Cheapest Kentucky Car Insurance Rates in 2026 (10 Most Affordable Companies)

For the cheapest Kentucky car insurance rates, Erie, Safeco, and Geico offer competitive pricing as low as $22 per month, making them top choices. These insurers offer comprehensive coverage and excellent customer service for Kentucky car owners. Compare their options to find what suits your needs and budget best.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated October 2024

Company Facts

Min. Coverage in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Kentucky

A.M. Best Rating

Complaint Level

Pros & Cons

Discover the top picks for the cheapest Kentucky car insurance rates with Erie, Safeco, and Geico, offering competitive pricing as low as $22 per month. Erie offers competitive pricing and excellent customer service, making it the preferred choice for affordable coverage in Kentucky. Read on to discover why these companies are highly recommended.

Kentucky drivers can benefit from learning how to compare car insurance rates and coverages to find the best deal. Our guide covers everything you need to know about cheap car insurance in Kentucky.

Finding free car insurance quotes online is straightforward and efficient. Enter your ZIP code above into our free comparison tool to see how much car insurance costs in your area.

Our Top 10 Company Picks: Cheapest Kentucky Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $22 A+ Competitive Rates Erie

#2 $27 A Flexible Coverage Safeco

#3 $29 A++ Online Tools Geico

#4 $36 B Local Agents State Farm

#5 $41 A+ Innovative Usage Progressive

#6 $51 A++ Affordable Premiums Travelers

#7 $60 A Many Discounts American Family

#8 $61 A Customizable Policies Liberty Mutual

#9 $67 A+ Customer Service Nationwide

#10 $86 A+ Safe-Driving Discounts Allstate

- Top insurers offer Kentucky rates from $22 per month

- Erie excels with competitive rates and service

- Compare options for best coverage and budget fit.

- Compare Kentucky Car Insurance Rates

- Best Somerset, KY Car Insurance in 2026

- Best Richmond, KY Car Insurance in 2026

- Best Prestonsburg, KY Car Insurance in 2026

- Best Pikeville, KY Car Insurance in 2026

- Best Oak Grove, KY Car Insurance in 2026

- Best Hodgenville, KY Car Insurance in 2026

- Best Hazard, KY Car Insurance in 2026

- Best Edgewood, KY Car Insurance in 2026

- Best Cave City, KY Car Insurance in 2026

- Best Campbellsville, KY Car Insurance in 2026

- Best Bowling Green, KY Car Insurance in 2026

- Best Beaver Dam, KY Car Insurance in 2026

- Best Arlington, KY Car Insurance in 2026

#1 – Erie: Top Pick Overall

Pros

- Personalized Service: Erie Insurance provides personalized service through local agents, offering tailored coverage options.

- Competitive Rates: Known for competitive rates, especially for bundled policies such as home and auto. Learn more in our Erie car insurance review.

- Strong Financial Stability: Erie maintains high financial strength ratings, ensuring reliability in paying claims.

Cons

- Limited Availability: Erie Insurance is available in select states, primarily in the Midwest and Mid-Atlantic regions.

- Digital Tools: While improving, Erie’s digital tools may not be as robust as those offered by larger national insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Safeco: Best for Flexible Coverage

Pros

- Competitive Pricing: Safeco Insurance offers competitive pricing with various discounts available, appealing to cost-conscious consumers.

- Extensive Coverage Options: As mentioned in our Safeco car insurance review, the company is known for its wide range of coverage options, including unique add-ons like pet insurance and rideshare coverage.

- Strong Customer Service: Safeco has a reputation for reliable customer service, providing support when filing claims and handling inquiries.

Cons

- Availability Variability: Safeco’s availability varies by state, and some coverage options may not be offered in all areas.

- Claims Processing: While generally efficient, some policyholders have reported occasional delays in claims processing.

#3 – Geico: Best for Online Tools

Pros

- Competitive Pricing: Geico is well-regarded for offering competitive rates, particularly for good drivers and those with clean driving records.

- User-Friendly Platform: Geico provides a user-friendly website and mobile app for policy management, claims filing, and obtaining quotes.

- 24/7 Customer Service: With around-the-clock customer support, Geico ensures assistance is available whenever needed. Learn more in our Geico car insurance review.

Cons

- Limited Personalization: Geico’s policy options may not offer as much customization compared to some other insurers.

- Variable Discounts: Availability and amount of discounts can vary by state and policy type, impacting potential savings.

#4 – State Farm: Best for Local Agents

Pros

- Extensive Agent Network: State Farm boasts a vast network of local agents who provide personalized service and guidance. Unlock details in our State Farm car insurance review.

- Financial Stability: As one of the largest insurers in the U.S., State Farm holds high financial strength ratings, ensuring policyholder claims are covered.

- Diverse Discounts: State Farm offers a wide array of discounts, including those for bundling policies, safe driving, and more.

Cons

- Higher Rates: Premiums with State Farm may be higher compared to some competitors, particularly for certain demographics or regions.

- Digital Limitations: State Farm’s digital tools and online user experience may not be as advanced as those offered by newer, tech-focused insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Innovative Usage

Pros

- Discount Variety: Progressive is known for its extensive range of discounts, including Snapshot® for safe drivers and other usage-based discounts.

- User-Friendly Tools: Progressive offers intuitive online tools and a mobile app for managing policies, making claims, and obtaining quotes.

- Customer Service: Progressive receives positive reviews for customer service, particularly in claims handling and assistance. Delve into our evaluation of Progressive car insurance review.

Cons

- Higher Rates for Some: While competitive overall, Progressive’s rates may not always be the lowest available, depending on the driver profile and location.

- Service Consistency: Some customers have reported inconsistencies in customer service experiences, particularly during claims processes.

#6 – Travelers: Best for Affordable Premiums

Pros

- Coverage Options: Travelers provides a wide range of coverage options to suit diverse needs, including specialized policies for businesses and high-value items.

- Financial Strength: Travelers boasts strong financial stability ratings, ensuring policyholder claims are paid promptly and reliably. See more details on our Travelers car insurance review.

- Customer Service: Travelers has a reputation for excellent customer service, with responsive agents and efficient claims handling.

Cons

- Premium Costs: Travelers’ premiums may be higher compared to some competitors, especially for certain demographics or high-risk drivers.

- Limited Availability: Travelers’ availability may vary by state, and not all coverage options may be offered in every region.

#7 – American Family: Best for Many Discounts

Pros

- Personalized Service: As mentioned in our American Family car insurance review , they offer personalized service through local agents who understand the specific needs of their communities.

- Innovative Coverage: Known for innovation, American Family provides unique coverage options like rideshare insurance and extensive home insurance bundles.

- Customer Satisfaction: American Family consistently receives high marks for customer satisfaction, reflecting their commitment to service excellence.

Cons

- Regional Availability: American Family’s availability is limited primarily to the Midwest and a few other states, potentially restricting coverage options for customers in other regions.

- Competitiveness: While generally competitive, American Family’s rates may not always be the lowest available in the market.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Coverage and Discounts: Liberty Mutual offers comprehensive coverage options and a variety of discounts to help customers save on premiums.

- Financial Stability: With strong financial strength ratings. Learn more in our Liberty Mutual car insurance review.

- Digital Tools: Liberty Mutual provides user-friendly online resources and a mobile app for convenient policy management and claims processing.

Cons

- Premium Costs: Liberty Mutual’s premiums may be higher compared to some competitors, particularly for certain demographics or high-risk drivers.

- Claims Experience: While generally positive, some customers have reported mixed experiences with claims handling and customer service.

#9 – Nationwide: Best for Customer Service

Pros

- Coverage Variety: Nationwide offers a broad range of coverage options, including specialty policies for unique needs like classic cars and pet insurance.

- Financial Stability: Nationwide maintains strong financial stability ratings, ensuring policyholders’ financial protection and claims payments. Check out insurance savings in our complete Nationwide car insurance discount.

- Customer Service: Nationwide is recognized for its excellent customer service, providing support and guidance through all stages of the insurance process.

Cons

- Regional Pricing: Nationwide’s pricing can vary significantly by region, impacting affordability for some customers.

- Availability: Nationwide may not be available in all states, limiting coverage options for potential customers in certain areas.

