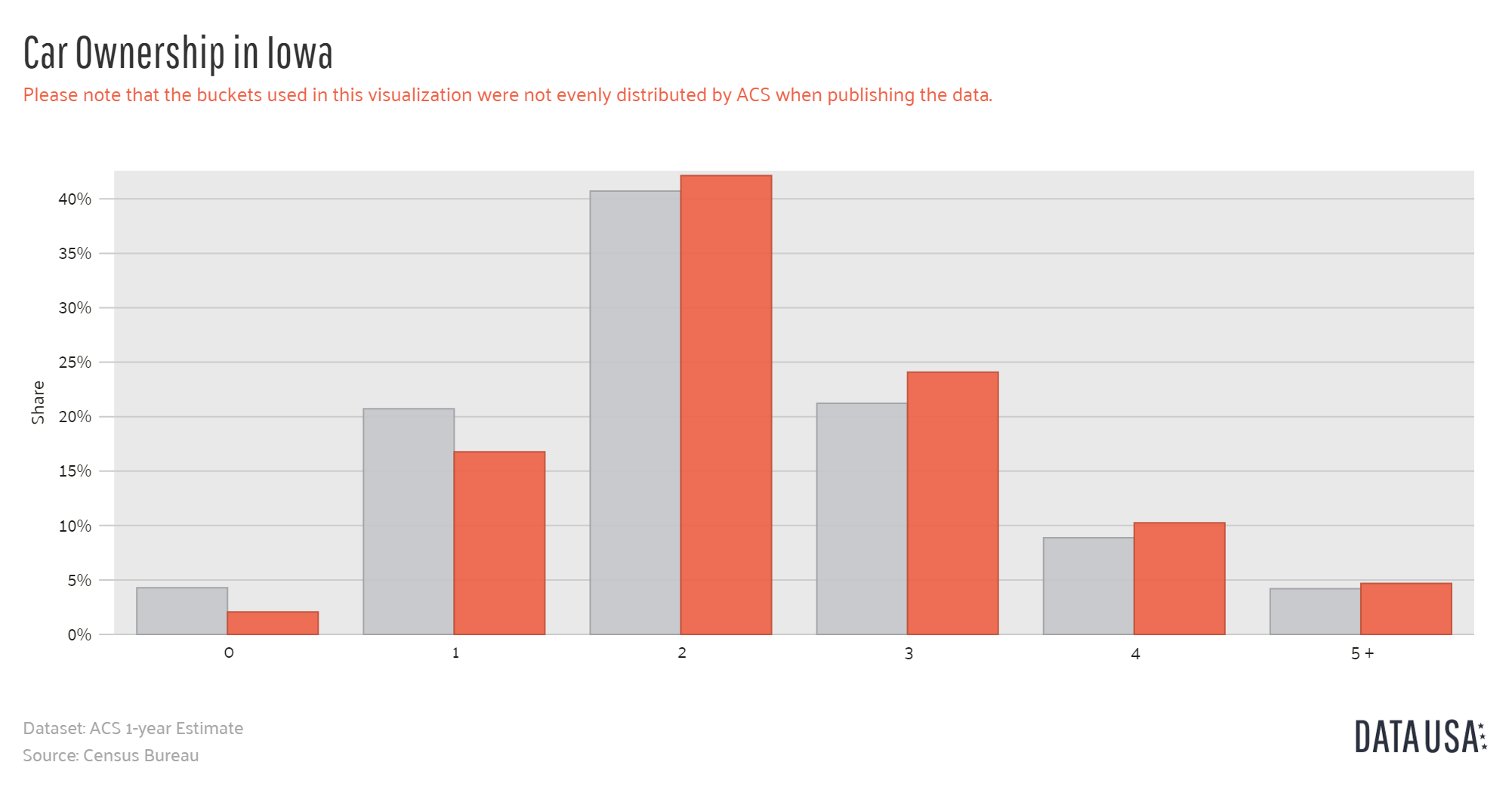

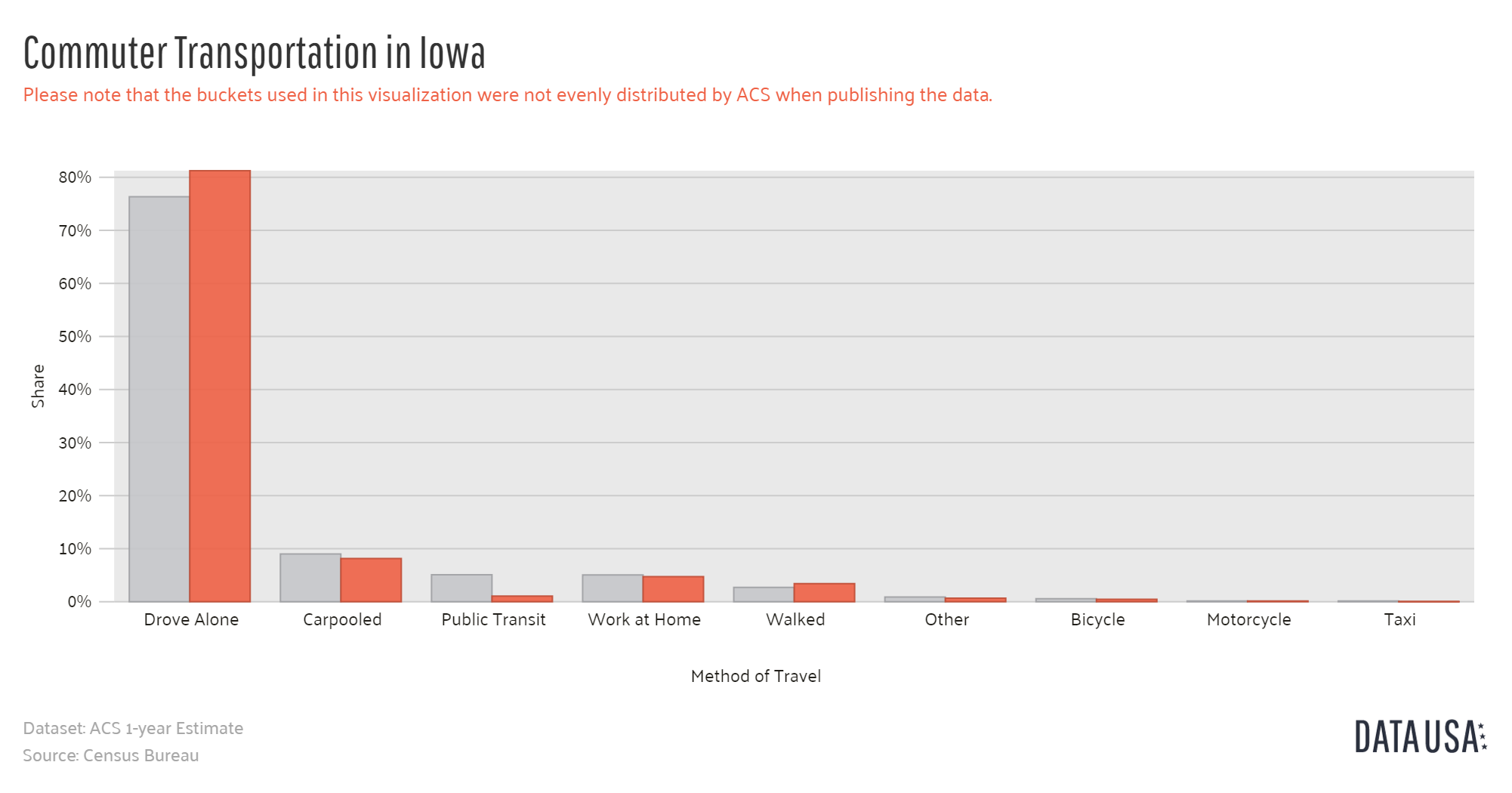

We rely heavily on transportation to get us to where we need to go, from riding the bus to driving our own car. In Iowa, the average person owns between two to three cars for transportation. That’s a lot of cars on the road.