#10 – Allstate: Best for Safe-Driving Discounts

Pros

- Coverage Options: Allstate provides a wide array of coverage options to meet diverse customer needs, including specialized policies like identity theft protection.

- User-Friendly Tools: Allstate offers intuitive online tools and a mobile app for policy management, claims filing, and obtaining quotes.

- Financial Stability: Allstate holds high financial strength ratings, ensuring policyholders’ claims are paid promptly and reliably. Discover more about offerings in our Allstate car insurance review.

Cons

- Premium Costs: Allstate’s premiums may be higher than some competitors, particularly for certain demographics or regions.

- Claims Handling: While generally efficient, some customers have reported mixed experiences with claims processing and customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Kentucky Car Insurance Companies

There are a lot of companies to choose from when you’re shopping for auto insurance coverage. It can be hard to find the right one for you but don’t worry; we’ll help you know what steps to take to find the best company for your needs.

Read More: Best Full Coverage Car Insurance

The table below compares monthly rates for minimum and full coverage car insurance in Kentucky from various providers

Kentucky Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $86 $236

American Family $60 $164

Erie $22 $58

Geico $29 $80

Liberty Mutual $61 $168

Nationwide $67 $184

Progressive $41 $111

Safeco $27 $71

State Farm $36 $98

Travelers $51 $139

We’ll show you financial ratings, complaint information, and car insurance company customer satisfaction ratings information. Most importantly, we’ll show you which companies offer the best Kentucky car insurance.

Kentucky Car Insurance Companies’ Financial Ratings

First up, financial ratings. AM Best is an independent rating agency. They examine the financial standing of insurance companies and predict how they’ll do in the future. A good grade and a stable outlook indicate the company will remain solvent and able to pay claims.

Kentucky Car Insurance Financial Ratings

| Company | Grade |

|---|---|

| Allstate | A+ |

| Geico | A++ |

| Kentucky Farm Bureau | A |

| Liberty Mutual | A |

| Nationwide | A+ |

| Progressive | A+ |

| Shelter Insurance | A |

| State Auto Mutual | A- |

| State Farm | B |

| USAA | A++ |

All of the largest companies in Kentucky have good grades and stable outlooks, so if you go with one of these, the odds are favorable that your insurer will remain solvent and able to pay your claims.

Kentucky Car Insurance Companies’ Consumer Ratings

What AM Best provides for financial ratings, J.D. Power provides for consumer ratings. Overall customer satisfaction will give you an idea of how your interaction with your insurance company will be.

Consumer Reports is another valuable resource for consumer ratings.

Kentucky Car Insurance Company Complaints

The complaint ratio is the number of complaints per $1 million of premiums received. Larger companies will have more complaints than smaller companies because of how many more customers they have.

That’s why the complaint ratio matters more than the number of complaints. Evaluating insurance companies based on their complaint ratio helps you understand their performance in handling customer issues relative to their size.

Read More: Car Insurance Companies With the Worst Customer Satisfaction

Largest Car Insurance Companies in Kentucky

There are 900 foreign insurance companies licensed in Kentucky and seven domestic insurers. This diversity offers a wide range of choices for consumers seeking car insurance, providing various options for coverage and pricing.

If you have a bad credit score or a bad driving record, make sure to look for auto insurance discounts. Most major insurers offer various discounts, including the safe driving discount, good student discount, multi-policy discount (for bundling a car insurance policy with homeowners insurance or renters insurance), automatic payments discount, and the defensive driving course discount.

Read More: Best Car Insurance Companies for Bad Credit

When shopping around for the best insurance premiums, don’t forget to note which companies offer the best discounts.

Don’t let the slightly higher auto insurance costs prevent you from getting the necessary coverage. A minimum liability insurance policy may be cheapest, but it doesn’t offer a lot of coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Car Insurance Coverages

Are you tired of paying an insurance company without understanding why? We’ll show you how that money for your Kentucky auto insurance is used. Most of it is used for good, but unfortunately, some of it has to go to preventable problems, like fraud.

We’ll dive right in and show you exactly what coverage is required in Kentucky.

Kentucky Minimum Car Insurance Coverage

To drive in Kentucky, you must have coverage at these levels: 25/50/25. To spell it out:

- $25,000 – Bodily injury liability coverage per person

- $50,000 – Total bodily injury liability coverage per accident

- $25,000 – Property damage liability coverage

- $10,000 – Personal Injury Protection (PIP)

Alternatively, Kentucky residents can opt for a single-limit insurance policy of $60,000.

Uninsured/underinsured motorist (UM/UIM) coverage is required at the level of $25,000 per person and $50,000 per accident but can be rejected in writing.

Notice that the minimum coverage required is for liability. The state-required liability coverage is known as basic coverage. If you cause an accident, your basic coverage will pay for the damage done to another party up to the limits of your policy.

If you want coverage for your own vehicle after you cause an accident or after storm damage, you’ll need to carry full coverage, which includes collision insurance and comprehensive car insurance.

Full coverage costs more than basic coverage, and it’s not worth the extra cost in all cases. If you’re leasing or financing a car, you’ll almost certainly be required to carry full coverage. If you own your car outright, you can decide what is best.

Typically, experts recommend that if the extra cost for full coverage is 10% or less annually of your vehicle’s value, it’s a good idea to carry it.

At a certain point, your vehicle loses so much value, that the increased cost for full coverage is a waste of money.

Because Kentucky is a no-fault insurance state, residents must carry personal injury protection (PIP) car insurance, which pays for each party’s own medical costs and a portion of lost wages. So, why carry bodily injury liability if each party pays for their own medical costs?

Kentucky Car Insurance Monthly Rates by Coverage Type

| Coverage Type | Kentucky Average | U.S. Average | Full Coverage |

|---|---|---|---|

| Liability | $44 | $45 | $111 |

| Collision | $22 | $27 | $58 |

| Comprehensive | $12 | $12 | $39 |

If the injuries are severe and cost more than the PIP coverage, the injured party can sue the at-fault driver, in which case bodily injury liability coverage would kick in.

The minimum coverage is required on all vehicles, even those driven seasonally. If you would like to avoid purchasing insurance year-round for a car you only drive in the summer, you’ll have to turn your plates in to the DMV before canceling insurance during the off-season.

If you don’t, you can expect penalties for not being insured.

Kentucky Car Insurance Rates as a Percentage of Income

The average percentage of income that a Kentucky resident pays for car insurance is shown next. This metric provides insight into the financial burden of car insurance on residents relative to their income. Comparing this percentage to the national average helps to understand how affordable car insurance is in Kentucky compared to other states.

Kentucky Car Insurance as Percentage of Income

| Summary | Data |

|---|---|

| Monthly Full Coverage Average Premiums | $76 |

| Average Premiums | $76 |

| Monthly Per Capita Disposable Personal Income | $2,770 |

| Monthly Per Capita Disposable Personal Income | $231 |

| Percentage of Income | 2.76% |

Nationwide, the average is 2.4%, so you can see that Kentucky residents pay a bit over the national average. This information is crucial for residents and policymakers to recognize the relative cost of car insurance in Kentucky, potentially guiding decisions and discussions around affordability and insurance regulation in the state.

Additional Liability Car Insurance in Kentucky

If you cause a major accident resulting in a vehicle being declared a total loss and injuries to persons requiring extended hospitalization and rehabilitation, the minimum liability coverage levels required in Kentucky won’t be sufficient.

If you have assets or are planning for future assets that you would like to protect, please consider increasing your liability limits.

The minimum limits of personal injury protection required in Kentucky will pay 80% of your lost wages following an accident for a maximum of $200 per week.

You might consider higher limits for that as well, especially if you need to protect your income and you make considerably more than $200 a week.

One way to help you see how the insurance industry as a whole is doing is to check out loss ratios. The rates consumers pay in premiums compared to the amount that insurers pay in claims gives us the loss ratio.

Insurance providers need extra money for overhead, but a low loss ratio indicates the companies are spending too much money on overhead while too high a loss ratio suggests they may not be charging high enough premiums to stay solvent.

Kentucky Loss Ratio by Insurance Type

| Insurance Type | Loss Ratio | U.S. Average Ratio |

|---|---|---|

| Uninsured/Underinsured Motorist Coverage | 71 | 67 |

| Personal Injury Protection | 75 | 69 |

The overall numbers for Uninsured/Underinsured Motorist Coverage and Personal Injury Protection in Kentucky are pretty healthy.

Having the added coverage for Uninsured/Underinsured motorists is one of the best supplemental protections to get. Other supplemental coverage types to consider are as follows:

- Gap insurance

- Personal umbrella policy (PUP)

- Rental car reimbursement coverage

- Emergency roadside assistance

- Mechanical breakdown insurance

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

- Pay-as-you-drive or usage-based insurance

- Accident forgiveness car insurance

Pay-as-you-drive coverage is becoming increasingly popular with companies such as Metromile. So far, such coverage is unavailable in Kentucky, but as its popularity grows, you might want to check back in a couple of years.

Drivers who put on less than 5,000 miles annually can save big with a pay-by-the-mile plan.

Usage-based coverage is a broader type of plan. Several companies offer plans with the option to install a telemetric device to monitor driving habits. Good driving habits will yield lower premiums.

Root Insurance only offers an app-based, driving-based plan. If you’re willing to let your driving be monitored, you may be able to find solid savings with usage-based plans. Consider each of these additional coverage options carefully when you’re shopping for an auto insurance policy.

Compare Car Insurance Rates in Your City

Discover the variations in car insurance rates within Kentucky cities. Car insurance premiums can differ significantly from one location to another due to factors such as local traffic conditions, crime rates, and the overall risk of accidents. By comparing rates across different cities, you can gain a clearer understanding of where you might find the most affordable coverage.

Kentucky Car Insurance Cost by City

Compare rates in Arlington, Edgewood, and Prestonsburg, KY, as well as other locations such as Beaver Dam, Hazard, Richmond, Bowling Green, Hodgenville, Somerset, Campbellsville, Oak Grove, Cave City, and Pikeville. Stay informed to find the best make the best decision for your car insurance needs.

Kentucky State Car Insurance Laws

The type of driver you are has a big impact on your premiums. Knowing the laws can help you follow the laws. Have you looked at a codebook lately? There are a lot of laws. You won’t be able to memorize all of them, but we’ll point out some of the most important laws related to driving.

Read More: Understanding Car Insurance Codes and Laws

We’ll start by examining how Kentucky makes car insurance laws, and then we’ll get into the rules of the road.

Kentucky Vehicle Licensing Laws

If you don’t have your vehicle registered and insured, you’re going to get into trouble. The state legislature has mandated a crackdown on those who drive uninsured.

Kentucky Insurance Laws

Insurers in Kentucky don’t have free reign to charge whatever they want. If the rate jumps up or down by 25% or more, prior approval must be given. Forms for prior approval must be filed no less than 60 days before delivery. The Commissioner may extend 30 days with notice.

Kentucky High-Risk Insurance

If you’ve had your license suspended for committing a major traffic offense, you may be considered a high-risk insurance customer. In many states, the insurance company for a high-risk driver is required to fulfill future financial responsibility requirements, such as filing an SR-22.

I advise high-risk drivers in Kentucky to explore the Kentucky Automobile Insurance Plan (KAIP) for essential coverage without extra paperwork.

Brandon Frady LICENSED INSURANCE AGENT

Kentucky does not require such a filing. The high-risk individual is still required to purchase insurance; they don’t have to file additional paperwork.

If you’re unable to find insurance from the general market, you may need to look into the Kentucky Automobile Insurance Plan (KAIP). This plan offers basic liability insurance to people denied coverage from the voluntary market.

Kentucky Windshield Coverage

Kentucky law requires insurance to provide deductible- and fee-free windshield replacement for customers carrying comprehensive coverage. It’s one of the few states that stipulates this. That’s great news if you have comprehensive coverage and need a new windshield.

Aftermarket parts may be used. If the consumer prefers factory parts, he or she may be required to pay the difference in cost.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Car Insurance Fraud

Insurance fraud matters because it drives your premiums up. There’s soft fraud and hard fraud. Soft fraud is the “white lies” in insurance. If you’ve stretched the truth about your annual mileage or where you park your car, you’re guilty of soft fraud.

Hard fraud is deliberately lying to an insurance company by falsifying claims or staging accidents (like in the video above).

Committing insurance fraud in Kentucky is a crime, and the state has formed a fraud bureau whose sole job is to investigate insurance fraud. Also, insurers are mandated to have a fraud plan.

Kentucky’s Department of Insurance Fraud Division has been cracking down on those who commit fraud and ordered over $3 million in restitution in 2016. They publish monthly reports with the names of the offenders and the amount of money ordered for restitution.

Read More: Car Insurance Claim Investigation

Those who suspect insurance fraud are welcome to submit a report to the state.

Kentucky Car Insurance Statute of Limitations

After an accident, you have a specific amount of time to file a claim. Understanding the statute of limitations for car insurance claims in Kentucky is crucial to ensure you receive the compensation you are entitled to. Below are the timeframes for filing different types of claims:

- Property Damage – Two years

- Personal Injury – One year

Past that timeframe, you are totally out of luck. There’s no reason to wait to file a claim; do it right away. Promptly filing your claim helps ensure that you meet the legal deadlines and can secure the necessary support and compensation for any damages or injuries sustained.

Penalties for Driving Without Insurance in Kentucky

Law enforcement may access information regarding your car’s insurance through AVIS. If you purchased insurance within the past 45 days and it’s not reflected in AVIS, you may show your insurance card (paper or electronic) as proof of insurance.

Kentucky Penalties for Driving Without Insurance

| Penalty | First Offense | Second Offense in Five Years |

|---|---|---|

| Fine | $500–$1000 | $1000–$2000 |

| Imprisonment | Up to 90 days (imprisonment may be in place of or in addition to the fine) | Up to 180 days (imprisonment may be in place of or in addition to the fine) |

| Registration | Registration will be revoked and license plates suspended for one year or until proof of insurance can be shown | Registration will be revoked and license plates suspended for one year or until proof of insurance can be shown |

Vehicles registered in Kentucky must be insured by a company licensed to sell insurance in the state, even if they’re not being driven. The only exceptions to this are as follows:

- You may cancel insurance if you’ve already turned the vehicle’s plates into the County Clerk’s Office

- You may cancel insurance if you’re a college student and have insurance licensed in the state where you’re from or where you’re attending

- Active duty military may stay with insurance from another state

- People temporarily working out of state may purchase insurance in the state where they are working

Read More: What is the penalty for driving without insurance in Kentucky?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Teen Driver Laws

Out-of-state permit holders must be 16 years old to drive in Kentucky. Kentucky has a zero-tolerance law for alcohol and drivers under 21. Drivers under 21 may not drive with a blood alcohol content at or above 0.02%.

Kentucky Teen Driving Laws

| Restrictions | Permit | Intermediate License | Unrestricted License |

|---|---|---|---|

| Age | Minimum age 16 | After having a permit for six months (minimum age 16 years six months). If convicted of a traffic offense, the teen must begin the six-month period again | After holding an intermediate license for six months (minimum age 17) or age 18 |

| Hours of Driving | Minimum 60 hours, 10 of which must be at night | Must have completed the permit requirement | Must have completed the permit requirement |

| Time | Cannot drive between 12:00 a.m. and 6:00 a.m. without good cause | Cannot drive between 12:00 a.m. and 6:00 a.m. without good cause | No restrictions |

| Passenger | One unrelated passenger under 20 years old limit except when supervised by a driving training instructor | One unrelated passenger under 20 years old limit except when supervised by a driving training instructor | No restrictions |

Driving privileges may be suspended for a driver under 18 who accumulates more than six points and a driver over 18 who accumulates 12 or more points.

Kentucky students who are 16 and 17 years old and wish to drive must obtain a School Compliance Verification Form. If a student drops out of high school or receives non-passing grades, he or she will not be allowed driving privileges.

Kentucky Vehicle Registration Procedures

When renewing your vehicle registration in Kentucky, it’s essential to be aware of the necessary documents and requirements. Whether renewing in person or online, ensuring you have the correct items and meet the eligibility criteria can streamline the process. The following information outlines what you need to prepare for a smooth renewal experience.