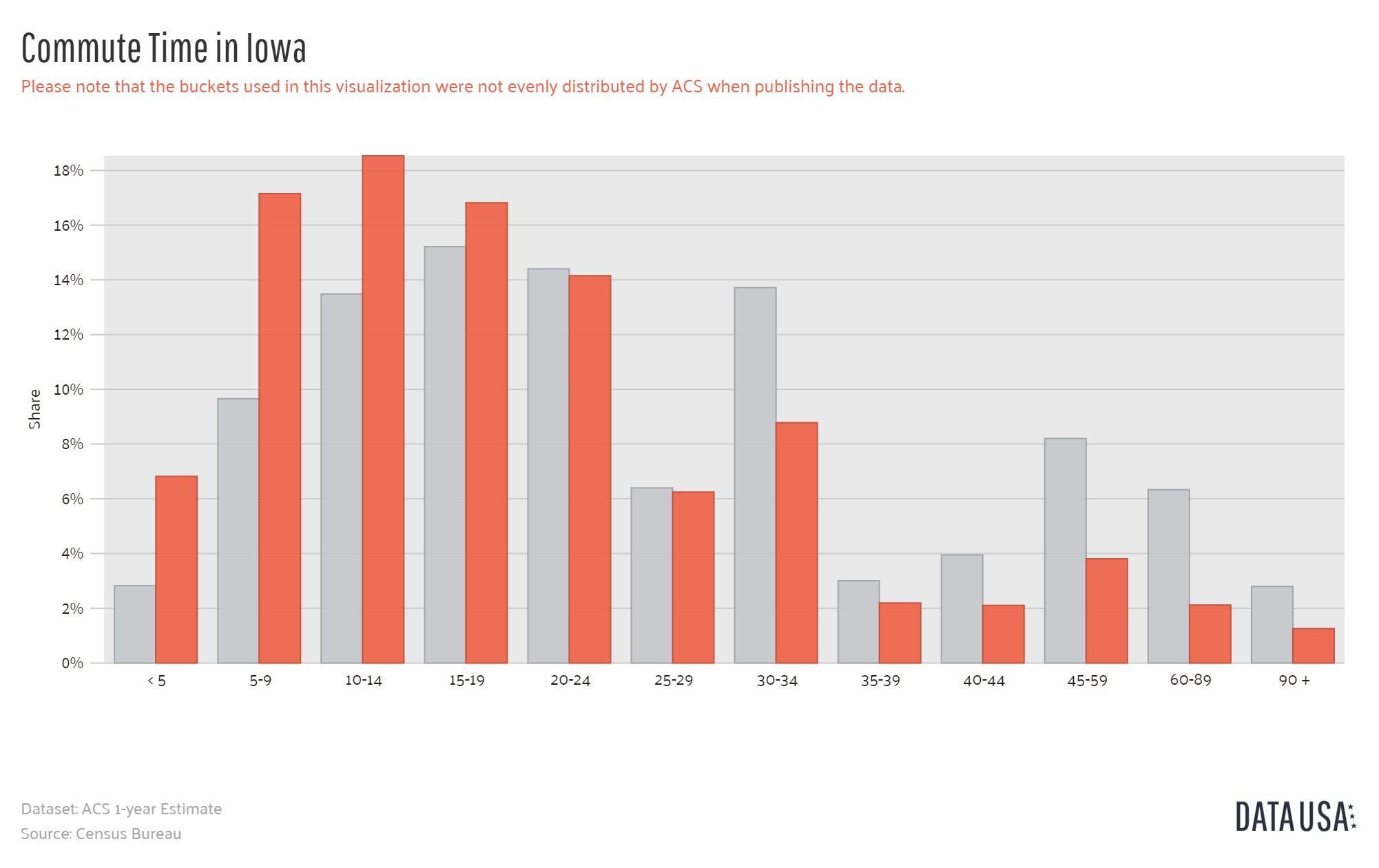

Since Iowans spend only 18 minutes on average commuting, it seems that they are not spending exorbitant amounts of time sitting in traffic. You’ve reached the end of this comprehensive guide, and you are now ready to drive through Iowa’s beautiful state.

Start comparing car insurance rates today by entering your ZIP code below in our free online tool.

Frequently Asked Questions

What are the minimum car insurance requirements in Iowa?

Iowa’s minimum liability insurance requirements are 20/40/15, which means drivers must have at least $20,000 for bodily injury per person, $40,000 for bodily injury per accident, and $15,000 for property damage coverage.

Is car insurance mandatory in Iowa?

While Iowa doesn’t have compulsory car insurance laws, drivers must provide proof of financial responsibility in the event of an accident. This can be done through liability insurance or other forms of financial responsibility.

Read More: How do you find car insurance coverage requirements in your state?

What happens if I drive without car insurance in Iowa?

If you drive without car insurance in Iowa and get into an accident, you will be unable to pay for medical bills and property damage. It is highly recommended to have car insurance coverage to protect yourself financially.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Should I purchase more than the minimum liability insurance in Iowa?

Yes, it is advisable to purchase more than the minimum liability insurance in Iowa. Minimum requirements may not be enough to cover all expenses in case of a serious accident. By comparing liability car insurance quotes, you can find the best coverage for your needs.

Read More: Minimum Car Insurance Requirements by State

How can I find the best car insurance rates in Iowa?

To find the best car insurance rates in Iowa, it’s important to compare quotes from multiple insurance companies. By using a free online quote tool, you can easily compare rates and coverage options to make an informed decision.

What types of optional coverages are available in Iowa?

In addition to the minimum liability coverage, Iowa drivers can opt for additional coverages such as collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. These coverages provide extra financial protection in various situations like accidents, theft, or damage from natural disasters.

How does my driving record affect my car insurance rates in Iowa?

Your driving record is a significant factor in determining your car insurance rates in Iowa. A clean driving record with no accidents or traffic violations will typically result in lower premiums, while a history of accidents or violations can increase your rates.

Read More: Safe Driver Car Insurance Discounts

Are there discounts available for car insurance in Iowa?

Yes, many insurance companies in Iowa offer discounts to help lower your premiums. Common discounts include those for safe driving, bundling multiple policies, having anti-theft devices, good student discounts, and paying your premium in full upfront.

Can I get car insurance if I have a bad credit score in Iowa?

Yes, you can still get car insurance if you have a bad credit score, but your rates may be higher. Insurance companies often use credit scores as a factor in determining premiums, as they believe it correlates with the likelihood of filing a claim. Shopping around and comparing quotes can help you find the best rate despite a lower credit score.

How do I file a car insurance claim in Iowa?

To file a car insurance claim in Iowa, you should contact your insurance company as soon as possible after an accident or incident. Provide all necessary information, including details of the accident, contact information for any other parties involved, and any police reports or documentation.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.