When renewing your license in person, be prepared with the following items:

- Photo ID

- Kentucky certificate of registration

- Current original (not a copy) proof of Kentucky insurance effective date within 45 days

- Money for fees and applicable taxes (check with your County Clerk’s office for accepted forms of payment)

Read More: Do I need car insurance to register my car?

You may also renew online if all of the following points apply to your situation, according to the state of Kentucky website:

- A list of eligible plates is available online.

- Vehicles registered in separate counties to the current owner must be renewed separately.

- Leased vehicles cannot be renewed online.

- The vehicle(s) renewed must have unexpired registration(s).

- The owner of the vehicle(s) cannot have overdue property taxes on any other vehicles they own.

- The vehicle(s) must be insured for at least 45 days with the same insurance company for database verification.

Understanding the requirements and options for renewing your vehicle registration in Kentucky can save you time and hassle. Whether you choose to renew in person or online, ensuring you have the necessary documents and meet the eligibility criteria will help ensure a seamless renewal process.

Kentucky License Renewal Procedures

Previously, Kentucky driver’s licenses needed to be renewed every four years. The time between renewals has been increased to eight years

Anyone wishing to renew their license must do so in person. The only exception is for military personnel who may renew by mail.

New Residents in Kentucky

New residents need to be aware of the following guidelines. Moving to a new state involves updating several documents and understanding local regulations. For those relocating to Kentucky, here are the essential steps to follow to ensure you are legally compliant:

- New residents in Kentucky have 30 days to get a Kentucky license.

- To get a license, you must be a U.S. citizen or permanent resident.

- You will need to bring your out-of-state license and social security card to the Circuit Court Clerk’s office (photocopies are not accepted). If your name is different than that on your birth certificate, you may need to show a marriage license or court-ordered name change.

- Those under the age of 18 must present a School Compliance Verification Form signed by the out-of-state school.

- Out-of-state permit holders must transfer their permit to Kentucky before applying for a license.

By following these guidelines, new residents can ensure a smooth transition and stay compliant with Kentucky’s regulations. Don’t delay these steps, as failing to obtain a Kentucky license within 30 days can result in fines and complications.

Read More: Can your car be insured in a different state than its registration?

College Students in Kentucky

A college student may drive on their valid out-of-state license and is not required to transfer that license to Kentucky if they meet specific conditions. Understanding these exemptions can save students time and effort while they focus on their studies. Here are the key requirements for college students driving in Kentucky:

- They are a citizen of the United States;

- They are enrolled as a full-time or part-time student at a university, college, or technical college located in Kentucky; and

- They must have a student identification card from the university, college, or technical college located in Kentucky in their immediate possession at all times when driving in Kentucky.

This allows for uninterrupted mobility without the need for additional paperwork or license transfers, provided they adhere to the specified requirements. By meeting these conditions, college students can continue driving legally on their out-of-state licenses, making their stay in Kentucky more convenient and hassle-free.

REAL ID in Kentucky

Kentucky is working to get REAL ID compliant. If you have a standard Kentucky driver’s license as your only form of ID, you won’t be able to fly after October 2020. Between March and May 2019, the state will roll out licenses, permits, and personal IDs, which are REAL ID compliant.

You can still opt for a standard driver’s license, but remember, it won’t be enough for you to fly domestically after October 2020.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Car Insurance Points System

Points on your license stay for two years from the conviction date—not the infraction date.

Infractions stay on your record for five years, but the points come off after two. Insurance companies have access to three years of your driving infractions.

Read More: What happens if I drive my car with a suspended registration?

Accumulating 12 points in two years may result in a license suspension. For those under 18, accumulating seven points may result in a license suspension.

Kentucky License Points for Driving Infractions

| Three-point Offenses | Three-point Offenses | Four-point Offenses | Five-point Offenses | Six-point Offenses | Hearing — Possible Suspension |

|---|---|---|---|---|---|

| Careless driving | 11–15 mph over speed limit on limited access highway | Reckless driving | Improper passing | 16–25 mph over speed limit on any road or highway | 26 mph over speed limit on any road or highway |

| Improper lane usage | 15 mph or less over speed limit on any non-limited access highway | Following too close | NA | Failure to stop for church or school bus | Attempting to elude police officer |

| Improper use of left lane/limited access highway | Failure to yield | Driving on wrong side of roadway | NA | Committing a moving hazardous violation involving an incident | Racing |

| Failure to illuminate headlights or failure to dim headlights | Failure to yield right-of-way to funeral procession | Changing drivers in a motor vehicle | NA | Committing two or more moving hazardous violations in any continuous occurrence | NA |

| Failure to comply with Instructional Permit requirements | Stop violation (traffic signal, railroad crossing, stop sign) | Vehicle not under control | NA | NA | NA |

| Any other moving hazardous violation | Wrong way on a one-way street | Failure to yield to emergency vehicle | NA | NA | NA |

| Texting while driving | Too fast or too slow for road conditions | NA | NA | NA | NA |

| NA | Improper driving, improper start, or improper turn | NA | NA | NA | NA |

If your infraction was for 10 mph or less over the speed limit on a limited access highway, the points are zero.

Kentucky Rules of the Road

Next up — driving laws you need to know about. We’ll cover everything from headlights to DUIs.

Kentucky Car Insurance Fault Versus No-fault

Kentucky is a choice, no-fault state. Drivers may opt out of no-fault coverage (PIP) in writing. If you don’t opt out, you must purchase PIP coverage, and each party must pay for their own medical bills following an accident regardless of who is at fault.

The victim may sue the at-fault party if the medical costs exceed $1,000 or if the accident caused the claimant’s permanent disfigurement, fracture of a weight-bearing bone; compound, compressed, or displaced fracture of any bone; any permanent injury, or any permanent loss of a body function.

For minor accidents, your own PIP coverage will pay for your medical expenses and a portion of your lost wages.

The at-fault party will still be responsible for property damage.

Kentucky Keep Right and Move Over Laws

Have you ever been on a four-lane (or more) highway, and even though there’s no heavy traffic, you’re stuck going under the speed limit because some idiot is just lolly-gagging in the left lane and totally impeding the flow of traffic? Yeah, it’s frustrating. But guess what…it’s also illegal.

In Kentucky, you must drive in the right lane unless you are passing or turning left. Now, if everyone would abide by that, it would surely open up the roadways.

As for “move over” laws, in Kentucky, they require motorists to move to the lane not adjacent to an emergency vehicle if safe and possible to do so. If impossible or unsafe to do so, the law requires motorists to slow down and use caution while passing emergency vehicles.

Kentucky Headlight Law

Headlights can only be white, and this restriction applies to cars registered in other states that are traveling through Kentucky. Not only does the bulb have to be white, but there cannot be a colored film or tint put on the headlights.

Kentucky Sharing the Roadway

Bicyclists and motorists don’t always get along in perfect harmony. To enhance safety and promote mutual respect on the road, a new law in Kentucky requires vehicles to stay at least three feet from bicycles when passing. This regulation aims to protect cyclists and ensure a safer coexistence between different types of road users.

Kentucky Speed Limits by Road Type

| Road Type | Speed Limits |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 65 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 55 mph |

Motorists may cross a double line to safely pass a bicyclist if it is safe to do so. Adhering to these guidelines not only complies with the law but also contributes to a safer and more considerate driving environment for everyone. Always be vigilant and considerate when sharing the road with cyclists to help prevent accidents and ensure a harmonious journey for all.

Kentucky Seatbelt and Car Seat Laws

Seatbelt and car seat violations are primary offenses in Kentucky. This means that law enforcement officers can stop and cite drivers or passengers solely for not wearing a seatbelt or for improper use of car seats. Ensuring that everyone in the vehicle is properly restrained is crucial for safety and compliance with state laws.

Kentucky's Child Safety Seat and Seatbelt Laws

| Kentucky's Child Safety Laws | Fines | Car Seat | Adult Belt | Additional Fines |

|---|---|---|---|---|

| Who is covered? In what seats? | Maximum base fine first offense, additional fees may apply | Must be in child safety seat | Adult belt permissible | Maximum base fine first offense, additional fees may apply |

| 7 and younger and more than 57 inches in all seats; 8+ in all seats | $25 | 40 inches or less in a child restraint; 7 and younger who are between 40 and 57 inches tall in a booster seat | taller than 57 inches | $50 child restraint: $30 booster seat |

You can be pulled over for just that violation. In states where it’s a secondary offense, you can be ticketed for it, but there has to be another reason to be pulled over by law enforcement. If you’re curious whether or not you can ride in the cargo area of a pickup truck, you can. It’s not safe, but there aren’t any laws against it in Kentucky.

Read More: Do seat belt laws impact my car insurance?

Kentucky Ridesharing

There are several companies that offer rideshare car insurance in Kentucky.

- Geico

- Allstate

- Erie Insurance

- USAA

- State Farm

Kentucky residents can participate in a ridesharing program called “Slugging.” Drivers pick up passengers (slugs) who have the same destination as themselves. Money is not exchanged. The slug gets a ride while the driver gets to travel in the HOV lane.

Standard ridesharing services such as Uber and Lyft have rules to abide by. They have to:

- Apply to operate in Kentucky

- Renew applications each year

- Carry $1 million in insurance while transporting passengers

- Be insured while waiting for customers

Following these regulations ensures that ridesharing services operate safely and responsibly within Kentucky. By requiring substantial insurance coverage and annual application renewals, the state helps protect both passengers and drivers. Always choose ridesharing services that comply with these standards to ensure a secure and reliable transportation experience.

Kentucky Automation on the Road

According to the Insurance Institute for Highway Safety, Kentucky has “regulated platooning technology, which allows groups of individual trucks or buses to travel together with set distances between them at electronically coordinated speeds.”

While Kentucky hasn’t passed legislation governing autonomous vehicles, lawmakers focused on future planning are looking into how to embrace autonomous technology wisely.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Safety Laws

Driving is a serious task. To be a safe driver, you cannot be under the influence of drugs alcohol. Here’s how Kentucky cracks down on impaired driving.

Kentucky DUI Laws

Bourbon whiskey and Kentucky — a match made in heaven. When you live in the state that produces 95% of the world’s bourbon, you’re probably going to have access to some fabulous distilleries.

Even so, there are 39 dry counties in the state prohibiting the sale of alcohol.

In Louisville, alcohol can be served from 6:00 a.m. until 4:00 a.m. Monday through Saturday and 1:00 p.m. through 4:00 a.m. on Sundays. The rest of the state closes down alcohol service at 2:00 a.m.In Kentucky, a DUI includes driving under the influence of the following substances which impair driving ability:

- Alcohol

- Over-the-counter medication

- Prescription drugs

- Illegal drugs

- Inhalants

The first three offenses within ten years are considered misdemeanors, while the fourth and subsequent offenses within 10 years are considered felonies.Kentucky DUI Penalties

| Penalty | First Offense | Second Offense | Third Offense | Fourth Offense |

|---|---|---|---|---|

| Suspended License | 30–120 days | 12–18 months | 24–36 months | 60 months |

| Imprisonment | Two to 30 days | Seven days to six months | 30 days–12 months | Minimum 120 days without probation |

| Fine | $200–$500 | $350–$500 | $500–$1000 | NA |

| Program Attendance | 90 days of alcohol or substance abuse program | One year alcohol or substance abuse treatment | One year alcohol or substance abuse treatment | One year alcohol or substance abuse treatment |

| Community Service | Possible 48 hours–30 days of community labor | 10 days to six months community labor | 10 days–12 months community labor | NA |

| Mandatory Ignition Interlock Device | No (Yes, if BAC is over 0.15) | Yes | Yes | Yes |

Kentucky has harsher penalties for high blood alcohol concentration (BAC) of 0.15% or greater. Statistics prove that the risk of being involved in a crash raises greatly. At 0.15% BAC, you’re over 1000% more likely to be in an accident than when you’re sober.

Read More: What are the DUI insurance laws in Kentucky?

Kentucky Distracted Driving Laws

Drivers under 18 may not use a handheld electronic device, like a cell phone, while driving. If you’re over 18, you can talk on a cell phone but are banned from texting. Texting and driving is a primary offense in Kentucky, so you can be pulled over just for that violation.

Kentucky Can’t-Miss Facts

You may be interested in the statistics related to driving in Kentucky, but there’s a lot of data to sift through to find what’s relevant. We’ll help you out and show you some of the most interesting information, from vehicle thefts to fatalities to EMS response times to commute times right here in one place.

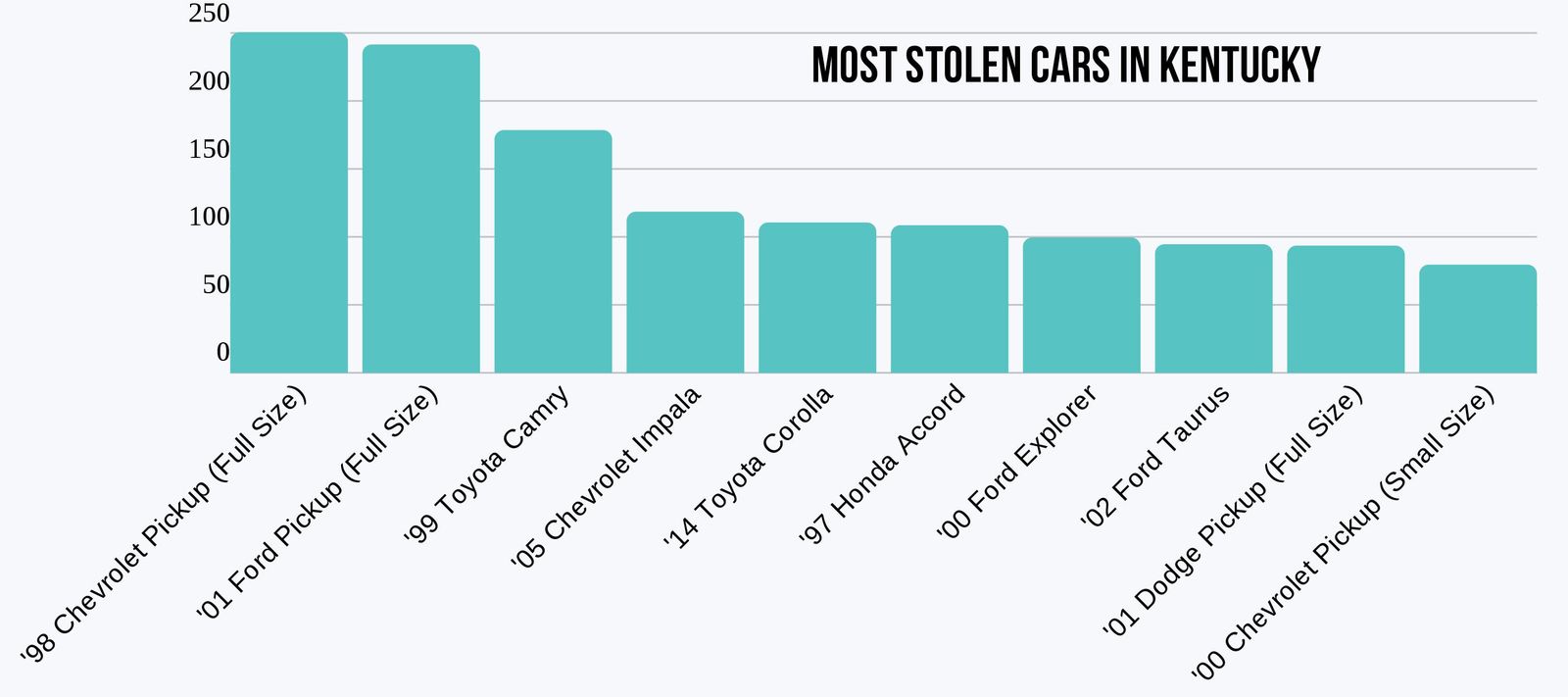

Vehicle Theft in Kentucky

Vehicle theft is a significant concern for car owners, and certain models are more frequently targeted by thieves. The chart below highlights the most stolen cars in Kentucky, showcasing the makes and models that are most at risk. Understanding which vehicles are commonly stolen can help you take preventive measures to protect your car.

By being aware of the most stolen car models, you can take extra precautions to safeguard your vehicle. Consider investing in additional security features such as alarms, steering wheel locks, and tracking devices. Staying vigilant and informed can help reduce the risk of theft and provide peace of mind for car owners in Kentucky.

Urban areas have a higher population density than rural areas, and as a result of more people, they have more crimes. See table below:

Kentucky Car Thefts by City in 2024

| City | Vehicle Thefts |

|---|---|

| Bowling Green | 125 |

| Covington | 158 |

| Florence | 73 |

| Frankfort | 59 |

| Henderson | 59 |

| Lexington | 831 |

| Louisville Metro | 2,025 |

| Newport | 56 |

| Owensboro | 106 |

| Shively | 77 |

It’s not a surprise that Kentucky’s largest city, Louisville, has the highest number of stolen vehicles.

Read More: Common Ways Cars Are Stolen

Kentucky Driving Risky and Harmful Behavior

Driving is a convenience that is hard to live without, but please don’t forget the risk involved. Don’t become a statistic. Drive carefully.

Kentucky Fatality Rates by City

Analyzing traffic fatality rates by city in Kentucky provides valuable insights into regional safety and highlights areas with higher incidences of fatal accidents. The following table details the fatality rates in various cities across the state, offering a comprehensive overview of urban traffic safety.

Kentucky Traffic Fatalities by City in 2024

| City | Total Deaths | Fatality Rate |

|---|---|---|

| Louisville/Jefferson County Metro | 87 | 14.12% |

| Lexington-Fayette Urban County | 50 | 15.7% |

The data on fatality rates by city in Kentucky reveals significant differences in road safety across urban areas. This information is crucial for targeting specific cities with higher fatality rates to implement effective safety measures and reduce traffic-related deaths.

Kentucky Traffic Fatalities by County

Traffic fatality data broken down by county helps to identify regional disparities and high-risk areas within Kentucky. The following table presents the number of traffic fatalities in each county, providing a localized perspective on road safety.

Kentucky Traffic Fatalities by County

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Boone | 9 | 5 | 15 | 14 | 19 |

| Fayette | 18 | 28 | 27 | 50 | 35 |

| Hardin | 20 | 16 | 22 | 16 | 16 |

| Jefferson | 88 | 78 | 85 | 99 | 107 |

| Kenton | 5 | 9 | 17 | 9 | 17 |

| Laurel | 13 | 10 | 8 | 11 | 18 |

| Muhlenberg | 6 | 2 | 2 | 6 | 12 |

| Nelson | 8 | 5 | 15 | 13 | 14 |

| Pike | 20 | 21 | 14 | 16 | 12 |

| Warren | 18 | 17 | 13 | 23 | 26 |

| Top Ten Counties | 223 | 220 | 246 | 284 | 276 |

| All Other Counties | 415 | 452 | 515 | 550 | 506 |

| All Counties | 638 | 672 | 761 | 834 | 782 |

Examining traffic fatalities by county highlights the regions with the highest incidences of fatal accidents. This county-level data is essential for focusing road safety initiatives and resources on the areas most in need of intervention to improve overall traffic safety in Kentucky.

Kentucky Traffic Fatalities Rural Versus Urban

Understanding the difference in traffic fatalities between rural and urban areas in Kentucky can shed light on unique challenges faced in each environment. The following table compares traffic fatalities in rural and urban settings, offering insights into how location impacts road safety.

Kentucky Traffic Fatalities by Location

| Type of Roadway | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Rural | 494 | 517 | 593 | 607 | 510 |

| Urban | 144 | 155 | 168 | 226 | 271 |

The comparison of traffic fatalities in rural versus urban areas in Kentucky underscores the distinct safety challenges in different settings. Addressing these unique challenges with tailored safety measures can help reduce fatalities and enhance road safety across both rural and urban regions.

Kentucky Fatalities by Person Type

Categorizing traffic fatalities by person type provides a clear picture of which groups are most affected by fatal accidents. The following table breaks down traffic fatalities in Kentucky by different person types, such as drivers, passengers, pedestrians, and cyclists.

Kentucky Fatalities by Person Type

| Occupant/Non-Occupant | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Passenger Car | 269 | 278 | 314 | 353 | 326 |

| Light Truck – Pickup | 92 | 115 | 120 | 116 | 126 |

| Light Truck – Utility | 84 | 84 | 99 | 88 | 90 |

| Light Truck – Van | 20 | 21 | 25 | 32 | 32 |

| Light Truck – Other | 0 | 0 | 0 | 0 | 1 |

| Large Truck | 10 | 9 | 9 | 16 | 10 |

| Other/Unknown Occupants | 15 | 17 | 24 | 23 | 15 |

| Total Occupants | 490 | 524 | 591 | 628 | 600 |

| Total Motorcyclists | 87 | 86 | 91 | 111 | 90 |

| Pedestrian | 55 | 57 | 67 | 81 | 83 |

| Bicyclist and Other Cyclist | 3 | 4 | 7 | 9 | 7 |

| Other/Unknown Nonoccupants | 3 | 1 | 5 | 5 | 2 |

| Total Nonoccupants | 61 | 62 | 79 | 95 | 92 |

| Grand Total | 638 | 672 | 761 | 834 | 782 |

The data on fatalities by person type in Kentucky highlights the vulnerable groups on the road. By understanding which person types are most frequently involved in fatal accidents, targeted safety measures can be developed to protect these groups and reduce overall traffic fatalities.

Kentucky Fatalities by Crash Type

Analyzing traffic fatalities by crash type reveals the most dangerous scenarios on Kentucky’s roads. The following table categorizes fatalities based on different types of crashes, providing insights into the circumstances that lead to fatal accidents.

Kentucky Fatalities by Crash Type

| Crash Type | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 638 | 672 | 761 | 834 | 782 |

| Single Vehicle | 355 | 395 | 400 | 451 | 413 |

| Involving a Large Truck | 78 | 68 | 81 | 100 | 89 |

| Involving Speeding | 125 | 125 | 140 | 138 | 138 |

| Involving a Rollover | 157 | 200 | 229 | 216 | 203 |

| Involving a Roadway Departure | 410 | 456 | 499 | 529 | 472 |

| Involving an Intersection (or Intersection Related) | 116 | 119 | 122 | 152 | 179 |

The breakdown of fatalities by crash type in Kentucky helps identify the most hazardous driving situations. This information is crucial for developing targeted interventions and safety campaigns aimed at reducing specific types of crashes and improving road safety.

Kentucky Fatalities Involving Speeding by County

Speeding is a major contributor to traffic fatalities. The following table presents data on fatalities involving speeding in various counties across Kentucky, highlighting the impact of this dangerous behavior on road safety.

Kentucky Fatalities per 100,000 Residents by County

| County Name | 2021 | 2022 | 2023 |

|---|---|---|---|

| Adair | 5.18 | 0 | 10.26 |

| Allen | 4.84 | 9.65 | 0 |

| Anderson | 0 | 0 | 0 |

| Ballard | 0 | 0 | 12.44 |

| Barren | 2.3 | 0 | 4.57 |

| Bath | 16.4 | 0 | 0 |

| Bell | 0 | 0 | 11.15 |

| Boone | 2.35 | 3.1 | 2.29 |

| Bourbon | 24.88 | 9.97 | 4.99 |

| Boyd | 6.18 | 0 | 0 |

| Boyle | 6.73 | 0 | 3.34 |

| Bracken | 12.08 | 0 | 0 |

| Breathitt | 0 | 7.58 | 7.72 |

| Breckinridge | 5.01 | 0 | 0 |

| Bullitt | 3.81 | 2.52 | 3.74 |

| Butler | 0 | 0 | 7.79 |

| Caldwell | 7.84 | 0 | 7.91 |

| Calloway | 0 | 5.16 | 2.57 |

| Campbell | 1.09 | 6.52 | 0 |

| Carlisle | 0 | 0 | 20.64 |

| Carroll | 0 | 0 | 0 |

| Carter | 10.93 | 3.67 | 7.37 |

| Casey | 0 | 0 | 6.35 |

| Christian | 4.1 | 5.58 | 0 |

| Clark | 0 | 2.79 | 5.55 |

| Clay | 9.53 | 4.83 | 0 |

| Clinton | 0 | 0 | 9.73 |

| Crittenden | 0 | 10.91 | 0 |

| Cumberland | 0 | 0 | 14.91 |

| Daviess | 2.01 | 4.01 | 3.99 |

| Edmonson | 0 | 0 | 16.36 |

| Elliott | 0 | 0 | 0 |

| Estill | 0 | 0 | 0 |

| Fayette | 0.95 | 3.45 | 2.48 |

| Fleming | 0 | 6.89 | 0 |

| Floyd | 2.66 | 0 | 13.79 |

| Franklin | 0 | 0 | 3.96 |

| Fulton | 0 | 0 | 0 |

| Gallatin | 0 | 0 | 22.79 |

| Garrard | 0 | 0 | 0 |

| Grant | 4.04 | 0 | 0 |

| Graves | 13.45 | 5.38 | 0 |

| Grayson | 0 | 3.83 | 3.79 |

| Green | 0 | 0 | 0 |

| Greenup | 0 | 2.79 | 0 |

| Hancock | 0 | 11.45 | 0 |

| Hardin | 4.71 | 0.94 | 1.85 |

| Harlan | 0 | 3.7 | 0 |

| Harrison | 0 | 5.38 | 0 |

| Hart | 10.87 | 16.19 | 0 |

| Henderson | 2.16 | 2.16 | 0 |

| Henry | 6.42 | 0 | 0 |

| Hickman | 0 | 0 | 0 |

| Hopkins | 8.68 | 6.56 | 2.2 |

| Jackson | 0 | 0 | 7.45 |

| Jefferson | 1.7 | 2.74 | 3.63 |

| Jessamine | 0 | 3.83 | 1.87 |

| Johnson | 4.32 | 0 | 0 |

| Kenton | 2.44 | 0 | 0 |

| Knott | 0 | 0 | 0 |

| Knox | 9.55 | 3.19 | 0 |

| Larue | 0 | 0 | 0 |

| Laurel | 1.67 | 3.33 | 4.99 |

| Lawrence | 0 | 0 | 0 |

| Lee | 0 | 0 | 0 |

| Leslie | 0 | 0 | 9.68 |

| Letcher | 0 | 4.4 | 0 |

| Lewis | 14.72 | 22.26 | 7.5 |

| Lincoln | 0 | 0 | 12.27 |

| Livingston | 10.76 | 21.7 | 0 |

| Logan | 0 | 0 | 0 |

| Lyon | 12.03 | 12.37 | 24.75 |

| Madison | 3.4 | 3.35 | 2.19 |

| Magoffin | 7.83 | 7.89 | 15.95 |

| Marion | 5.21 | 5.22 | 5.16 |

| Marshall | 3.22 | 3.2 | 3.19 |

| Martin | 0 | 0 | 0 |

| Mason | 0 | 5.83 | 5.82 |

| McCracken | 7.7 | 3.06 | 3.06 |

| McCreary | 11.19 | 0 | 0 |

| McLean | 0 | 21.41 | 10.87 |

| Meade | 14.41 | 3.57 | 3.55 |

| Menifee | 0 | 0 | 0 |

| Mercer | 0 | 4.67 | 0 |

| Metcalfe | 0 | 0 | 0 |

| Monroe | 0 | 0 | 0 |

| Montgomery | 3.63 | 0 | 3.58 |

| Morgan | 0 | 0 | 0 |

| Muhlenberg | 0 | 6.44 | 0 |

| Nelson | 11.09 | 6.59 | 8.76 |

| Nicholas | 0 | 14.16 | 14.03 |

| Ohio | 0 | 4.13 | 0 |

| Oldham | 0 | 0 | 0 |

| Owen | 0 | 18.76 | 18.58 |

| Owsley | 0 | 0 | 0 |

| Pendleton | 0 | 0 | 0 |

| Perry | 3.66 | 14.72 | 7.53 |

| Pike | 6.47 | 3.31 | 3.4 |

| Powell | 8.17 | 8.13 | 0 |

| Pulaski | 1.57 | 3.12 | 1.55 |

| Robertson | 0 | 0 | 0 |

| Rockcastle | 5.91 | 5.93 | 11.98 |

| Rowan | 4.06 | 4.1 | 4.08 |

| Russell | 5.66 | 0 | 0 |

| Scott | 3.84 | 0 | 1.82 |

| Shelby | 0 | 0 | 2.11 |

| Simpson | 5.59 | 5.56 | 0 |

| Spencer | 0 | 5.48 | 5.4 |

| Taylor | 7.81 | 0 | 7.85 |

| Todd | 16.1 | 0 | 0 |

| Trigg | 7.03 | 0 | 13.85 |

| Trimble | 0 | 0 | 11.68 |

| Union | 0 | 20.28 | 0 |

| Warren | 0 | 3.17 | 2.33 |

| Washington | 8.33 | 0 | 8.25 |

| Wayne | 29.12 | 9.64 | 0 |

| Webster | 0 | 0 | 0 |

| Whitley | 13.85 | 5.54 | 11.05 |

| Wolfe | 13.8 | 13.86 | 0 |

| Woodford | 7.75 | 0 | 0 |

The data on speeding-related fatalities by county emphasizes the need for stricter enforcement and public awareness campaigns about the dangers of speeding. Addressing speeding through targeted initiatives can significantly reduce the number of fatal accidents in Kentucky.

Kentucky Fatalities Involving an Alcohol-impaired Driver by County

Alcohol impairment is a leading cause of traffic fatalities. The following table provides data on fatalities involving an alcohol-impaired driver in different counties in Kentucky, shedding light on the prevalence and impact of drunk driving.

Kentucky Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

| County Name | 2021 | 2022 | 2023 |

|---|---|---|---|

| Adair | 0 | 1 | 3 |

| Allen | 2 | 3 | 2 |

| Anderson | 0 | 1 | 0 |

| Ballard | 0 | 0 | 0 |

| Barren | 2 | 1 | 1 |

| Bath | 2 | 1 | 1 |

| Bell | 3 | 1 | 2 |

| Boone | 1 | 5 | 3 |

| Bourbon | 0 | 1 | 2 |

| Boyd | 0 | 0 | 2 |

| Boyle | 1 | 0 | 2 |

| Bracken | 2 | 0 | 0 |

| Breathitt | 0 | 1 | 1 |

| Breckinridge | 1 | 0 | 0 |

| Bullitt | 3 | 3 | 4 |

| Butler | 0 | 1 | 0 |

| Caldwell | 0 | 0 | 0 |

| Calloway | 0 | 3 | 1 |

| Campbell | 4 | 3 | 4 |

| Carlisle | 0 | 0 | 0 |

| Carroll | 1 | 0 | 0 |

| Carter | 3 | 1 | 2 |

| Casey | 2 | 2 | 2 |

| Christian | 2 | 5 | 2 |

| Clark | 2 | 0 | 1 |

| Clay | 4 | 0 | 1 |

| Clinton | 0 | 0 | 0 |

| Crittenden | 1 | 0 | 0 |

| Cumberland | 1 | 0 | 0 |

| Daviess | 0 | 4 | 5 |

| Edmonson | 0 | 0 | 1 |

| Elliott | 0 | 0 | 1 |

| Estill | 1 | 0 | 1 |

| Fayette | 8 | 13 | 12 |

| Fleming | 0 | 3 | 1 |

| Floyd | 3 | 2 | 1 |

| Franklin | 0 | 0 | 4 |

| Fulton | 1 | 0 | 1 |

| Gallatin | 2 | 1 | 0 |

| Garrard | 2 | 0 | 0 |

| Grant | 1 | 0 | 0 |

| Graves | 4 | 5 | 2 |

| Grayson | 4 | 2 | 2 |

| Green | 1 | 0 | 1 |

| Greenup | 1 | 0 | 1 |

| Hancock | 0 | 0 | 0 |

| Hardin | 5 | 1 | 1 |

| Harlan | 1 | 1 | 0 |

| Harrison | 0 | 0 | 0 |

| Hart | 2 | 5 | 0 |

| Henderson | 2 | 0 | 0 |

| Henry | 0 | 2 | 1 |

| Hickman | 0 | 0 | 0 |

| Hopkins | 0 | 0 | 2 |

| Jackson | 0 | 1 | 2 |

| Jefferson | 27 | 20 | 26 |

| Jessamine | 2 | 3 | 0 |

| Johnson | 0 | 0 | 0 |

| Kenton | 6 | 1 | 7 |

| Knott | 0 | 2 | 1 |

| Knox | 2 | 0 | 0 |

| Larue | 0 | 0 | 1 |

| Laurel | 2 | 1 | 7 |

| Lawrence | 0 | 0 | 1 |

| Lee | 0 | 0 | 0 |

| Leslie | 0 | 0 | 0 |

| Letcher | 0 | 0 | 2 |

| Lewis | 2 | 3 | 0 |

| Lincoln | 3 | 0 | 2 |

| Livingston | 3 | 0 | 0 |

| Logan | 0 | 0 | 0 |

| Lyon | 2 | 0 | 2 |

| Madison | 6 | 4 | 2 |

| Magoffin | 0 | 1 | 1 |

| Marion | 1 | 2 | 0 |

| Marshall | 0 | 1 | 1 |

| Martin | 1 | 0 | 1 |

| Mason | 0 | 0 | 1 |

| McCracken | 2 | 0 | 0 |

| McCreary | 1 | 1 | 3 |

| McLean | 1 | 0 | 1 |

| Meade | 4 | 4 | 3 |

| Menifee | 0 | 3 | 0 |

| Mercer | 1 | 0 | 2 |

| Metcalfe | 0 | 1 | 0 |

| Monroe | 1 | 0 | 0 |

| Montgomery | 2 | 0 | 0 |

| Morgan | 0 | 0 | 1 |

| Muhlenberg | 0 | 1 | 1 |

| Nelson | 5 | 2 | 1 |

| Nicholas | 0 | 0 | 0 |

| Ohio | 0 | 1 | 1 |

| Oldham | 0 | 1 | 0 |

| Owen | 1 | 1 | 2 |

| Owsley | 1 | 2 | 0 |

| Pendleton | 0 | 0 | 2 |

| Perry | 3 | 6 | 1 |

| Pike | 6 | 2 | 3 |

| Powell | 1 | 1 | 0 |

| Pulaski | 3 | 3 | 3 |

| Robertson | 0 | 0 | 0 |

| Rockcastle | 0 | 0 | 1 |

| Rowan | 0 | 2 | 3 |

| Russell | 1 | 1 | 2 |

| Scott | 2 | 2 | 0 |

| Shelby | 1 | 4 | 1 |

| Simpson | 1 | 0 | 2 |

| Spencer | 1 | 0 | 1 |

| Taylor | 1 | 0 | 0 |

| Todd | 2 | 0 | 1 |

| Trigg | 0 | 1 | 2 |

| Trimble | 0 | 0 | 1 |

| Union | 0 | 4 | 1 |

| Warren | 2 | 4 | 4 |

| Washington | 2 | 1 | 1 |

| Wayne | 1 | 1 | 0 |

| Webster | 2 | 0 | 0 |

| Whitley | 3 | 5 | 2 |

| Wolfe | 1 | 2 | 0 |

| Woodford | 1 | 1 | 0 |

The prevalence of alcohol-impaired driving fatalities by county highlights the critical need for enhanced DUI enforcement and prevention programs. By focusing on reducing drunk driving incidents, Kentucky can improve road safety and reduce the number of fatal accidents caused by alcohol impairment.

Read More: Mercer Insurance Group Car Insurance Review

Kentucky Teen Drinking and Driving

In 2016, law enforcement in Kentucky made 66 arrests for drunk driving by individuals under 18 years old. Since Kentucky has just over a million residents under 18, that puts the arrests per million people at 65.

Read More: Most Dangerous States for Drunk Driving

The national average for under 21 alcohol-impaired driving fatalities per 100.000 population is 1.2. Kentucky comes in under that average at 0.9.

Kentucky EMS Response Time

Emergency Medical Services (EMS) response times are crucial in determining the outcomes of accidents. The following table provides a comparison of average EMS response times in Kentucky based on population density, highlighting the differences between urban and rural areas.

Kentucky EMS Response Times by Location

| Location | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Urban | 4 | 12 | 38 | 50 |

| Rural | 4 | 12 | 38 | 50 |

Understanding the average EMS response times by location helps identify areas where improvements may be needed to ensure timely medical assistance. This information is vital for enhancing emergency response strategies and ensuring that all residents, whether in urban or rural areas, receive prompt and effective care in the event of an accident.

Kentucky Transportation

The average Kentucky household has two cars. Most drive themselves to work and the average commute time is 22.4 minutes compared to the 25.3-minute average countrywide.

Public transportation isn’t a huge factor in the average Kentucky resident’s commute. Here’s how car ownership compares with the rest of the U.S. Kentucky is represented by orange, and the U.S. average is represented by gray.

Kentucky Car Ownership

According to the U.S. Census Bureau’s American Community Survey (ACS), 42.3% of households in Kentucky owned two cars in 2018.

Kentucky Commute Time

The ACS also found that in 2018, Kentucky workers spent an average of 22.5 minutes on their daily commute compared to a national average of 25.7 minutes. Furthermore, 2.05% of Kentuckians had “super commutes” of longer than 90 minutes.

Kentucky Commuter Transportation

The majority of Kentucky workers, 82.4%, drove alone to work. That’s compared to only 9.36 of Kentuckians who carpooled.

Kentucky Traffic Congestion

While the Louisville and Lexington metro areas definitely have some traffic congestion, at least it’s not like Los Angeles. If you’re sitting in traffic in Kentucky, getting aggravated with those around you, remind yourself of that.Kentucky Traffic Congestion by City

| City | Hours spent in congestion | Percent spent in congestion – PEAK | Percent spent in congestion – DAYTIME | Percent spent in congestion – OVERALL |

|---|---|---|---|---|

| Louisville | 19 | 10% | 6% | 6% |

| Lexington | 17 | 10% | 6% | 6% |

Now, with all this information, you can consider yourself an informed driver.

Remember, as a driver, car insurance is vitally important. You shouldn’t overpay for the coverage you need, though. Enter your ZIP code into our free tool below to compare rates and find the coverage that’s right for you.

Frequently Asked Questions

What are the minimum car insurance requirements in Kentucky?

In Kentucky, the minimum car insurance requirements are 25/50/25 for bodily injury and property damage liability, and $10,000 in personal injury protection (PIP) coverage.

What is the average cost of car insurance in Kentucky?

The average car insurance rates in Kentucky are around $77 per month.

Should I get basic coverage or full coverage for my car in Kentucky?

The decision between basic coverage and full coverage depends on your personal circumstances. Basic coverage is the minimum required by law and covers liability only. Full coverage includes collision and comprehensive insurance, which provide additional protection for your own vehicle.

Read More: What is the best car insurance?

Are there any additional coverage options I should consider in Kentucky?

Additional coverage options to consider in Kentucky include uninsured/underinsured motorist coverage, higher liability limits, and supplemental coverage such as pay-as-you-drive or usage-based coverage.

Find cheap car insurance quotes by entering your ZIP code below.

Which are the best car insurance companies in Kentucky?

The best car insurance company for you will depend on your specific needs and preferences. It’s recommended to compare quotes from multiple companies to find the best rates and coverage. Some well-known insurance companies in Kentucky include Geico, Progressive, State Farm, and Allstate.

Read More: How do you get competitive quotes for car insurance?

Who has the cheapest car insurance in Kentucky?

Which Kentucky car insurance company offers the cheapest rates will depend on your coverage needs, driving record, and more. However, some companies that are usually cheaper are USAA, State Farm, and Geico.

What discounts are available for car insurance in Kentucky?

Many car insurance companies in Kentucky offer discounts such as good driver, multi-policy, good student, and discounts for safety features. Additional savings can come from paying in full, automatic payments, or completing a defensive driving course.

Why is Kentucky car insurance so expensive?

Average Kentucky car insurance rates are more expensive due to state factors, such as the number of drivers, average crashes, weather, and more. The best way to find cheap Kentucky car insurance is to shop around for quotes. For more information, read our article titled “Why is my car insurance so expensive?“.

What is the cheapest Kentucky minimum car insurance?

Minimum car insurance in Kentucky costs an average of $55 per month.

How can I file a car insurance claim in Kentucky?

To file a claim, report the accident to the police, notify your insurance company, and provide necessary information like the police report number and accident details. An adjuster will investigate, and you may need to provide additional documents. Your insurer will then process the claim and inform you of the outcome.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.